Binance Futures Trading Volume Hits $2.55 Trillion, but User Activity Plummets 57%, Showing Polarization

This article is machine translated

Show original

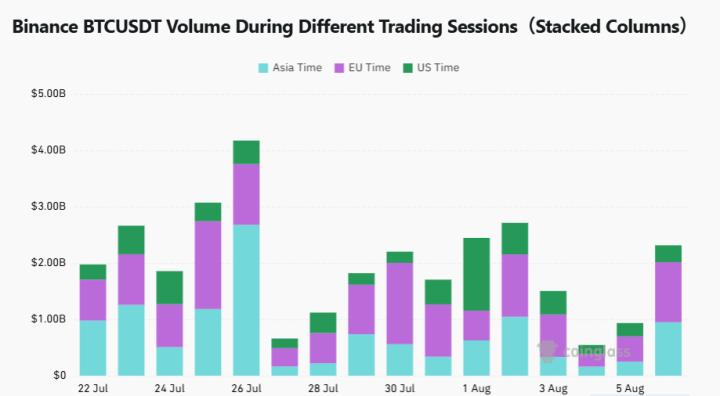

Binance is solidifying its dominance in the industry by recording the highest futures trading volume this year. This is analyzed as a result of a massive influx of traders due to the recent price surge of Bitcoin (BTC) and some altcoins, coupled with market volatility. However, independent of this trading increase, user activity indicators are showing a downward trend, revealing a distinctly polarized market flow.

According to market analysis firm CryptoQuant, Binance's futures trading volume in July reached approximately $2.55 trillion (about ₩3,544.5 trillion), setting a new high for the year. This surpasses the $2.43 trillion (about ₩3,377.7 trillion) in January and $2.26 trillion (about ₩3,141.4 trillion) in May. In contrast, competing exchanges like OKX recorded $92.9 billion (about ₩1,291.8 trillion), and Bybit recorded $1.09 trillion (about ₩1,515.1 trillion), falling far short of Binance in scale.

This exchange, led by Binance founder Changpeng Zhao, boasts an overwhelming market share, occupying about half of the total futures trading volume of major global exchanges including Kraken, Coinbase, and Bybit. CryptoQuant analyst Maartun diagnosed that "trader activity is increasing again in conjunction with the recent price uptrend."

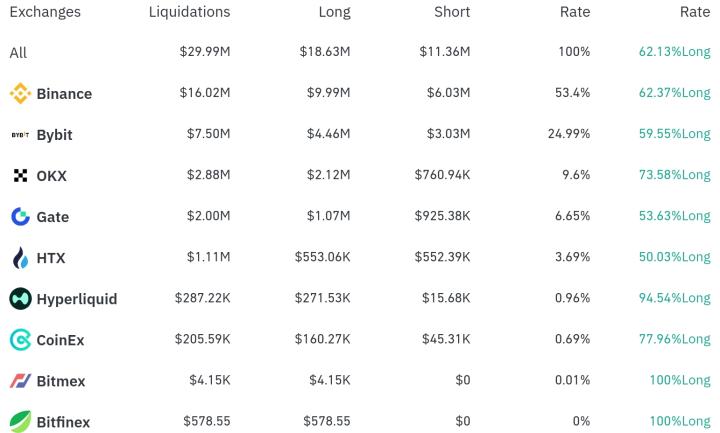

However, while the futures market is thriving, other key indicators are sounding alarms. A recent large-scale Bitcoin sell-off resulted in liquidations of about $1.5 billion (about ₩2.085 trillion), and the funding rate in perpetual futures contracts, which indicates the cost difference between long and short positions, has turned negative. This suggests an increase in short positions and is interpreted as a signal that the market has entered a risk-averse phase.

Moreover, according to blockchain data platform Token Terminal, Binance's monthly active addresses plummeted from about 800,000 in early June to around 340,000 in early August, a decrease of approximately 57.5%, suggesting a noticeable contraction in user participation.

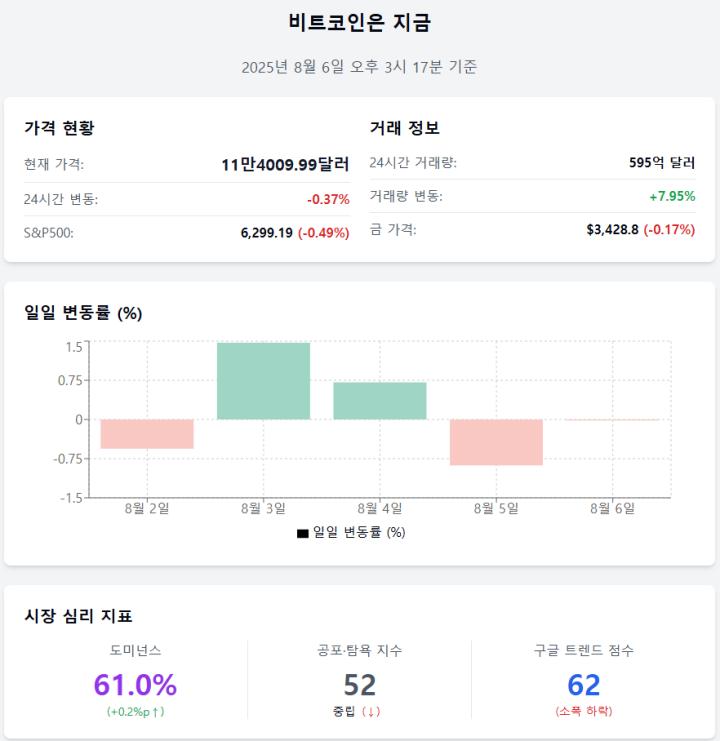

The overall cryptocurrency market is also showing mixed signals. According to CoinMarketCap, the total market size has dropped from $4 trillion (about ₩5,560 trillion) in July to $3.7 trillion (about ₩5,143 trillion) in August. These data show that the market is moving without a clear direction, within a neutral sentiment.

The fact that Binance's increased trading volume does not directly translate to market prosperity or user growth reflects the structural complexity of the cryptocurrency market and the continued significant impact of excessive leverage strategies. While short-term trading increases may be a positive signal, without sustainable participation and strengthening of sound fundamentals, the bullish trend may not last long.

Sector:

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content