As of 3:17 PM on August 6, 2025

As the number of active Bitcoin wallets decreased by more than 3% in a day and trading participation slowed down, the trading volume increased, revealing signs of buying pressure.

📈 Price now

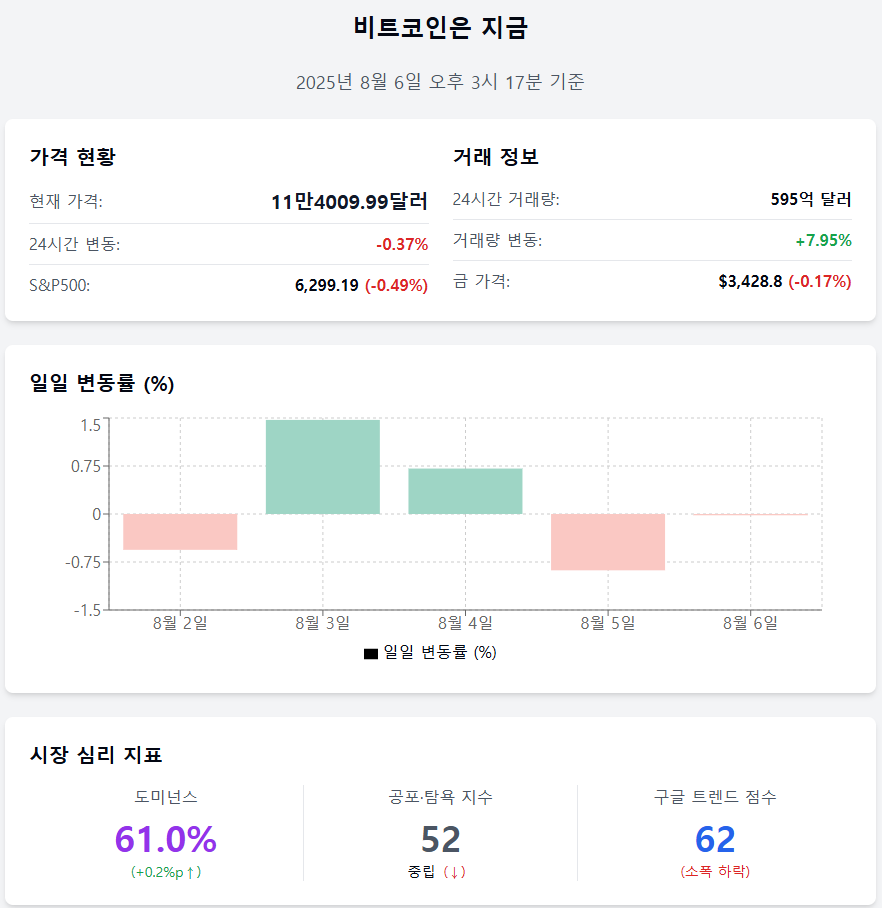

Price $114,009.99 (–0.37%) Bitcoin is trading at $114,009.99, down 0.37% from the previous day. It continues to explore direction near the support line amid a short-term adjustment trend.

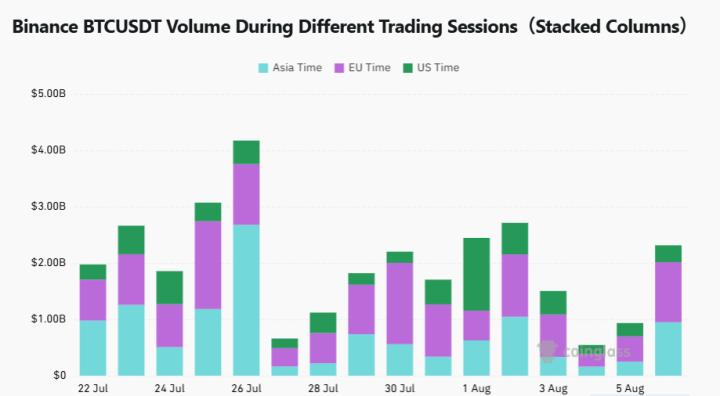

Trading volume $59.5 billion (+7.95%) The 24-hour trading volume increased by 7.95% to $59.5 billion, maintaining the market's short-term vitality.

Daily volatility –0.02% The daily volatility over the past 5 days was –0.56% (August 2), +1.47% (August 3), +0.71% (August 4), –0.88% (August 5), and –0.02% (August 6). The amplitude is gradually decreasing, entering a short-term range-bound period.

Asset comparison S&P500↓ · Gold↓ The S&P 500 index fell 0.49% to 6,299.19, and gold prices dropped 0.17% to $3,428.8. Both risk and safe-haven assets show weakness, continuing to lack direction.

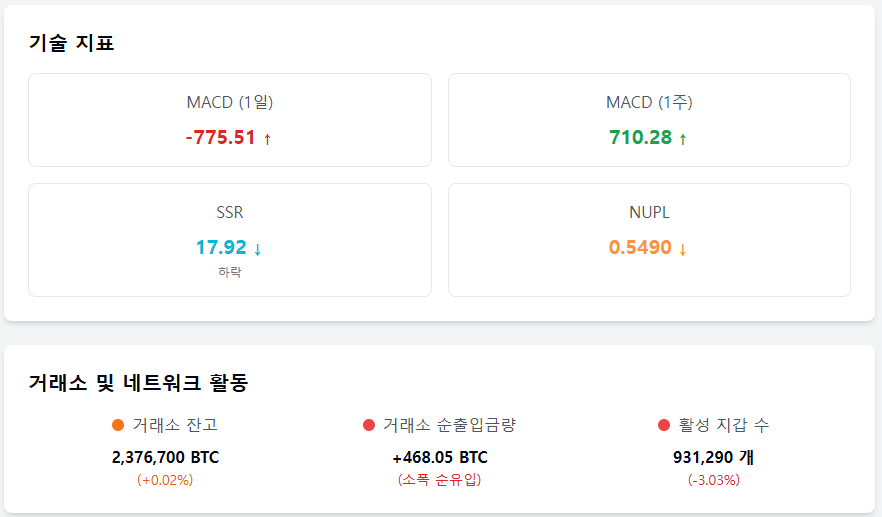

MACD –775.51 The short-term MACD is –775.51, continuing a bearish trend, but the 1-week MACD is 710.28, maintaining a medium-term upward trend.

❤️ Investor sentiment now

Dominance 61.0% (+0.2%p) Bitcoin dominance increased by 0.2 percentage points, showing a partial recovery of BTC-centered demand in the market.

Fear & Greed Index 52 (Neutral) The Fear & Greed Index slightly decreased from the previous day (55), maintaining a 'Neutral' level. Compared to last week (63), investment sentiment is gradually stabilizing.

Google Trend score 62 The Bitcoin-related search score dropped from 64 to 62, maintaining a flat level of public interest without a clear increase.

🧭 Market now

SSR 17.92 (–0.19) The Stablecoin Supply Ratio (SSR) decreased, recording 17.92, suggesting a partial recovery of stablecoin-based buying power.

NUPL 0.5490 (–0.0040) The Net Unrealized Profit/Loss (NUPL) slightly decreased, indicating a small reduction in the proportion of investors in the profit zone.

Exchange balance 2,376,700 BTC (+0.02%) The Bitcoin balance on exchanges increased by 0.02% to 2,376,700 BTC, with a slight increase in deposits.

Exchange net inflow +468.05 BTC (+0.13%) The 24-hour net inflow is 468.05 BTC, increasing by 0.13% from the previous day, continuing an inflow advantage.

Active wallets 931,290 (–3.03%) The number of active wallets decreased by 3.03% from the previous day (960,411), suggesting a temporary pause in on-chain activity.

Get news in real-time...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>