[Global Liquidity Radar] Bitcoin Holdings See Short-Term Net Inflows… Medium- to Long-Term Trends Remain Net Outflows

This article is machine translated

Show original

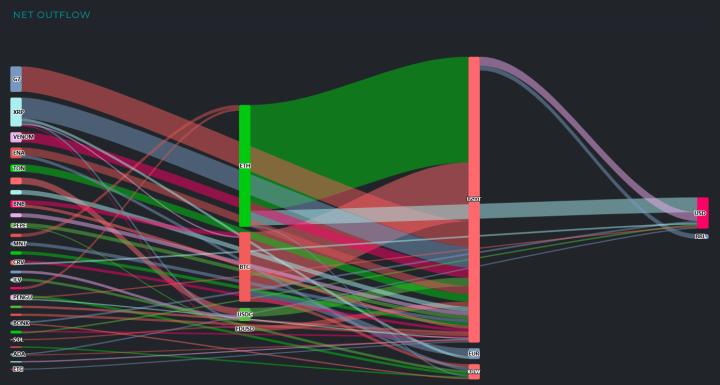

The global major exchanges' Bitcoin holdings have temporarily shifted to net inflow, but the medium to long-term trend still shows continued net outflow.

According to CoinGlass as of the 6th, the total Bitcoin balance of major exchanges was approximately 2,108,093.68 BTC.

While 1,928.99 BTC was net inflow in a day, the past week saw 3,861.85 BTC and the past month saw 27,094.98 BTC in net outflow.

Coinbase Pro holds the most Bitcoin at 560,601.47 BTC. It recorded 355.18 BTC net outflow in the past day and 53,604.84 BTC net outflow in the past month.

Binance holds 558,690.61 BTC, with 1,004.23 BTC net inflow on a daily basis. On a monthly basis, it has attracted 24,933.22 BTC, showing a contrasting trend.

Bitfinex holds 386,766.31 BTC, with 33.20 BTC net outflow in a day and 2,959.14 BTC in a week, but has converted to net inflow of 2,151.57 BTC on a monthly basis.

**Daily Maximum Net Inflow** ▲Binance (+1,004 BTC) ▲OKX (+593 BTC) ▲Gate (+567 BTC)

**Daily Maximum Net Outflow** ▲Kraken (–590 BTC) ▲Coinbase Pro (–355 BTC) ▲Gemini (–37 BTC)

Binance BTCUSDT trading volume was recorded at $948.04 million in the Asian time zone, $1.06 billion in the European time zone, and $303.29 million in the US time zone.

Compared to the previous day (August 4th), trading volume surged in Asian (+285.5%), European (+134.8%), and US (+27.0%) markets. Particularly, the Asian market led the short-term liquidity recovery, increasing from $245.88 million to $948.04 million, nearly quadrupling in a day.

Across all three regions, the matching volume of buy and sell orders increased, transitioning from a wait-and-see attitude to market participation. This can be interpreted as a sign of short-term risk-on shift, coinciding with Bitcoin price stability the previous day.

Sector:

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content