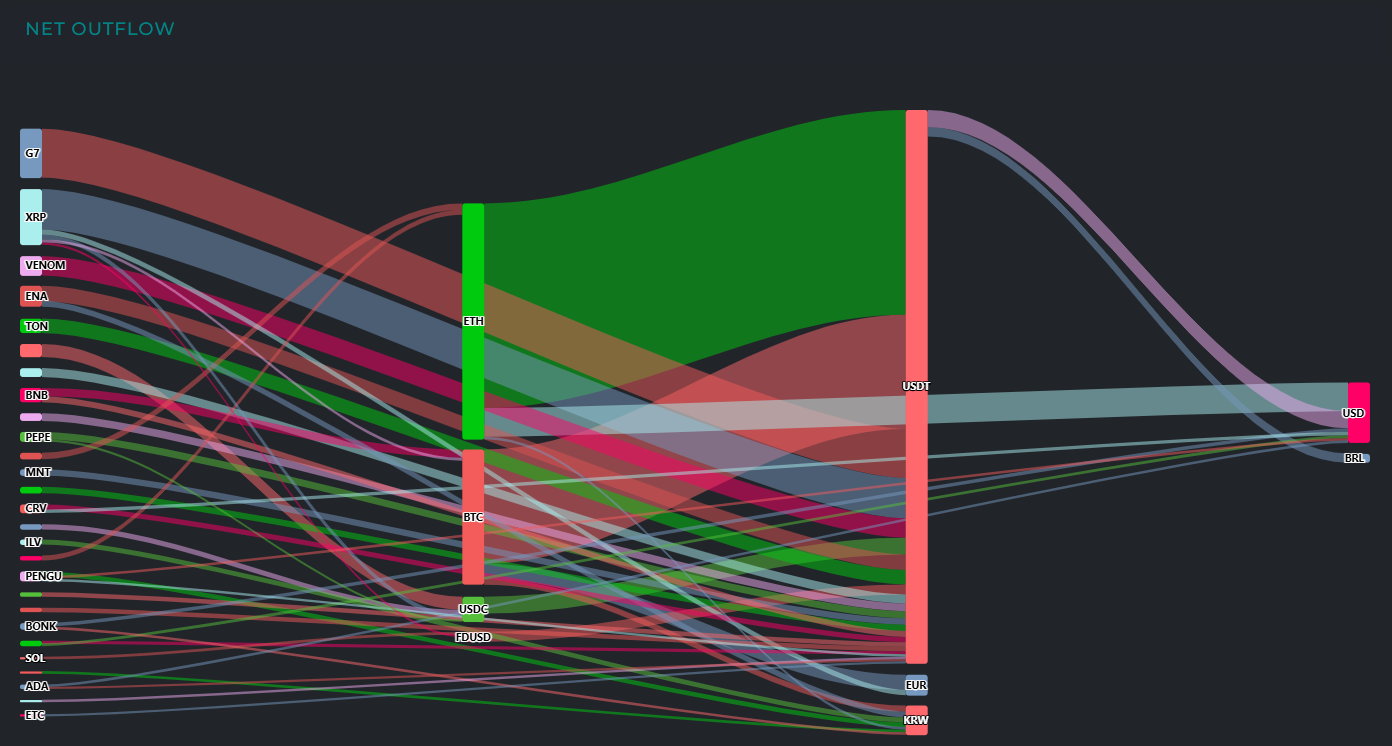

Funds flowing out of Bitcoin and Ethereum are converging on USDT, strengthening the refuge flow centered on stablecoins.

According to CryptoMeter as of the 5th, the most active inflow in the global cryptocurrency market over the past 24 hours was in US dollars (USD), with a total inflow of $24.4 million.

Dollar funds were widely distributed to ▲Solana (SOL, $9.3 million) ▲Bitcoin (BTC, $4 million) ▲Litecoin (LTC, $4 million) ▲Uniswap (UNI, $2 million) ▲Chainlink (LINK, $1.6 million) ▲Ripple (XRP, $1.6 million) ▲Optimism (OP, $1.9 million), etc.

Korean won (KRW)-based funds were totaled at $14 million. Most of this moved to ▲USDT ($11.6 million), and also flowed into ▲SOL ($1.3 million), ▲KAIA ($1.1 million).

Turkish lira (TRY) inflow was $5.3 million, moving to USDT ($4.7 million) and MAGIC ($0.63 million). Euro (EUR) inflow was $7.2 million, circulating to ▲USDC ($4.1 million) ▲SOL ($1.2 million) ▲LTC (equivalent to $0.84 million) ▲USDT ($1 million), etc.

Japanese yen (JPY)-based funds of $1.4 million were entirely inflows to Bitcoin (BTC), and Brazilian real (BRL) funds of about $1.3 million moved to Ethereum (ETH).

On this day, USDT funds worth $129.4 million moved to ▲USDE ($22.9 million) ▲SOL ($19.6 million) ▲LTC ($19.6 million) ▲USDC ($19 million) ▲BETH ($10.3 million), etc. Additionally, it was distributed to multiple altcoins such as ▲TRX ($8.7 million) ▲AVAX ($8.2 million) ▲UNI ($5.9 million) ▲USDP ($3.8 million), providing liquidity.

USDC funds worth $36.9 million were distributed to ▲ETH ($19.5 million) ▲BTC ($5.7 million) ▲FDUSD ($4.9 million) ▲LTC ($4.1 million).

FDUSD funds of $32 million were reallocated to major assets such as ▲BTC ($14.8 million) ▲ETH ($11.7 million) ▲BNB ($4.8 million).

The $25.8 million inflow into Bitcoin (BTC) was partially redistributed to ▲Ethereum ($12.9 million), ▲WBTC ($6.6 million), ▲Litecoin ($2.2 million), continuing the asset circulation flow.

Based on the final inflow, ▲ETH ($45.5 million) absorbed the most funds, followed by ▲LTC ($32.5 million) ▲SOL ($32.1 million) ▲USDE ($24.2 million) ▲WBTC ($6.6 million) ▲BNB ($4.8 million).

On this day, a total of $226.7 million flowed out of Ethereum (ETH). Most of it was converted to ▲USDT ($196.7 million), and funds also moved to ▲dollars ($27.5 million) ▲won ($2.5 million).

From Bitcoin (BTC), $130.1 million was withdrawn, moving to ▲USDT ($109.8 million), with conversions to ▲euro ($14.5 million) ▲won ($5.7 million) also confirmed.

From XRP, a total of $53.5 million was distributed to ▲USDT ($38.8 million) ▲euro ($5.1 million) ▲USDC ($4.5 million) ▲BTC ($2.8 million) ▲FDUSD ($2.3 million).

In G7, $47 million moved to USDT. VENOM $18.7 million and TON $14 million were also entirely converted to USDT.

ENA showed a conversion flow, with a total of $20.4 million divided into ▲USDT ($14.7 million) ▲won ($5.7 million). From BNB, $13.7 million flowed out to USDT and BTC.

Additionally, outflow trends were detected in multiple assets such as ▲PEPE ▲MNT ▲CRV ▲ILV ▲PENGU ▲BONK ▲SOL ▲ADA ▲ETC.

Funds collected in the intermediate asset USDC totaled $24.1 million, of which $16.2 million flowed back into USDT. FDUSD's entire $9.6 million was converted to USDT.

Ultimately, a total of $531.8 million converged on USDT, with only a portion continuing to ▲dollars ($16.5 million) ▲Brazilian real ($8.9 million) and other fiat currencies.

Among fiat currencies, movements to ▲dollars ($58.2 million) ▲won ($28.2 million) ▲euro ($19.6 million) were the most active.

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>