The Bitcoin holdings of global major exchanges have turned to net outflow again.

According to CoinGlass as of the 4th, the total Bitcoin balance of global major exchanges was approximately 2,102,643.56 BTC.

A net outflow of 1,017.72 BTC occurred in a day, with a net outflow of 59,986.55 BTC in the past week and 34,662.70 BTC in the past month.

Coinbase Pro holds the most Bitcoin with 559,777.86 BTC. A net outflow of -286.09 BTC was recorded on a daily basis.

Binance holds 556,877.95 BTC and experienced a daily net outflow of -1,037.51 BTC. Bitfinex holds 387,248.71 BTC and saw a daily net inflow of +495.03 BTC.

Largest Daily Net Inflow ▲Bitfinex (+495 BTC) ▲Bybit (+309 BTC) ▲Bitflyer (+66 BTC)

Largest Daily Net Outflow ▲Binance (-1,038 BTC) ▲OKX (-398 BTC) ▲Coinbase Pro (-286 BTC)

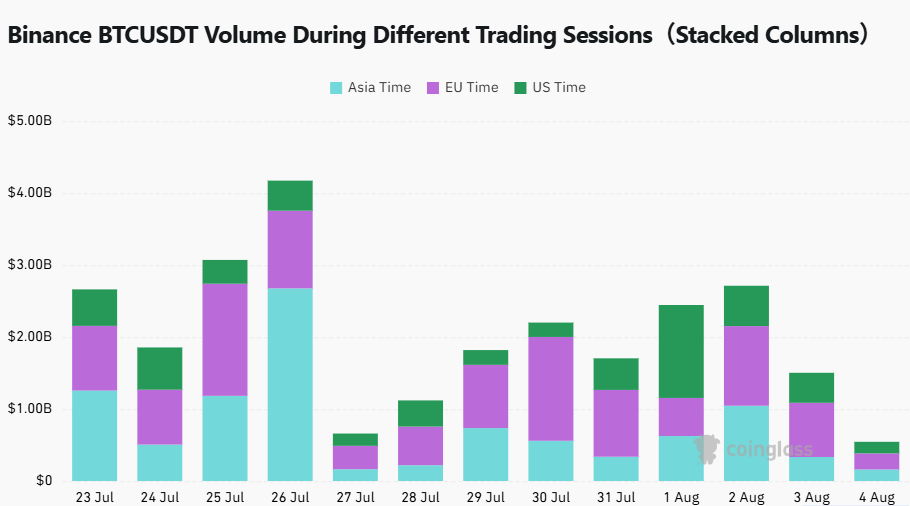

Binance BTCUSDT trading volume was recorded at $160.27 million in the Asian time zone, $223.18 million in the European time zone, and $160.85 million in the US time zone.

Compared to the previous day (August 2nd), trading volume decreased significantly in all markets: Asia (-51.9%), Europe (-70.4%), and the US (-61.4%). Particularly, the European market sharply declined from $575.94 million to $223.18 million in a day, clearly reflecting a contraction in trading sentiment.

In all three regions, the wait-and-see attitude for buying and selling is expanding, continuing a phase of catching a breath after a short-term price rebound. The market is interpreted as entering a liquidity adjustment flow.

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>