In the past 24 hours, a large-scale liquidation occurred in the cryptocurrency market. It appears that significant leveraged positions were liquidated on major exchanges such as Binance and Bybit.

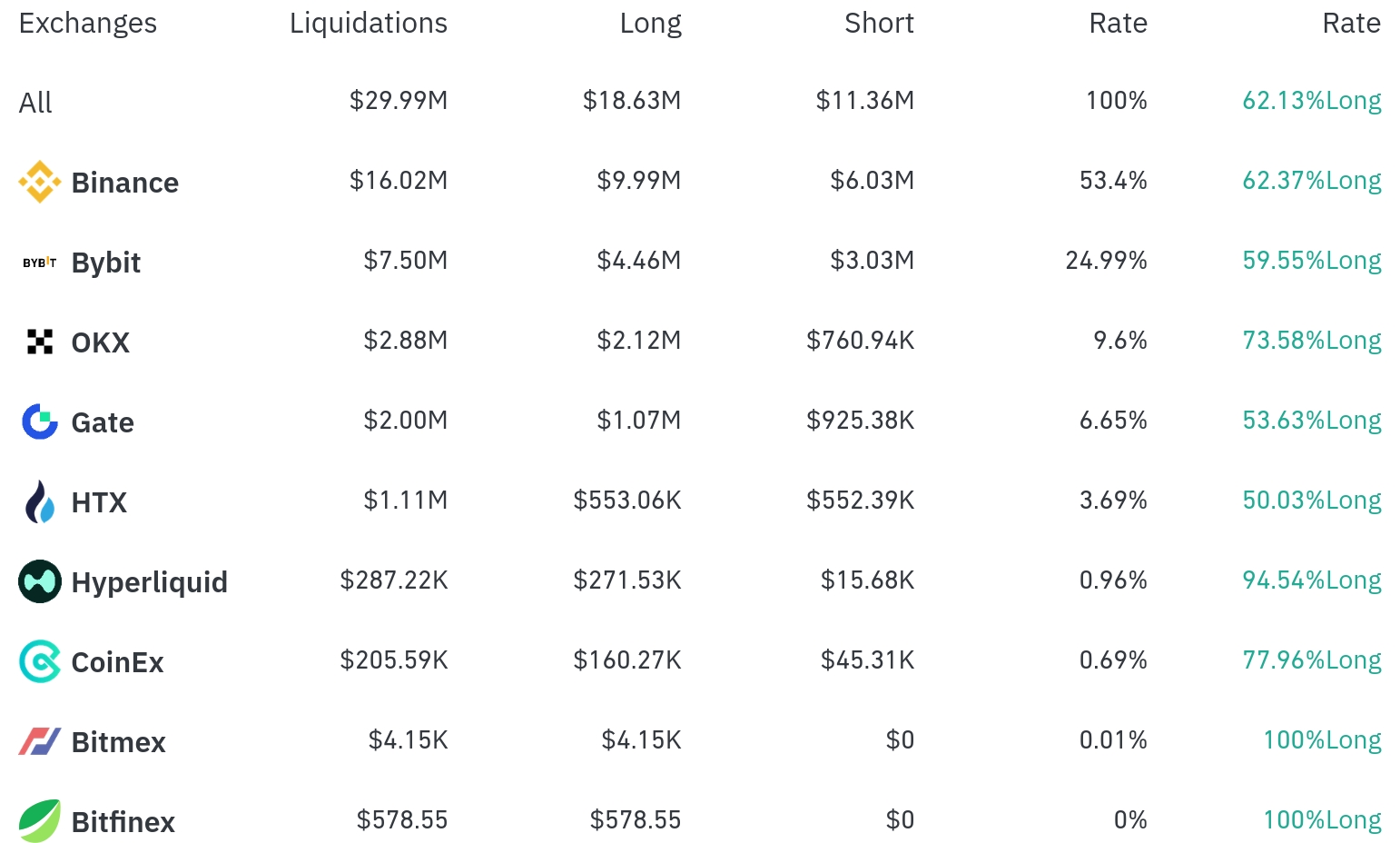

Looking at the liquidation data by exchange over 4 hours, Binance saw the highest liquidation at $16.02 million (approximately 53.4%), with long positions accounting for $9.99 million (62.37%). Bybit experienced $7.5 million (24.99%) in liquidations, with long positions at 59.55%.

OKX saw $2.88 million (9.6%) in liquidations, with a notably high long position ratio of 73.58% compared to other exchanges. Gate experienced $2 million (6.65%), and HTX had $1.11 million (3.69%) in liquidations.

Looking at coin-specific liquidation data, Bitcoin (BTC) saw approximately $54.79 million in liquidations over 24 hours, with $2.95 million in long positions and $4.65 million in short positions over 4 hours. The current Bitcoin price is $113,670, down 0.95% in 24 hours.

Ethereum (ETH) experienced the highest liquidations at approximately $105.45 million over 24 hours, with $2.36 million in long positions liquidated over 4 hours. Ethereum's price is $3,574, down 3.36% in 24 hours.

Solana (SOL) had approximately $15.29 million in liquidations over 24 hours, with $1.31 million in long positions liquidated over 4 hours. Solana's price is $162.46, down 2.82%.

Dogecoin (DOGE) saw approximately $8.26 million in liquidations over 24 hours, with $87,350 in long positions liquidated over 4 hours. Dogecoin's price is $0.19789, down 4.16%.

Notably, despite a significant price increase of 14.91%, the PUMP Token saw $2.14 million in short position liquidations over 24 hours. Additionally, SUI and PEPE tokens experienced substantial liquidations alongside price drops of 4.52% and 5.04%, respectively.

Examining liquidation ratios by exchange, BitMEX saw 100% long position liquidations, while HTX had almost equal liquidations of long and short positions (50.03% vs. 49.97%). Hyperliquid showed the highest long position liquidation ratio at 94.54%.

These large-scale liquidations in the cryptocurrency market indicate an expansion of market volatility, and investors need to pay more attention to managing leveraged positions.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>