Bitcoin (BTC) remains relatively stable ahead of the Federal Open Market Committee (FOMC) meeting, while some altcoins showed sharp declines. In particular, the meme coin BONK drew attention by plummeting 13% in just one day.

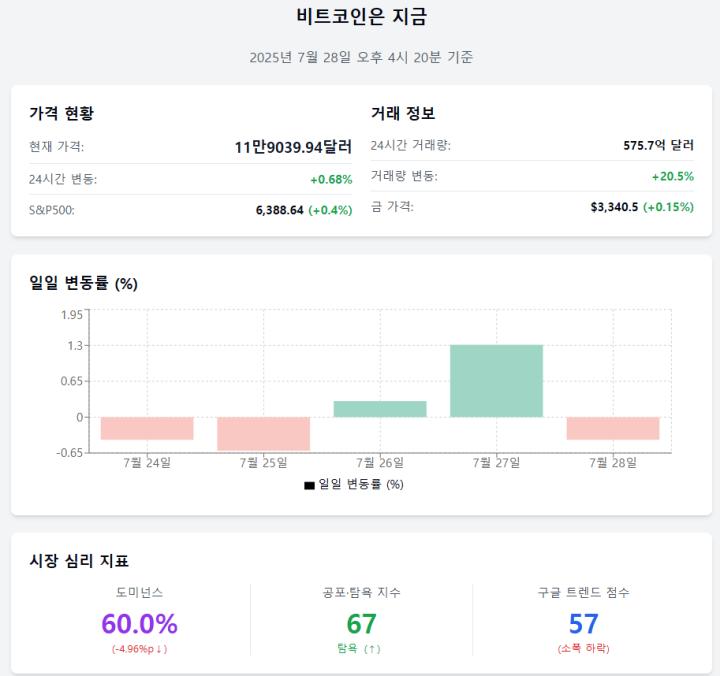

Bitcoin's price, which had shown high volatility in recent days, is currently trading around $118,000. Last week, Galaxy Digital sold 80,000 BTC for a third party, causing the price to drop to near its annual low of $114,500, but it rebounded over the weekend to recover above $117,000. It then attempted to break through $120,000 but soon faced selling pressure that halted its upward momentum.

Market participants are concerned about potential high volatility in Bitcoin's price ahead of today's scheduled FOMC interest rate announcement, as rate changes directly impact the crypto market. Currently, Bitcoin's market capitalization is around $235 billion, with its market share rising to 59.6%.

Meanwhile, Ethereum (ETH) failed to break through the $3,900 resistance line and dropped 1.6% to around $3,800. XRP also declined 2%, approaching $3.1. Major altcoins like BNB, SOL, Doge, and ADA showed significant declines, dampening investor sentiment.

Sui, HBAR, and AVAX dropped more than 5% in a day, while ENA, TAO, and ICP recorded similar declines. BONK, in particular, plummeted 13% in 24 hours, marking its largest recent drop, with TIA and SPX also falling 9% each.

Due to these declines, the global virtual asset market capitalization evaporated by $60 billion overnight, shrinking to $394 billion.

The short-term direction of Bitcoin and the entire crypto market will likely be determined by the market's movement following the Federal Reserve's announcement. The market remains sensitive to 'uncertainty', with Bitcoin's potential to break through $120,000 expected to be a key psychological and technical turning point.

Get news in real-time...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>