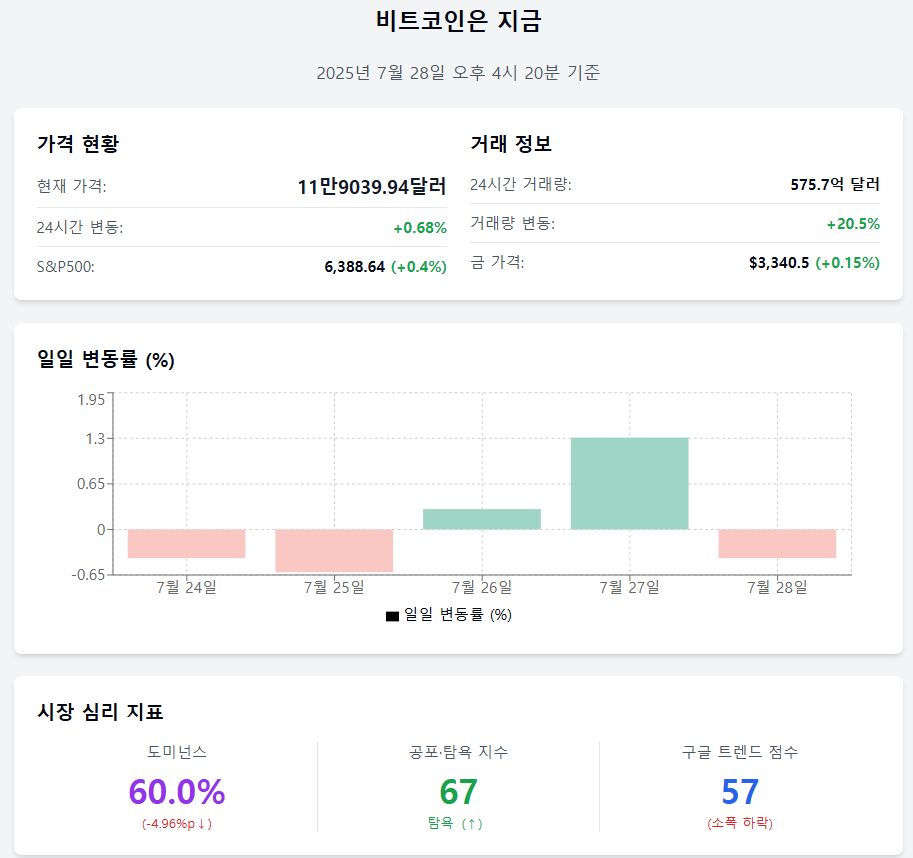

As of July 28, 2025, 4:20 PM

Bitcoin has recovered the psychological support line of $119,000 and is attempting a short-term rebound. On-chain indicators are showing mixed trends, and with the decline in dominance, funds are noticeably dispersing into altcoins.

📈 Price is now

$119,039.94 (+0.68%) Bitcoin recorded a 0.68% increase from the previous day at $119,039.94. It is attempting a rebound by recovering the $119,000 level.

Trading volume $5.757 billion (+20.5%) The 24-hour trading volume increased by 20.5% from the previous day to $5.757 billion. With the price rebound, buy inflows or short-term trading have become more active.

Daily volatility –0.41% The daily volatility over the past 5 days was –0.41% (24th), –0.61% (25th), +0.29% (26th), +1.31% (27th), –0.41% (28th). Short-term trends remain directionless and mixed.

Asset comparison S&P500↑ · Gold↑ Last Friday (as of the 25th), the S&P500 index rose 0.4% to 6,388.64, and gold prices increased 0.15% to 3,340.5. Overall, both risk and safe-haven assets showed a slight increase, indicating a balanced investment sentiment.

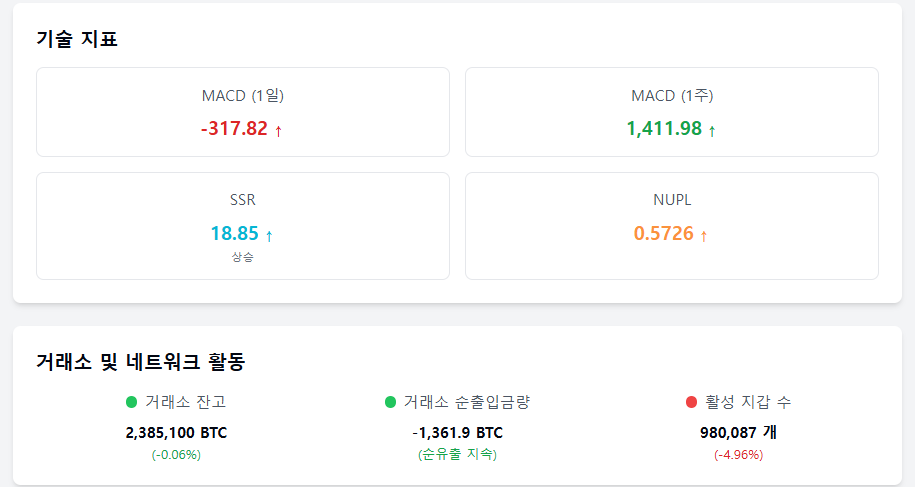

MACD –317.82 The short-term MACD remains in a downward trend at –317.82, while the 1-week MACD is 1,411.98, maintaining a medium-term upward trend.

❤️ Sentiment now

Dominance 60.0% (–4.96%p) Bitcoin dominance decreased by 4.96 percentage points from the previous day, showing a rapid flow of funds into altcoins.

Fear & Greed Index 67 (Greed) Recording 67, up from the previous day (64) and last week (67), maintaining the 'Greed' zone. Investment sentiment remains relatively stable.

Google Trends score 57 The Bitcoin search score on Google Trends rose from 50 on the 27th to 57 on the 28th. Public interest is recovering slightly.

🧭 Market now

SSR 18.85 (+1.29%) The Stablecoin Supply Ratio (SSR) compared to Bitcoin market cap increased to 18.85. Buying capacity appears to have decreased.

NUPL 0.5726 (+0.0051) The Net Unrealized Profit/Loss (NUPL) increased slightly, showing a small increase in the proportion of investors in the profit zone.

Exchange balance 2.3851M BTC (–0.06%) Exchange holdings slightly decreased to 2,385,100 BTC. Withdrawal trends continue.

Exchange net inflow –1,361.9 BTC (+1.78%) Bitcoin net outflow increased by 1.78% to 1,361.9 BTC. Withdrawal for holding purposes appears to be predominant over selling.

Active wallets 980,087 (–4.96%) Active wallet count decreased by 4.96% to 980,087. On-chain activity shows a temporary contraction.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>