Bitcoin is showing an exceptional strength this week. While the entire cryptocurrency market dropped by more than 5% compared to the previous day, the BTC price has only declined by 0.6%, maintaining around $118,000.

Such a flat performance in a weak market usually indicates an upward intention. However, Bitcoin has not broken through despite the lack of clear selling pressure. Currently, the upward trend is on hold. It's time to find out the reason!

Decrease in Taker Sell Volume... Weakening Selling Pressure

One of the clearest signals that sellers are retreating is the sharp decrease in taker sell volume. On July 25th, taker sell volume recorded nearly $17.8 billion, which was a short-term peak. However, it has since decreased by about 93%, dropping to around $1.2 billion at the time of writing.

This means the sell volume has significantly reduced. Conversely, this also increases the possibility of further market growth.

Usually, when sellers disappear and the price remains stable, an upward trend begins. However, in Bitcoin's case, the price has not moved anywhere. This does not weaken the upward logic, but merely pauses the upward trend. What is needed is a catalyst.

Taker sell volume tracks the value of trades where the seller is the aggressor, meaning when people market sell at the buy order. The decline in this indicator shows fewer traders are trying to quickly dump coins, which typically reflects reduced fear or fatigue on the selling side.

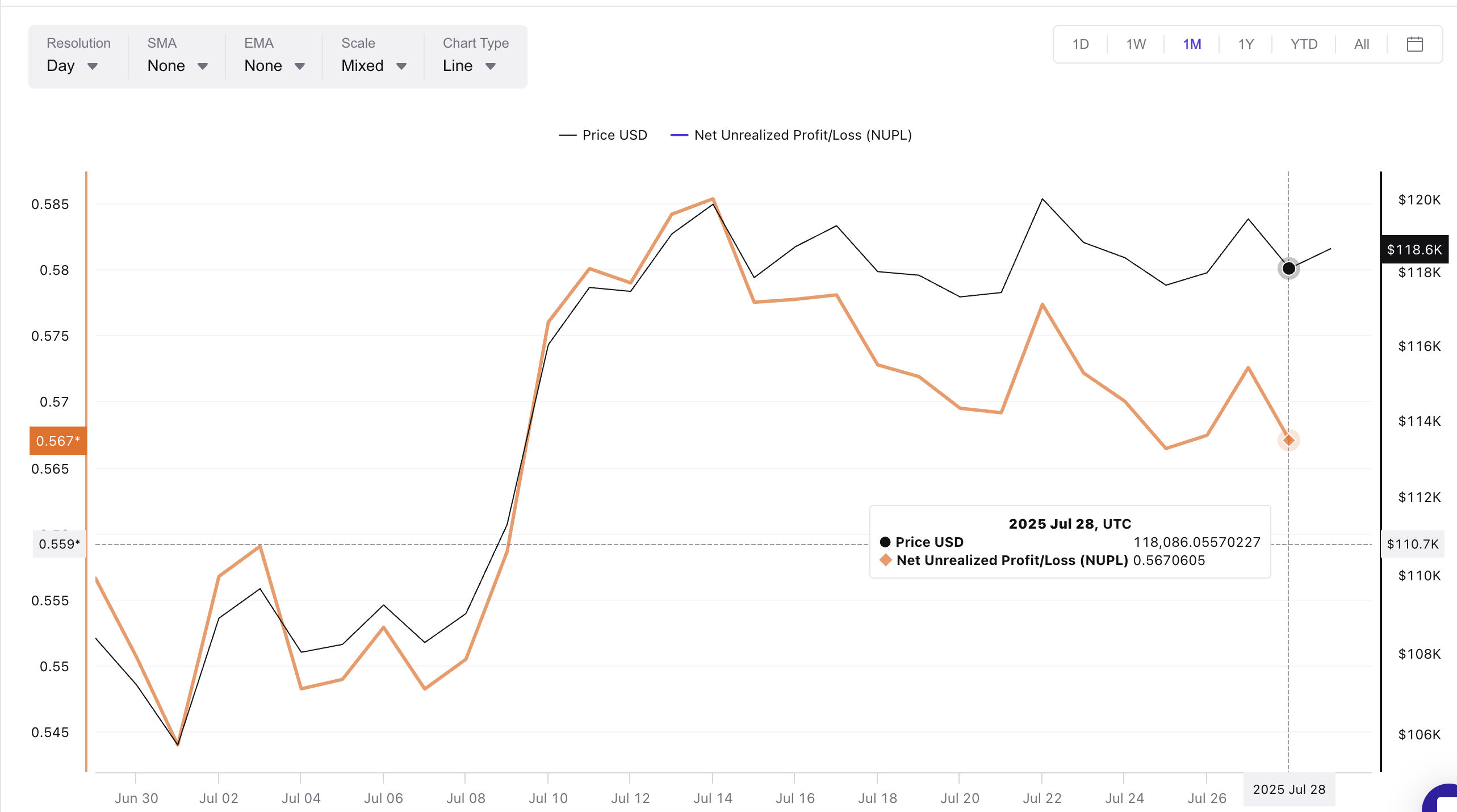

NUPL Peak, Continued Profit Taking

The lacking catalyst could be psychological, and Net Unrealized Profit/Loss (NUPL) helps explain the reason. NUPL measures the amount of unrealized profit in the system, roughly indicating when holders might feel the temptation to sell.

Over the past two weeks, Bitcoin has tested the $119,000 to $120,000 level multiple times on July 14th, 17th, 22nd, and even on July 27th. Each time, NUPL peaked between 0.57 and 0.58, and each time BTC price retreated without breaking higher.

This is no coincidence. The market is showing that the $119,000 to $120,000 range has become a major profit-taking zone.

After the last rejection, NUPL has slightly decreased while the price remains stable, suggesting some profit-taking has already occurred. Traders have locked in profits around $120,000, and the market is absorbing this movement without a new wave of selling.

NUPL means Net Unrealized Profit/Loss. It compares Bitcoin's market capitalization to realized market capitalization, indicating the amount of profit holders are sitting on without selling. When NUPL is high, there's a greater incentive to realize profits. As the price remains stable and NUPL declines, it means some profit-taking has already occurred, which could reset the market for the next potential rise.

Token Technical Analysis and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

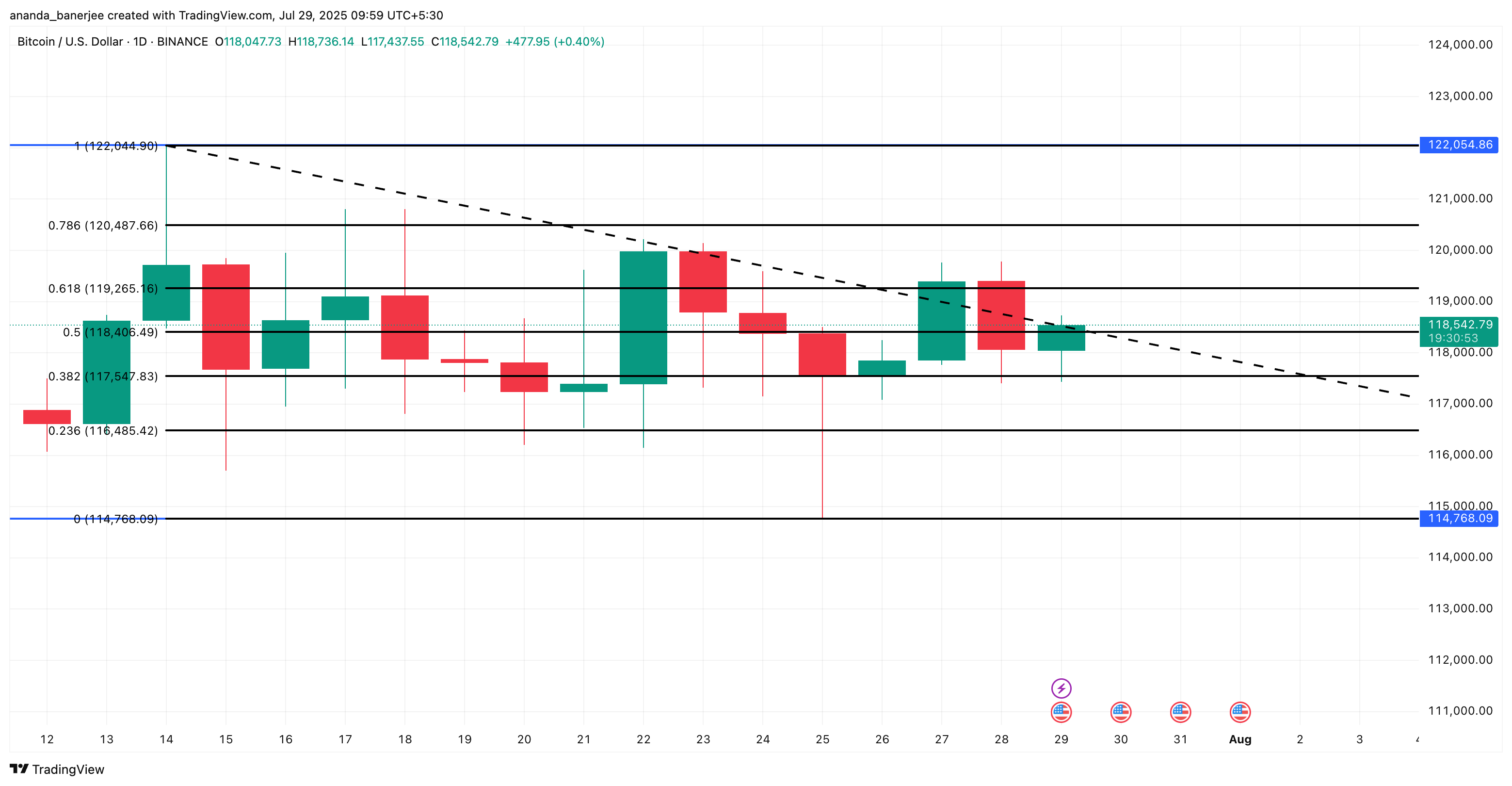

Bitcoin Price Maintained... Need to Break This Level

Despite multiple failed breakout attempts above $119,000, the BTC price still remains above the key support levels of $117,000 and $118,000. This zone is supported by the 0.382 and 0.5 Fibonacci retracement levels and has withstood multiple tests.

Sellers have retreated, but buyers have not managed to reverse the range.

What is stopping Bitcoin is the technical and behavioral resistance just before $120,000. This is where the 0.786 Fibonacci level is located and where NUPL recently peaked. Until BTC confidently breaks this zone, the Bitcoin upward trend will remain stagnant.

However, if $120,000 is breached, the structure will quickly open up. BTC could move to $122,000 and potentially beyond. With selling pressure disappearing, profits already realized, and support maintained, the conditions for the next Bitcoin rise are still alive. It just needs momentum.

However, if the Bitcoin price falls below $117,000, the short-term upward hypothesis will fail, opening the door to $114,000 and turning the entire structure bearish.