Tracking the Bitcoin supply and demand flow in the US market and monitoring changes in investment sentiment. In particular, analyzing market participants' psychology and supply environment through key indicators such as inflow and outflow status of Coinbase, a major exchange used by US institutional investors, premium index, and OTC trading volume. This can be used as a reference to gauge the short-term market trend and overall investment temperature. [Editor's Note]

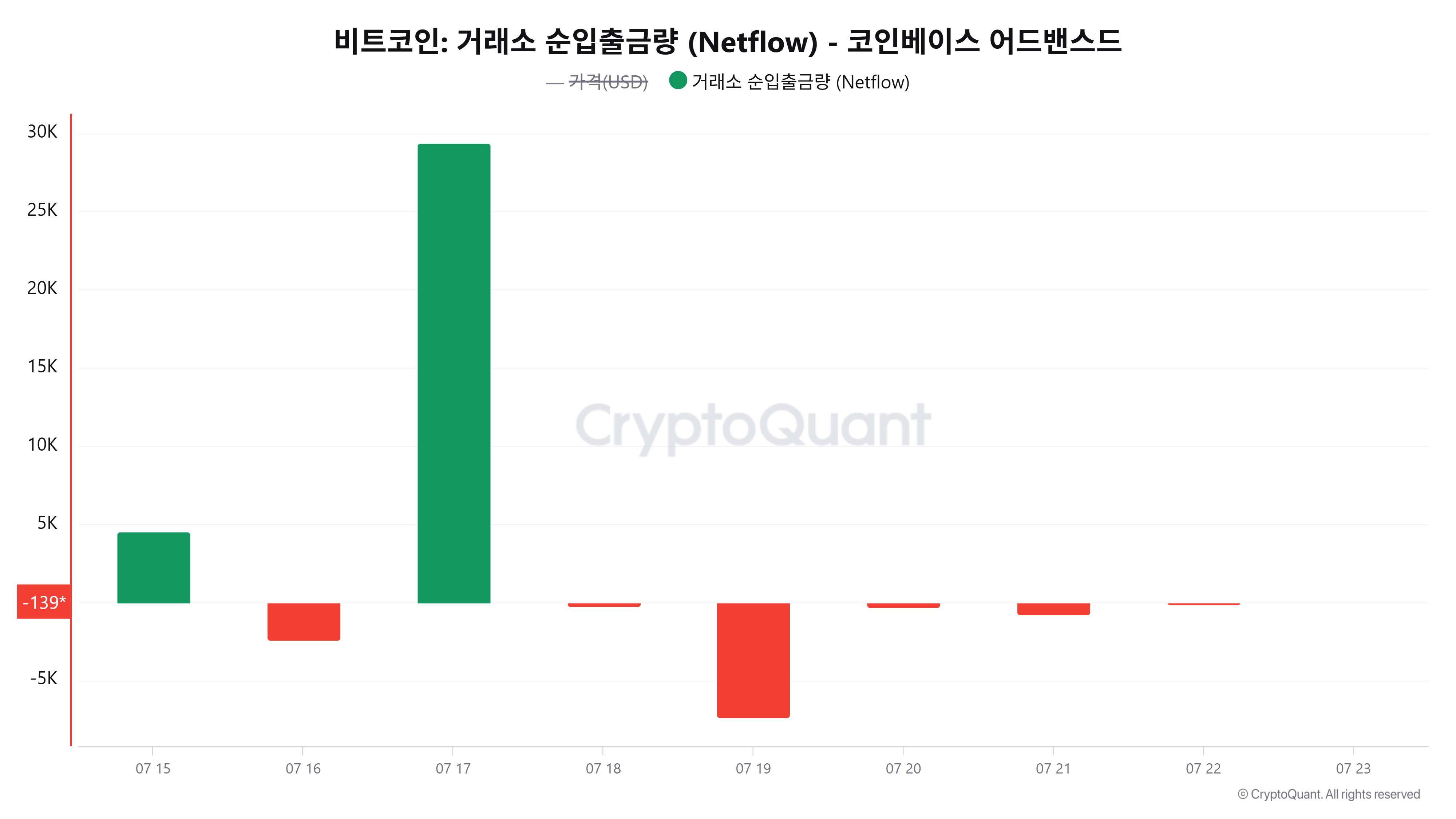

According to Cryptoquant data, the exchange Bitcoin netflow as of July 22, 2025 (UTC) was -139.03 BTC, showing a slight net outflow.

This is a significantly reduced figure compared to the large-scale outflow trend that continued over the past few days. In fact, on the 19th, over 7,300 BTC was withdrawn, and outflows of about 290 BTC and 790 BTC continued on the 20th and 21st, respectively.

Compared to this, the figure on the 22nd suggests that investors' asset exodus is somewhat calming. However, the net outflow trend itself is still maintained, indicating that the psychology of long-term holding and external wallet movement continues to influence the market.

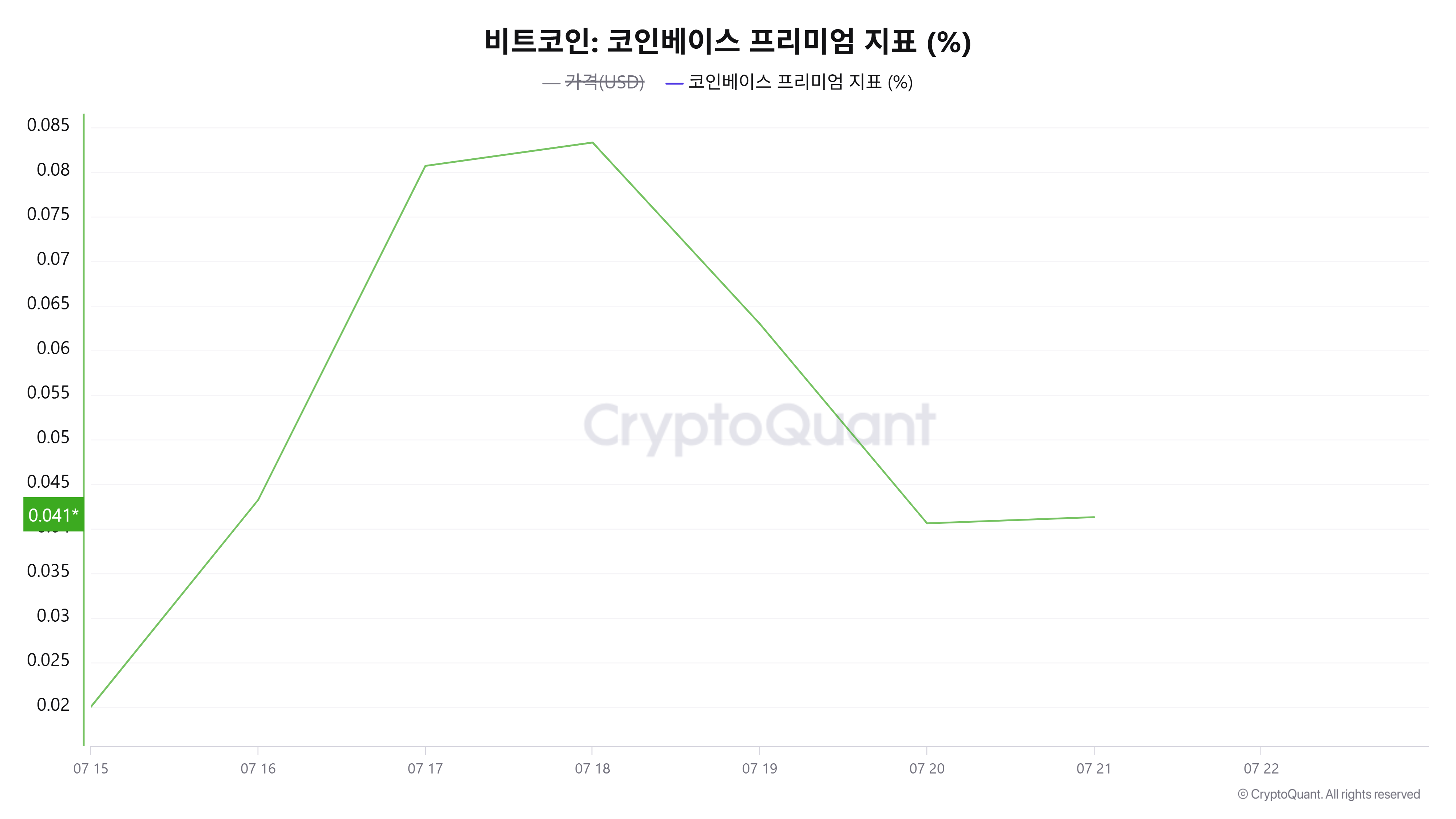

The Coinbase premium recorded 0.0413% as of July 21, slightly increasing from 0.0406% the previous day (20th).

This indicator represents the price difference between the US-based exchange Coinbase and the global exchange Binance for Bitcoin, and a positive value is interpreted as a signal of relatively strong buying sentiment in the US.

Compared to the high figures recorded in the latter part of last week, the current recovery trend appears limited. On the 18th, it recorded 0.0833%, and on the 19th, 0.0629%, showing strong buying sentiment in the US, but has since experienced continuous decline. This suggests that while US investors' buying demand is maintained to a certain extent, its intensity has somewhat weakened.

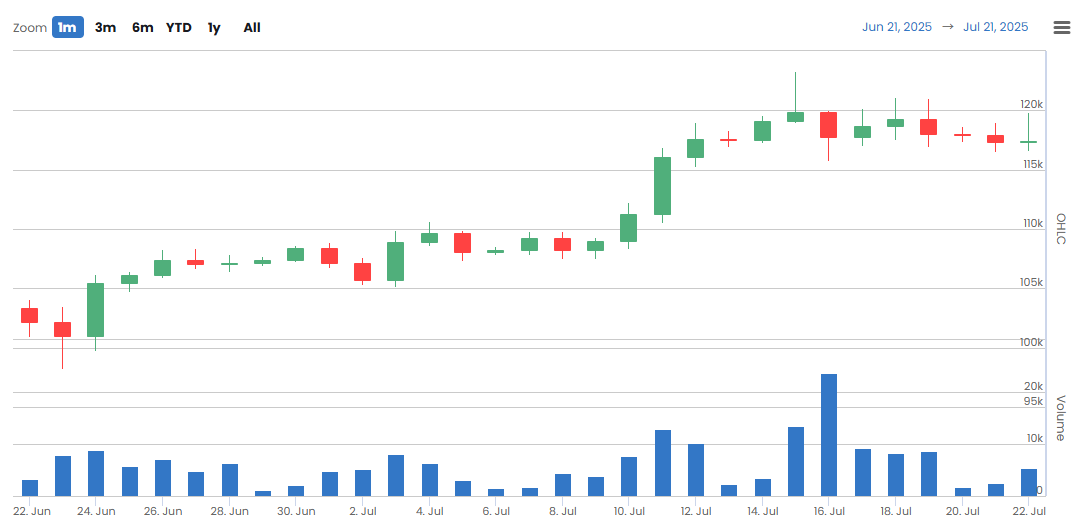

According to Coinigy, Coinbase Prime's Bitcoin trading volume was approximately 5,451.00 BTC as of July 21. This is more than double the previous day's (20th) 2,504.59 BTC. The 24-hour trading volume in dollars also exceeds $725 million, reflecting a significant inflow.

The surge in trading volume on Coinbase Prime, the main channel for institutional trading, suggests that some institutions attempted to buy at the bottom during the short-term price adjustment phase. With a rebound detected in the trading volume contraction trend of recent weeks, if this upward trend continues, it could serve as a positive signal for institutional demand recovery for Bitcoin prices.

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>