The cryptocurrency market is preparing for three U.S. economic signals this week. Expectations are rising as economic indicators increasingly impact Bitcoin (BTC) and the overall market.

Meanwhile, Bitcoin's price is maintaining well above $118,000 despite declining BTC dominance and selling concerns.

U.S. Economic Signals to Watch This Week

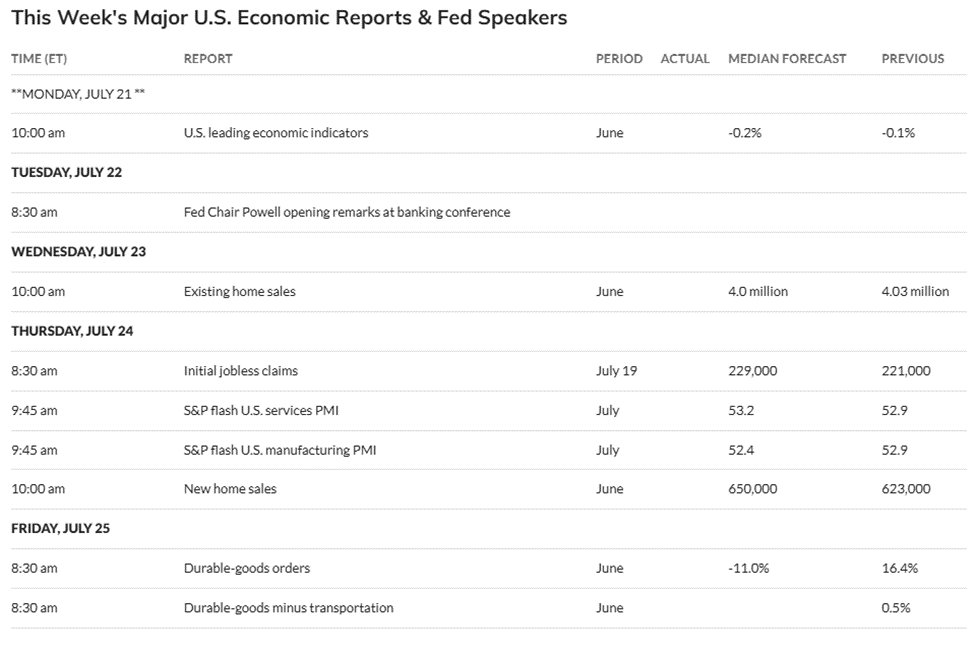

One of the three key U.S. economic signals to watch this week is Federal Reserve Chair Jerome Powell's opening remarks at Tuesday's bank meeting.

Powell's remarks are scheduled just a week after the U.S. Consumer Price Index (CPI) rose 2.7% annually in June.

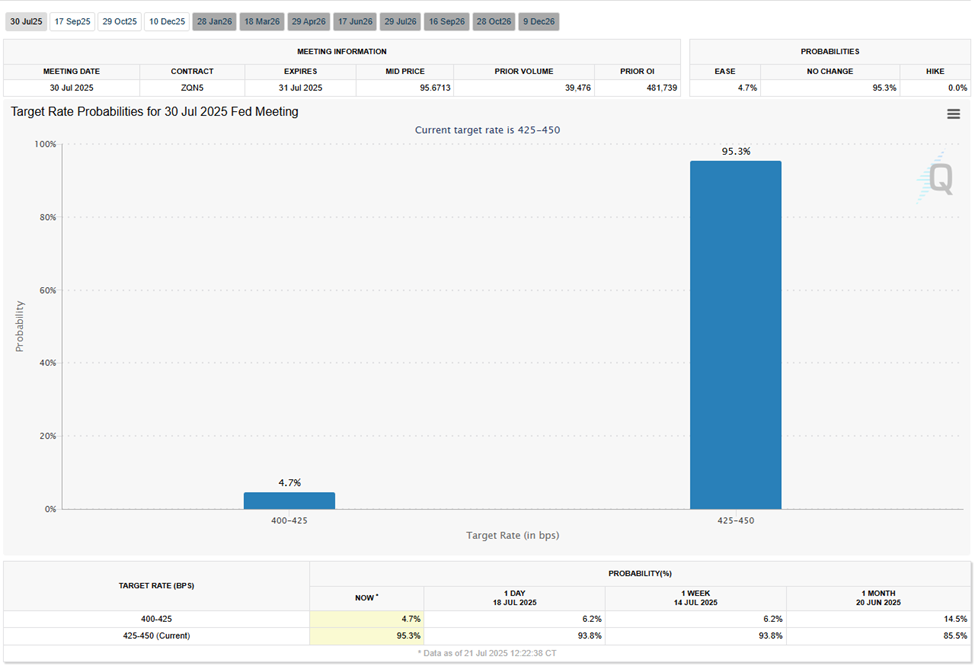

These remarks will come a week before the next FOMC meeting, with a 95.3% expectation of a rate freeze. Policymakers are anticipated to maintain the current rates.

Traders are closely watching Powell's remarks, hoping to gain insights into the rate decision scheduled for July 30th. However, concerns are also being raised amid these expectations.

Chair Powell is facing pressure from the Trump administration to cut rates, with concerns that high rates could hinder economic growth.

While maintaining a cautious stance, some speculate he might resign before his term expires in May 2026.

🚨 RUMOR MILL SPINNING 🚨

— Wall Street Gold (@WSBGold) July 21, 2025

Fed Chair Jerome Powell reportedly under pressure from the Trump team — may resign soon over refusal to cut rates.

👀 Word is he could announce it Tuesday in his next speech.

Keep a close eye on the markets. Something's brewing. pic.twitter.com/XKvC2M6kS2

The Fed Chair is also facing criticism from the White House over the agency's $2.5 billion building renovation. Government officials are demanding an audit, with speculation that this could provide grounds for his dismissal.

Particularly, Jerome Powell's potential dismissal or resignation could be positive for Bitcoin and cryptocurrencies, as it might signal a policy shift towards rate cuts.

BITCOIN WILL PUMP LIKE THIS WHEN THE FED CONFIRMS A RATE CUT! pic.twitter.com/O5RWIepDy1

— Ash Crypto (@Ashcryptoreal) July 8, 2025

Rate cuts would increase liquidity, boost risk appetite, weaken fiat currency, and stimulate demand for Bitcoin.

Initial Jobless Claims

Another U.S. economic signal to watch is initial jobless claims, which show the number of citizens filing for unemployment insurance for the first time. This U.S. economic indicator is important as its macro impact on the labor market is growing.

Initial jobless claims for the week ending July 12th were 221,000. According to MarketWatch, economists expect an increase to 229,000 for the week ending July 19th.

If initial jobless claims exceed the previous 221,000, the market may be unsettled due to job market weakness concerns.

However, if claims remain low, it indicates a strong labor market, which could dampen rate cut expectations and potentially negatively impact Bitcoin.

S&P Flash Services and Manufacturing PMI

Along with Thursday's initial jobless claims, another U.S. economic signal that could impact Bitcoin this week is the S&P Flash Services and Manufacturing PMI.

The Services PMI, reflecting the dominant service sector, showed expansion at 52.9 in June, slightly slowing from May's 53.7. Meanwhile, the Manufacturing PMI rose to 52.9 due to inventory increases, reaching a three-year high, influenced by tariff concerns.

MarketWatch data suggests July's Services PMI is expected at 53.2, with Manufacturing PMI below 52.4, indicating potential manufacturing weakness.

Historically, strong PMI figures can boost confidence in traditional markets, potentially diverting capital from Bitcoin. Conversely, weak figures might fuel rate cut expectations, supporting Bitcoin as a hedge against fiat currency weakness.

At the time of writing, Bitcoin is trading at $118,286, showing a slight 0.35% increase over the past 24 hours. Analysts emphasize the decline in Bitcoin dominance, often a precursor to an altcoin season.

Bitcoin miners and whales are selling BTC, and the UK government hints at Bitcoin sales. These factors could exacerbate market volatility this week.