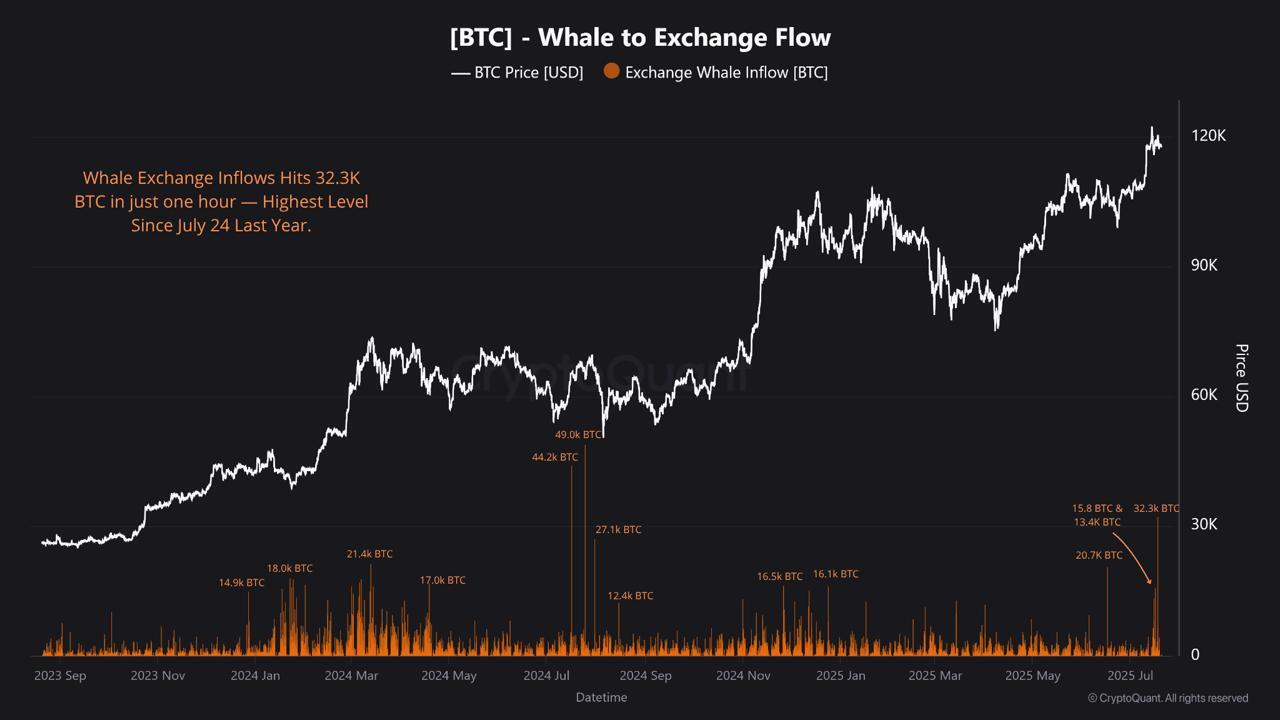

According to CryptoQuant data, Bitcoin whales sent over 61,000 BTC to exchanges on July 17th, which is the largest daily inflow in a year.

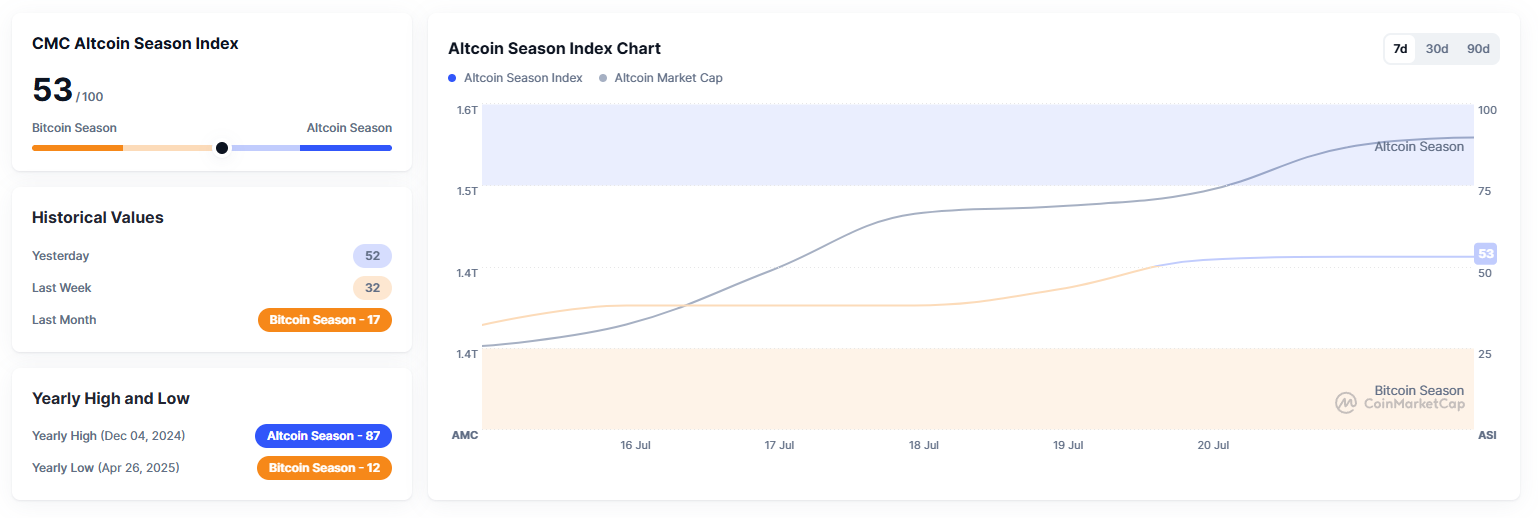

Along with this sudden increase in whale deposits, Bitcoin dominance sharply declined, raising questions about whether capital is moving to altcoins.

Whale Activity During Bitcoin Adjustment

According to CryptoQuant, 32,300 BTC flowed into exchanges within an hour on July 17th. This occurred after 15,800 BTC and 13,400 BTC were transferred from wallets holding over 100 BTC.

Such large movements typically indicate profit-taking, especially after Bitcoin reached a new all-time high of $123,000 on July 14th.

After the whale inflow, Bitcoin's price has dropped and is currently trading between $117,000 and $118,000.

Most importantly, this coincides with a sharp decline in Bitcoin dominance, dropping from 64% to 60% between July 17th and 21st.

The decline in dominance indicates investors are moving from Bitcoin to altcoins, which is one of the early signals of an altcoin season.

Altcoins perform better when Bitcoin stabilizes and capital flows into Ethereum, Solana, and mid-cap tokens.

Bitcoin's short-term outlook is currently entering an adjustment phase. Additional downward pressure may occur if whales continue selling. However, the price support at $115,000 is currently maintained.

Meanwhile, the altcoin market is showing strength. Ethereum, XRP, and Solana recorded double-digit increases last week. Meme coin market cap rose 8% today, approaching $9 billion.

The Altcoin Season Index also rose from 32 to 56, supporting the change in market momentum.

In summary, whale activity is cooling Bitcoin's rally and quietly promoting altcoin rises. The next move depends on whether buyers will absorb selling pressure or another wave of whale selling occurs.

Overall, this is a correction period for Bitcoin and the start of momentum for altcoins. Continue monitoring whale flows and BTC.D to confirm the next stage.