The global virtual asset market continues to adjust with BTC's sideways movement and altcoin weakness. MicroStrategy, the world's largest Bitcoin-holding listed company, once again drew market attention by purchasing Bitcoin on a large scale.

According to CoinMarketCap as of 9 AM, the total market capitalization of cryptocurrencies was approximately $3.72 trillion, a 1.49% decrease from the previous day. The 24-hour trading volume increased by over 24% to $14.67 billion, but this expansion did not lead to a market reversal.

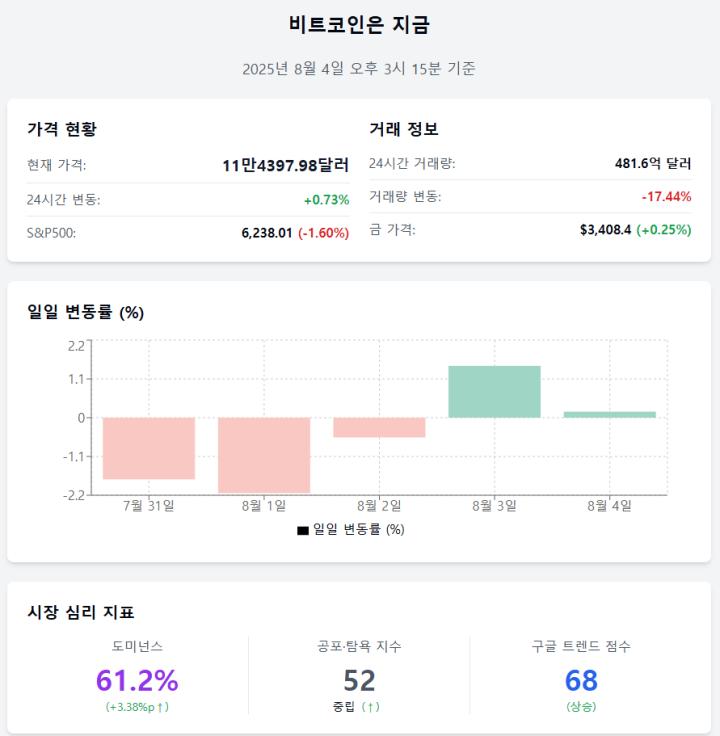

Bitcoin, ranked first in market capitalization, was trading at $114,092, declining 0.83% in 24 hours. On a weekly basis, it adjusted by 3.23%. ETH was at $3,609, down 2.96% in 24 hours, with a cumulative weekly decline of 4.79%. XRP also dropped to $2.96, falling more than 5% over seven days.

Among altcoins, Solana and BNB showed significant declines. Solana fell 3.22% to $164 in 24 hours and declined 9.56% weekly. BNB also dropped to $755, falling 6.17% in a week. In contrast, the dollar-pegged stablecoin USDT maintained its $1 level, showing stability amid market volatility.

The 'Fear and Greed Index' recorded 55, indicating a neutral sentiment. While there's no immediate sharp decline, investors' active buying momentum remains limited. The cryptocurrency adjustment appears related to the US stock market's decline, with the Dow Jones falling 0.14%, S&P 500 down 0.49%, and Nasdaq dropping 0.65%.

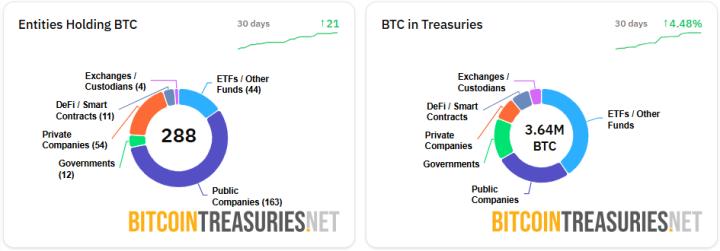

Meanwhile, MicroStrategy, the company holding the most Bitcoin globally, has again purchased Bitcoin on a large scale. The company announced buying 21,021 Bitcoins at $117,256 each from October 28 to November 3, totaling $246 million. This has increased MicroStrategy's Bitcoin holdings to 628,791 coins.