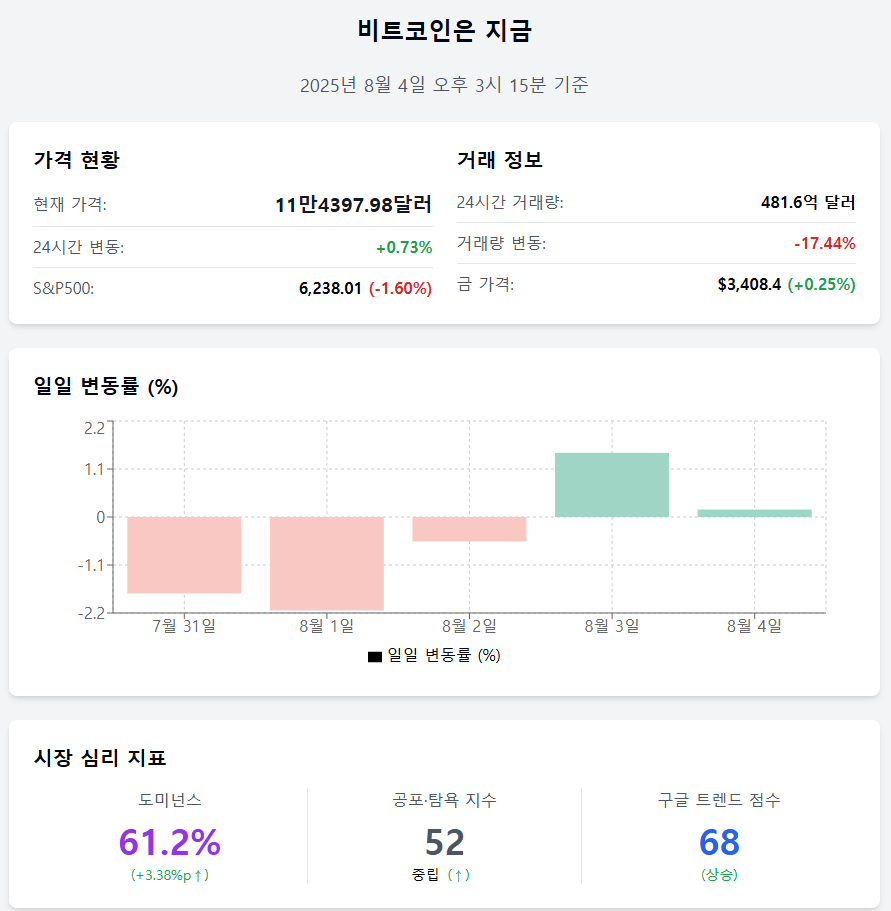

As of 3:15 PM on August 4, 2025

Bitcoin is maintaining a strong consolidation trend in the early 114,000 dollar range. Trading volume and active wallets have decreased simultaneously, showing a temporary contraction in market participation. Meanwhile, the dominance has shifted upward, indicating signs of funds flowing back into Bitcoin.

📈 Price right now

Price 114,397.98 (+0.73%) Bitcoin is trading at $114,397.98, up 0.73% from the previous day.

Trading volume $48.16 billion (–17.44%) The 24-hour trading volume has decreased by 17.44% to $48.16 billion from the previous day. While the price shows a strong consolidation, trading activity appears to be contracting.

Daily volatility +0.17 The daily volatility over the past 5 days has been recorded as –1.75% (July 31), –2.14% (August 1), –0.56% (August 2), +1.47% (August 3), +0.17% (August 4). In the short term, it appears to have entered a range of reduced decline and attempted recovery.

Asset comparison S&P500↓ · Gold↑ As of last Friday, the S&P500 index dropped 1.60% to 6,238.01, while gold prices rose 0.25% to $3,408.4. The divergent directions between risk and safe assets reflect the market's wait-and-see sentiment.

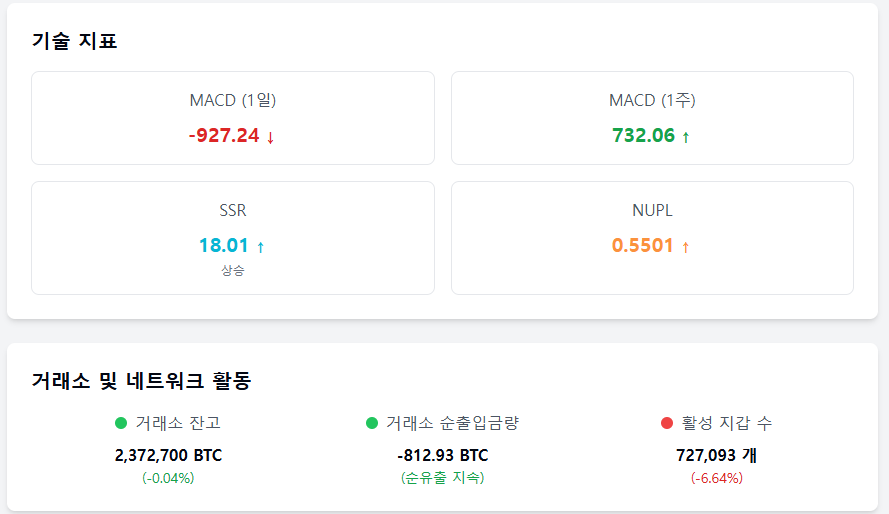

MACD –927.24 The short-term MACD is maintaining a downward trend at –927.24, while the 1-week MACD is 732.06, maintaining a medium-term upward trend.

❤️ Investor sentiment now

Dominance 61.2% (+3.38%p) Bitcoin dominance has increased by 3.38 percentage points from the previous day. A trend of market funds flowing back into Bitcoin is being detected.

Fear & Greed Index 52 (Neutral) The Fear & Greed Index has moderately recovered to the 'Neutral' range compared to the previous day (48) and last week (67). Investment sentiment is stabilizing and recovering.

Google Trend score 68 The Bitcoin-related search score has slightly increased from 63 on the 3rd to 68 on the 4th. Public interest is turning back to an increasing trend.

🧭 Market now

SSR 18.0079 (+1.51%) The Stablecoin Supply Ratio (SSR) has risen to 18.01 compared to the previous day. The stablecoin buying capacity has somewhat slowed down.

NUPL 0.5501 (+0.0065) The Unrealized Profit Ratio (NUPL) has increased from the previous day, slightly expanding the proportion of investors in the profit zone.

Exchange balance 2.3727M BTC (–0.04%) The Bitcoin holdings on exchanges have decreased by 0.04% to 2,372,700 BTC, continuing the withdrawal-dominant trend.

Exchange net inflow –812.93 BTC (–1.43%) The 24-hour net outflow is –812.93 BTC, decreasing by 1.43% from the previous day, maintaining a mild withdrawal trend.

Active wallets 727,093 (–6.64%) The number of active wallets has decreased by 6.64% from the previous day's 778,799 to 727,093, showing on-chain activity has returned to a slowdown.

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>