The price of Bit fell to $114,337 in early August under selling pressure. This decline is attributed to various factors, including market uncertainty due to Trump's tariff war.

However, one important factor seems to be easing: the impact of investor sentiment. Bitcoin's price movements are now more influenced by market conditions than investor fear.

Bitcoin Investor Selling Calms Down

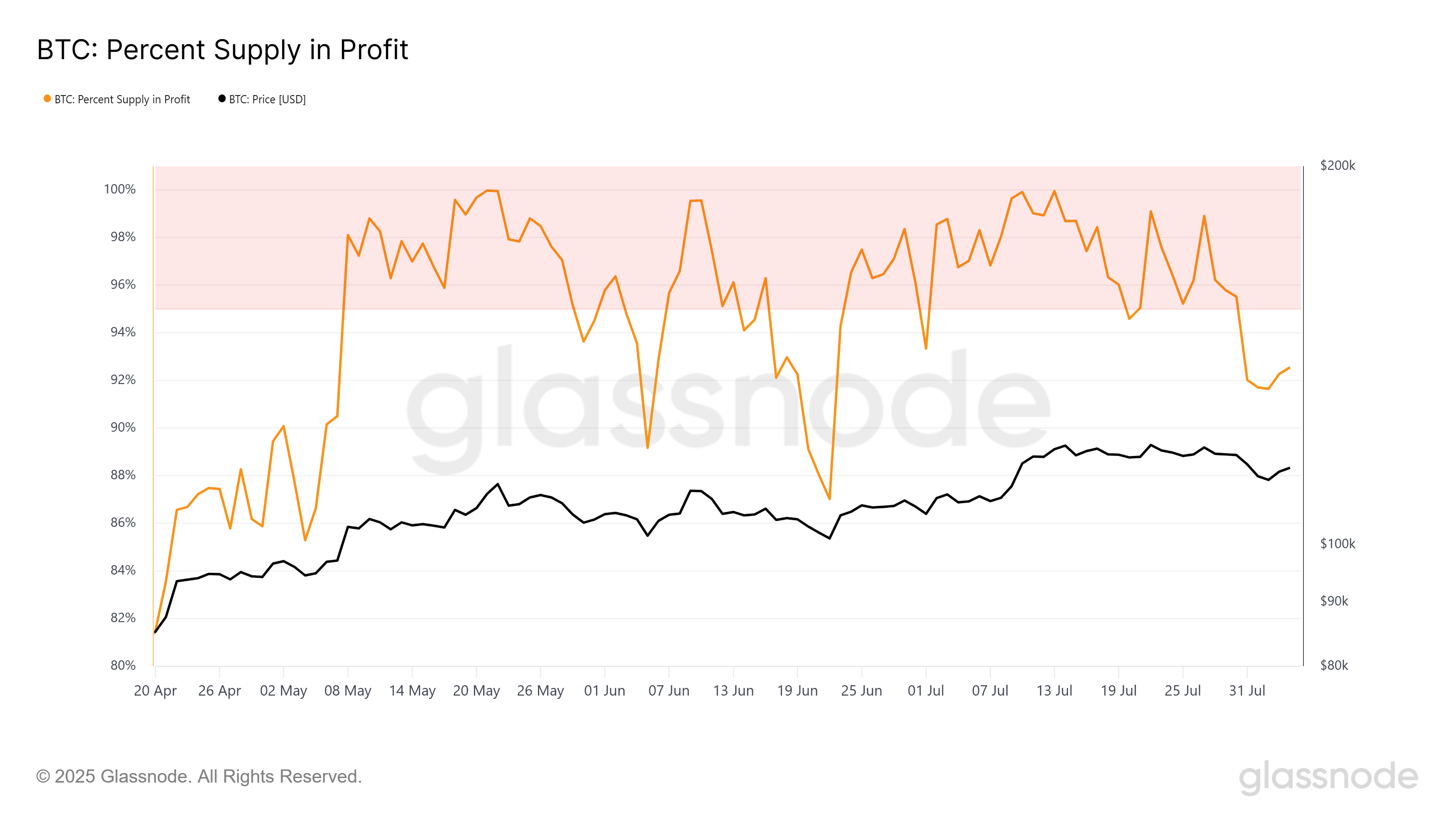

This week, Bitcoin's profit supply dropped below the 95% threshold, historically indicating a market peak. For over a month, Bitcoin's supply remained within the 95% profit zone, indicating an overly bullish market.

Generally, this increases selling pressure as the market becomes saturated with optimism. With the profit supply now decreasing to 92.5%, that pressure is beginning to ease, potentially suggesting a shift to a more neutral or positive momentum.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

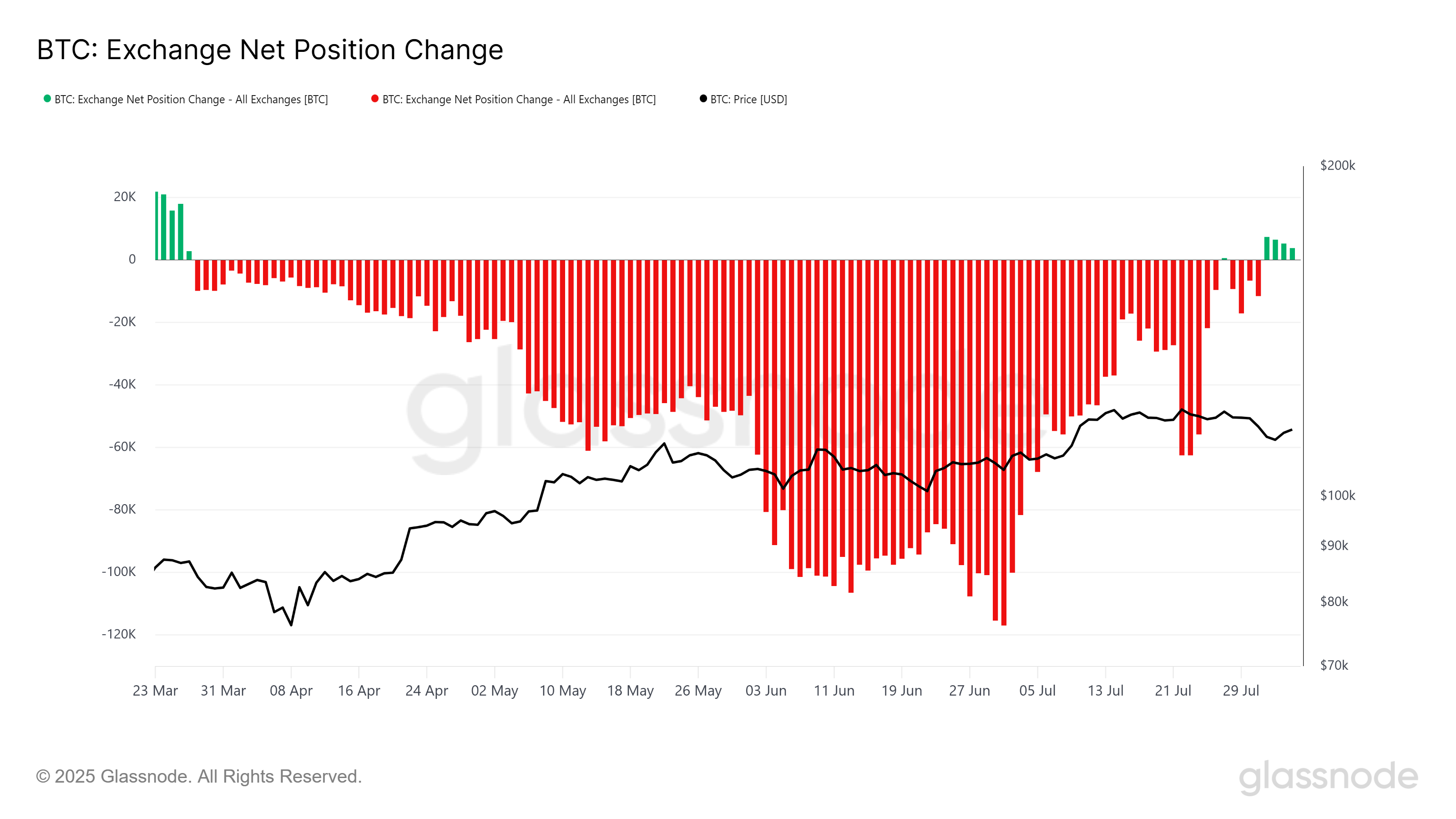

Exchange net position change has reached its highest level in four months, reflecting market peak conditions. Increases in exchange balances typically indicate high selling activity triggered by a market unable to maintain bullish momentum.

However, recent selling trends seem to be losing strength. Upcoming events like Trump's tariff decisions appear to be causing hesitation in the market.

With selling pressure decreasing, Bitcoin may now be entering a consolidation phase. This provides an opportunity for BTC to recover lost ground, especially as the broader market stabilizes.

BTC Price, Holding Steady

Bitcoin's price is currently experiencing downward pressure at $114,337. The Parabolic SAR is above the candlesticks, suggesting downward momentum. However, the 50-day EMA continues to provide strong support, indicating that broader market sentiment is not entirely negative. Bitcoin can continue to find stability above the $110,000 level and consolidate.

Given current factors, Bitcoin's price is likely to enter a correction within the $110,000 range for the time being. If Bitcoin breaks through and secures the $115,000 level as support, it could rise to $117,261. However, exceeding $120,000 seems unlikely in the near term.

If external factors like the upcoming tariff announcement cause market downward pressure, Bitcoin could face additional decline. Losing support at $111,187 could see Bitcoin drop to $109,476, with potential for further weakness. If Bitcoin moves above $110,000, bullish or neutral outlook could be invalidated.