Welcome to the Asia-Pacific Morning Brief—an essential summary of overnight cryptocurrency developments shaping regional markets and global sentiment. This Monday edition is provided by Paul Kim. Prepare your green tea and stay tuned.

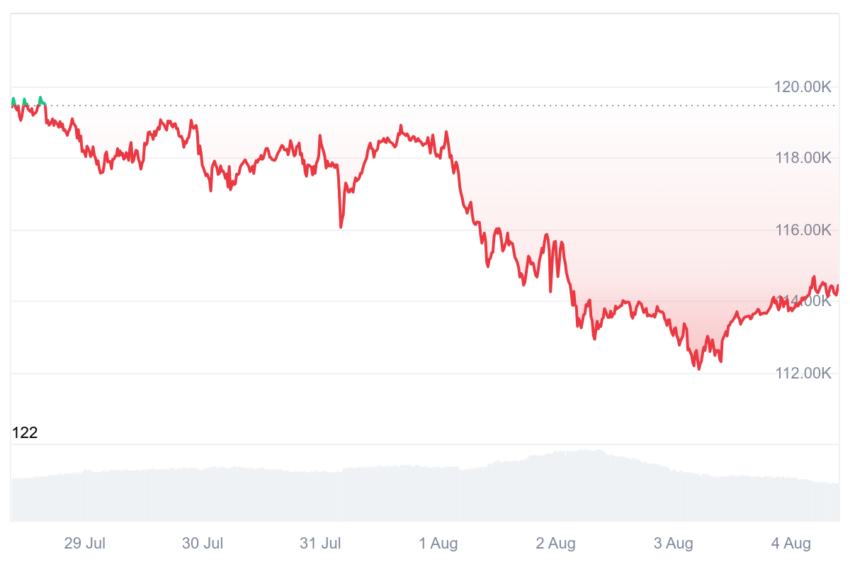

The cryptocurrency market is showing a challenging start in August. Bitcoin's price sharply dropped, breaking the $117,000–$120,000 range formed since July 11. Bitcoin declined nearly 4% during the week, with some altcoins plummeting over 15%.

First Powell, Then NFP

The week's decline unfolded in two major stages. One cause was Federal Reserve Chair Jerome Powell's remarks after the July Federal Open Market Committee (FOMC) meeting on Wednesday. While the market greatly anticipated a September rate cut after July's pause, Powell dampened these expectations.

Powell stated that the possibility of a September rate cut remains uncertain. While acknowledging signs of economic recession, he explained that maintaining rates is reasonable because the inflation effects of tariffs have not yet been confirmed.

He also emphasized that the labor market is robust and approaching balance, urging a shift in focus from employment to inflation risks.

Interestingly, there was strong opposition within the Fed. Fed Governor Christopher Waller pointed out that private sector employment growth has significantly slowed. While superficially appearing healthy, data revisions reveal weaknesses and demand preemptive rate cuts.

Currently, Powell's perspective aligns with the Fed majority, and the market must adjust its September rate cut expectations. Bitcoin's price dropped to $115,800.

A second decline occurred on August 1 with the release of Non-Farm Payrolls (NFP) data. Wall Street analysts estimated July NFP at around 110,000, but the actual figure was 73,000. This contradicts Powell's optimistic outlook and indicates significant U.S. labor market deterioration.

More concerning was the major downward revision of May and June data, with 258,000 jobs lost. The initially strong June NFP figure of 147,000 was mostly a statistical illusion. The U.S. Bureau of Labor Statistics revised June's figure to 14,000 and May's to 19,000—the lowest in five years.

The official unemployment rate matched expectations at 4.2%, but the broader U-6 unemployment rate reached 7.9%, the highest since the COVID-19 crisis. Long-term unemployment and those seeking jobs for over 27 weeks also worsened. These sharp economic recession and labor market weakness indicators triggered a crash in the U.S. stock market. Bitcoin retreated to $112,000 that day.

Macro Recession, Corporate Purchases, and ETF Decline

Major macroeconomic trends seemed to drag down the cryptocurrency industry throughout the week. Inflows into spot ETFs, which drove Bitcoin and Ethereum prices in July, significantly decreased after July 30. On August 1, spot ETFs recorded their largest daily outflow since February this year.

Ethereum-purchasing corporations also slowed down as a primary driver of Ethereum price increases. The week started positively: Shapella Gaming confidently announced additional Ethereum purchases and staking of $296 million, and Bitmain, led by CEO Tom Lee, claimed Ethereum's intrinsic value at $60,000.

Standard Chartered Bank predicted that companies purchasing Ethereum would hold about 10% of total supply, mentioning strategic accumulation exceeding $1 billion, a 50-fold increase in four months.

However, these corporations were powerless against the week's price collapse. Ethereum dropped 7.2%, and stock prices of major Ethereum holders Shapella Gaming (-30.80%) and Bitmain (-23.16%) also plummeted.

In this context, bearish sentiment naturally spread. Cryptocurrency influencer and BitMEX founder Arthur Hayes made bearish predictions for major cryptocurrencies. He predicted Bitcoin could drop to $100,000 and Ethereum to $3,000, citing the upcoming U.S. tariff bill and slow global credit expansion as key factors.

Over the weekend, on-chain data drew attention to worrying Ethereum indicators. The Ethereum holder accumulation rate reached a two-month low at 27.57%, indicating investors are no longer actively increasing ETH holdings.

U.S. Stock Market is Key

July's warm momentum suddenly disappeared in this sharp decline. What will happen to cryptocurrency prices this week? The key is whether the U.S. stock market can rebound from the NFP data revision shock.

The U.S. Bureau of Labor Statistics has a history of revising non-farm employment data by over 800,000 jobs last year, revealing jobs that actually did not exist despite previous reports. However, even that fact did not cause significant stock market volatility.

Last Friday's decline is partially related to the U.S. stock market recently recording new highs smoothly, and weakened employment figures provided an appropriate trigger for adjustment. If the U.S. stock market recovers without additional adjustments, the cryptocurrency market is likely to rebound.

However, if additional adjustments continue, Powell's statement denying a September rate cut despite strong US employment will become important. The Fed rate decision expectation site provided by the Chicago Mercantile Exchange (CME) group, FedWatch, is already predicting three rate cuts this year.

This week, no major macroeconomic issues are expected, but US employment remains a key focus. The Conference Board will release the employment trend index on Monday, and this data could significantly impact the US stock market.

We wish our readers successful investments this week as well.