Bitcoin (BTC) has returned to a mixed market trend, plummeting more than $10,000 from its all-time high of $123,000 (approximately 170.97 million won) recorded in mid-July. In recent days, the sharp decline has pushed Bitcoin below the $112,000 (approximately 155.68 million won) level, forming its lowest price in three weeks.

The market turning point was the downward trend that began at the end of July. Although there was an upward attempt on the 25th, buying momentum was dispersed, and it eventually entered a full-fledged decline in early August. Bitcoin faced resistance at $119,000 (approximately 165.41 million won) and showed a consecutive decline.

One of the biggest reasons is the spread of large-scale Bitcoin sell-offs. Crypto analyst Ali Martinez pointed out that approximately 3,000 Bitcoins (BTC) were recently disposed of by miners in a short period. This corresponds to approximately $336 million (about 467 billion won). These miner sell-offs further dampened existing investors' sentiment, adding fuel to the decline.

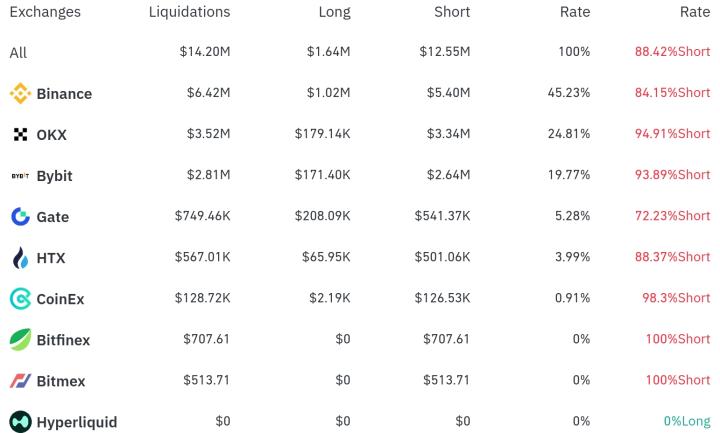

Due to this decline, derivative markets experienced significant capital losses, with over-leveraged positions approaching $1 billion (approximately 1.39 trillion won) being liquidated. In connection with this, Martinez suggested the key support level to watch is between $105,000 (approximately 145.95 million won) and $107,000 (approximately 148.63 million won). He particularly emphasized that the area around $107,160 (approximately 149.20 million won) is acting as a strong accumulation zone and could be a crucial turning point for Bitcoin's future trend.

Bitcoin has currently recovered to $113,000 (approximately 157.07 million won), but no clear rebound signs are detected. Experts warn that volatility may expand when traditional financial markets reopen next week. The fact that President Trump often makes market-moving statements around Sunday also heightens tension about short-term market movements.

For the time being, Bitcoin is expected to continue a phase where selling and buying pressures are evenly matched in defending key support levels. While some analyses suggest it is approaching an oversold area, caution is needed due to the intertwined external variables.

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>