It has been revealed that a large-scale position liquidation occurred in the cryptocurrency market over the past 24 hours. Notably, the short position liquidation rate was high across the market.

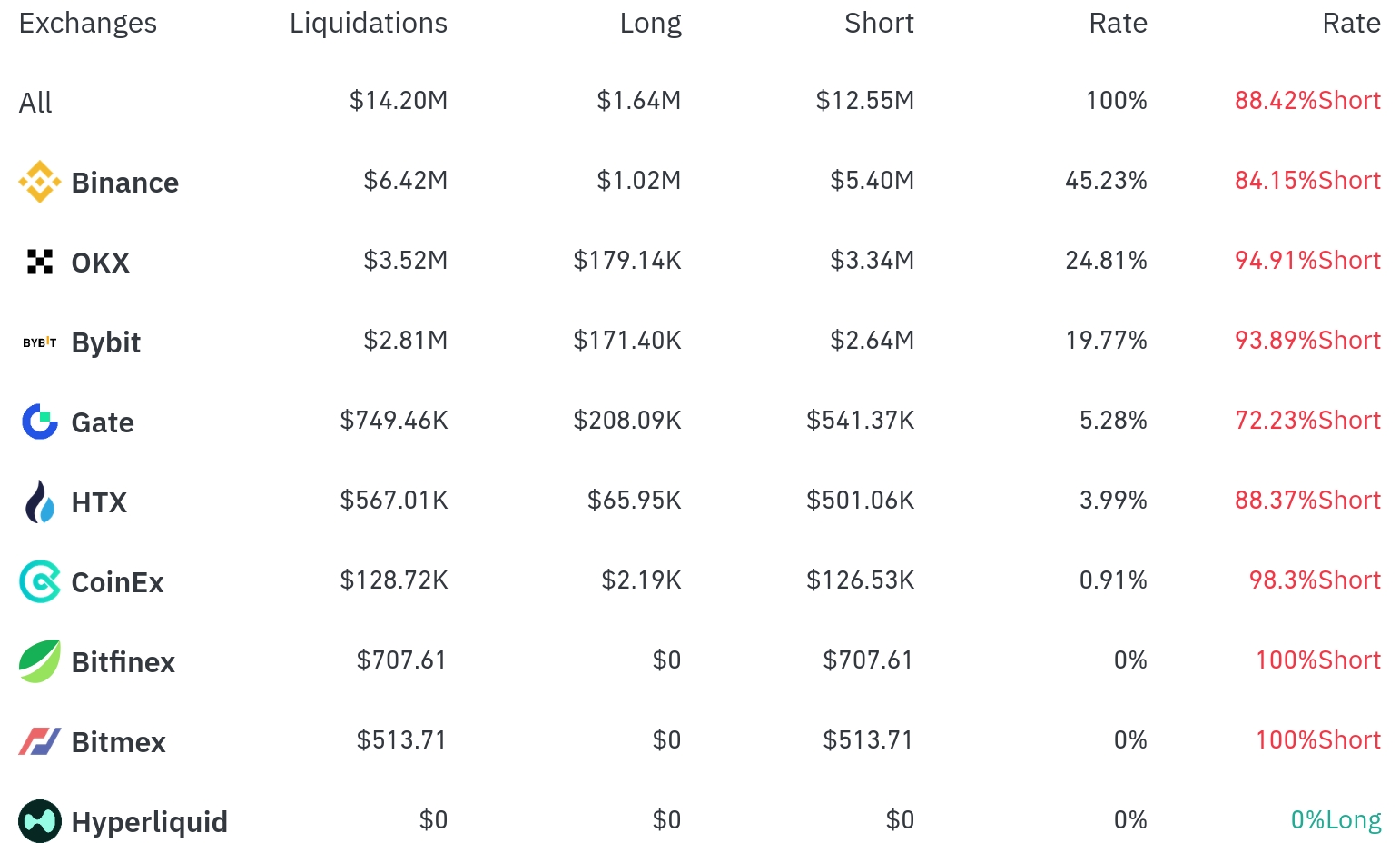

According to CoinGlass data, significant short position liquidations occurred on major exchanges within a 4-hour period. On Binance, a total of $6.42 million in liquidations occurred, with $5.4 million (84.15%) being short positions. A similar pattern was observed on OKX, where out of a total of $3.52 million in liquidations, $3.34 million (94.91%) were short positions.

Bybit also saw $2.81 million in total liquidations, with $2.64 million (93.89%) being short positions. Even smaller exchanges like Gate and HTX had short position liquidations of 72.23% and 88.37%, respectively. Notably, BitMEX had 100% of its liquidations in short positions.

While most exchanges saw an overwhelming number of short position liquidations, Bitfinex maintained a relatively balanced liquidation ratio between long and short positions.

By coin, Bitcoin (BTC) and Ethereum (ETH) experienced the most liquidations. Bitcoin is currently trading at $113,426 and saw approximately $64.43 million in positions liquidated over 24 hours. Within a 4-hour period, $3.23 million in short positions were liquidated, which is about 124 times the long position liquidation amount ($26,000).

Ethereum (ETH) accounted for the largest proportion of total liquidations. Approximately $131.08 million in positions were liquidated over 24 hours, with about $3.9 million in short positions liquidated within 4 hours. Ethereum is currently trading at $3,443, down 2.51% over 24 hours.

Among altcoins, Solana (SOL) showed a notable liquidation scale. Approximately $21.45 million in positions were liquidated over 24 hours, and it is currently trading at $160.34. XRP saw about $40.23 million in liquidations while its price dropped 6.44% over 24 hours.

Dogecoin (DOGE) is trading at $0.19559, down 3.54% over 24 hours, with a total of $15.3 million in positions liquidated. Notably, over $310,000 in short positions were liquidated within 4 hours.

Of particular interest, the PUMP Token rose 10.39% with approximately $1.87 million in positions liquidated, while the ENA Token dropped 7.18% with a large-scale liquidation of $10.06 million.

This large-scale short position liquidation could be interpreted as a signal suggesting the possibility of a rebound in the recently declining cryptocurrency market. Especially the massive short liquidations in Bitcoin and Ethereum could be an indicator of changing market sentiment.

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leveraged position when a trader fails to meet margin requirements. Particularly, large-scale short position liquidations occur when prices rise more than expected, which can create additional buying pressure.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>