Famous cryptocurrency trader AguilaTrades has been completely liquidated on the Hyperliquid platform, losing almost all of his capital. His losses are now approaching $40 million.

This liquidation means a dramatic collapse for the trader. His Bitcoin (BTC) long position collapsed due to recent market adjustments. This was triggered by heightened tariff tensions and the absence of expected Federal Reserve rate cuts.

From Recovery to Bankruptcy... AguilaTrades Suffers Major Losses on Hyperliquid

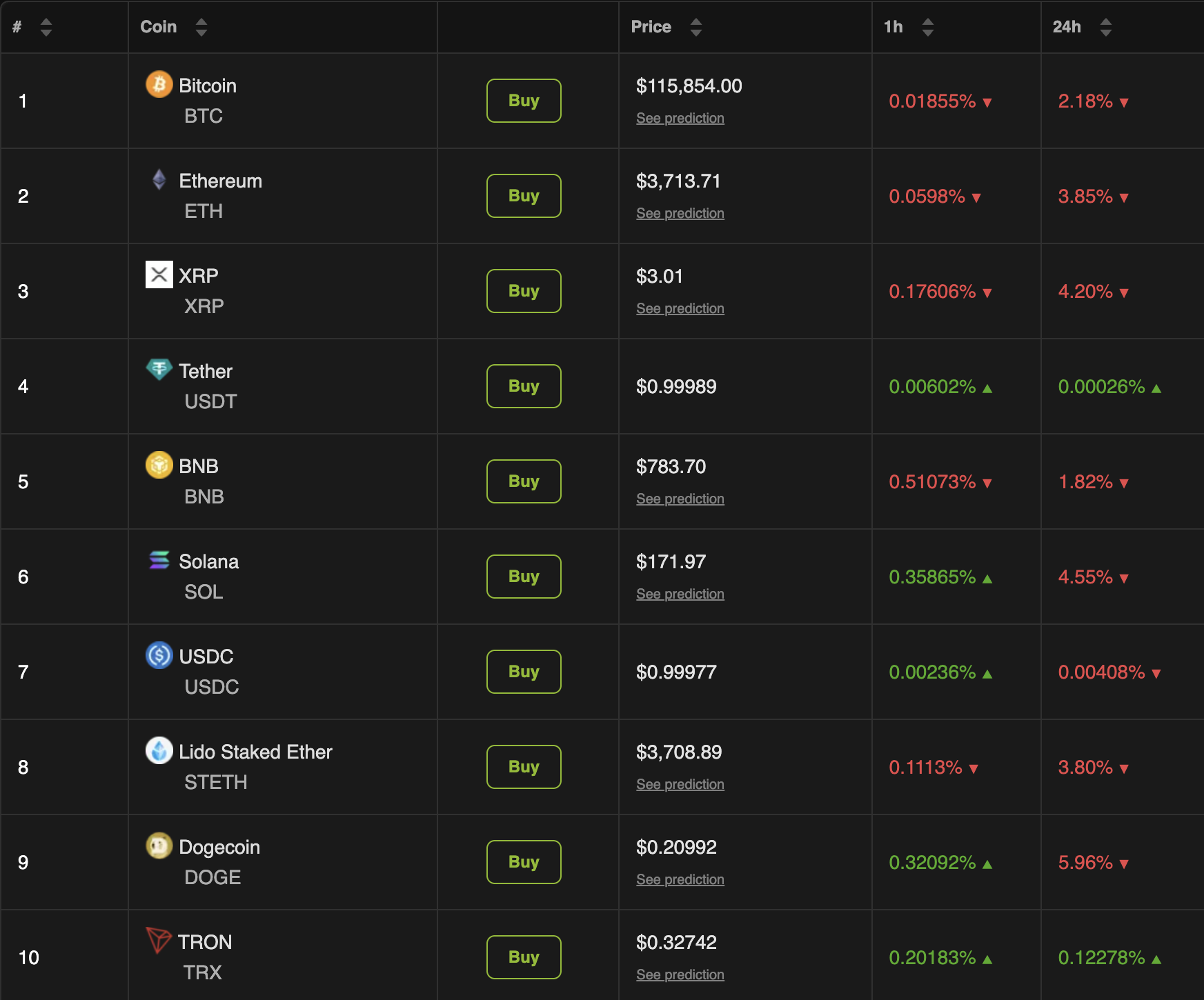

According to BeInCrypto market data, the cryptocurrency market dropped 6.9% in the last 24 hours, falling to $3.83 trillion. 80% of the top 10 coins recorded losses. Bitcoin dropped 2.8%, and Ethereum (ETH) fell 3.8%.

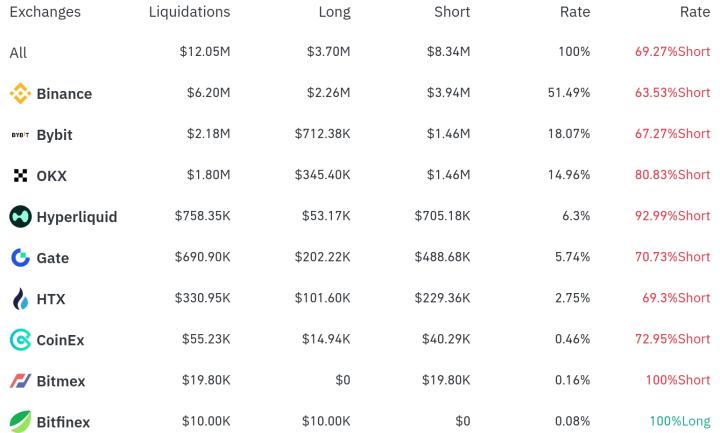

Meanwhile, those betting on market rises suffered massive losses. Approximately $630 million in liquidations were recorded in the past 24 hours. According to Coinglass data, most liquidations ($570.68 million) occurred in long positions.

For Bitcoin, $141.93 million in long positions were liquidated, while short positions were liquidated at $7.4 million.

On-chain data analysis company Lookonchain revealed on X (formerly Twitter) that AguilaTrades' Bitcoin long position was also liquidated.

There was a post stating, "AguilaTrades has been completely liquidated, losing almost all funds on Hyperliquid."

This was a significant blow to the trader who had recently recovered all losses. BeInCrypto reported that AguilaTrades' betting caused $32.7 million in losses at the end of June, which increased to $35 million by July.

However, mid-month, the trader recovered $35 million in losses. But these profits were short-lived. On July 25th, the trader lost approximately $83.3 million in value when 720 BTC were liquidated.

Lookonchain posted, "After recovering from over $35 million in losses to a $3 million profit, he has now fallen deeper into a deficit of over $36 million."

On July 31st, OnChainLens reported that AguilaTrades experienced four consecutive liquidations but subsequently slightly increased his BTC position. Now, with the latest hit, his losses are approaching $40 million.

Cryptocurrency influencer Zia ul Haque wrote, "AguilaTrades, once a top CEX trader, has lost nearly $39 million on-chain after going bankrupt. All longs and shorts were reversed. A brutal lesson that public PnL = public target."

Besides AguilaTrades, another high-risk trader, James Win, also experienced a series of liquidations.

The blockchain analysis platform added, "James Win's PEPE long position was consecutively liquidated from another wallet. Total losses exceeded $1 million, with only $14,850 remaining in the account."

Win's losses occurred after his previous wins. BeInCrypto emphasized that the trader made over $500,000 in profits last week, his largest gain since May 25th.

In contrast, some traders capitalized on the market conditions. Lookonchain mentioned that a trader (0xCB92) took an ETH short position with 20x leverage. This trader's decision netted him over $3.7 million in profits.

Whale 0x720A exited Hyperliquid with a profit of $13.6M, then stopped perps trading and bought 3,322 $ETH($12.84M) spot.https://t.co/0hewUqchdv pic.twitter.com/T0A2uyjGUi

— Lookonchain (@lookonchain) July 31, 2025

Therefore, these differences highlight the high-risk nature of leveraged trading on platforms like Hyperliquid. Small price fluctuations can lead to significant profits or fatal losses.