The cryptocurrency market entered a correction phase with major coins showing a slight decline amid an overall upward trend.

This decline emerged during the activities of major whales, showcasing various strategies among big players in the cryptocurrency market.

Cryptocurrency Whales Active on Both Buying and Selling Sides

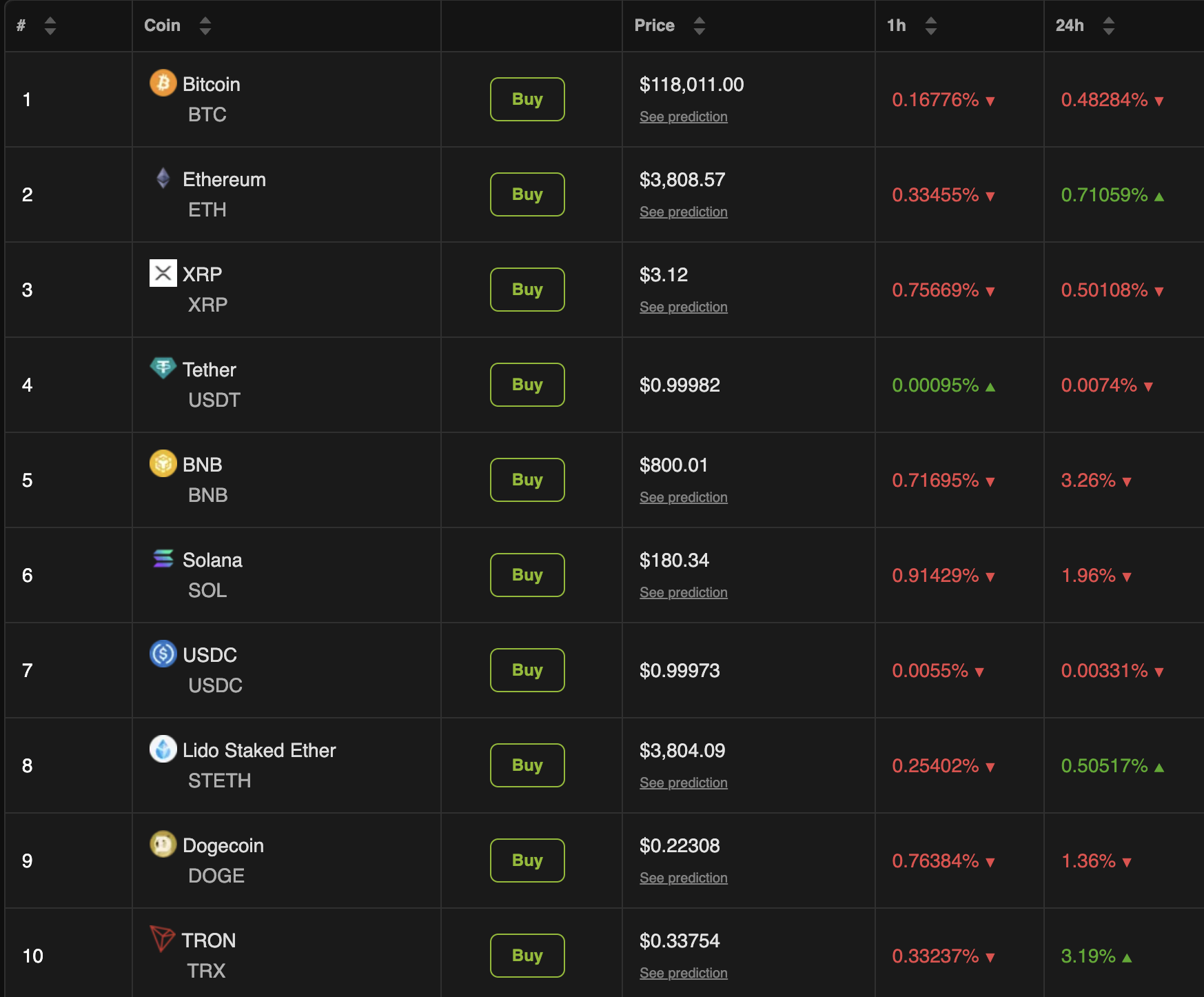

According to BeInCrypto market data, the cryptocurrency market dropped 3.83% over the past 24 hours. Additionally, 7 out of the top 10 cryptocurrencies are showing a downward trend.

Bitcoin (BTC) declined by 0.48% over the past day. Ethereum (ETH), Lido Staking Ether (STETH), and TRON (TRX) showed an upward trend, with TRX recording the highest increase at 3.19%.

Meanwhile, (Micro) Strategy took advantage of the decline to purchase 21,021 BTC for approximately $246 million. The average purchase price was $117,256 per coin.

This purchase was funded through a $2.5 billion initial public offering of the Variable Rate Series A Perpetual Preferred Stock (STRC). This increased the company's total holdings to 628,791 BTC. Currently, the company holds $2.818 billion in unrealized gains.

"With total proceeds of approximately $252.1 million, this is the largest IPO in the US to date in 2025 and the largest perpetual preferred stock offering in the US since 2009," the company added.

Additionally, BTC's yield from the beginning of the year has reached 25%. This purchase aligns with the company's strategy of increasing BTC holdings using stocks and debt, thereby establishing itself as a major institutional holder.

In addition to Strategy, LookOnChain highlighted that Anchorage Digital, a digital asset platform and infrastructure provider, increased its Bitcoin exposure.

"Anchorage Digital accumulated 10,141 BTC (approximately $1.19 billion) from multiple wallets over the past 9 hours," LookOnChain posted.

Conversely, the activity of previously inactive investors showed a profit-oriented approach. LookOnChain reported that after 12 years of inactivity, a Bitcoin holder transferred 343 BTC, approximately $40.52 million. Among these, the 'Bitcoin OG' deposited 130.77 BTC, about $15.45 million, to Kraken.

"This OG received 343 BTC when BTC price was $86 twelve years ago (approximately $29,600 at the time). That's a 1,368-fold return!" the blockchain analysis company revealed.

This small transfer occurred following one of the largest Bitcoin trades in cryptocurrency history. BeInCrypto reported that Galaxy Digital sold 80,000 Bitcoins worth over $9 billion on behalf of long-term investors.

In the Ethereum market, contrasting behaviors of whales were also observed. A new wallet (0x3dF3) accumulated 12,000 ETH worth over $45 million through Galaxy Digital.

"Since July 9th, a total of 9 new wallets have accumulated 640,646 ETH (approximately $2.43 billion)," LookOnChain wrote.

However, these accumulations are being offset by sales. On-chain analysts noted that Galaxy Digital deposited 5,000 ETH worth $19.28 million to Coinbase, and Cumberland also transferred 10,592 ETH worth approximately $40.79 million to the same exchange.

Fidelity also followed the same path and sent 12,981 ETH worth approximately $49.70 million to Coinbase.

"An institutional address estimated to be HashKey Capital transferred 12,000 ETH to OKX yesterday, then withdrew 46.16 million USDT from OKX. In other words, these 12,000 ETH were sold at $3,847," analyst EmberCN added.

Therefore, the contrasting strategies of cryptocurrency whales—accumulation and liquidation—demonstrate the diverse risk appetites and perspectives in the market.