Cryptocurrency inflows continue a positive trend across several weeks, bringing this month's inflows to $11.2 billion.

Ethereum (ETH) led the inflows, with altcoins outperforming Bitcoin (BTC). Bitcoin recorded significant outflows.

Ethereum Leads Coin Inflows… Increasing Altcoin ETF Speculation

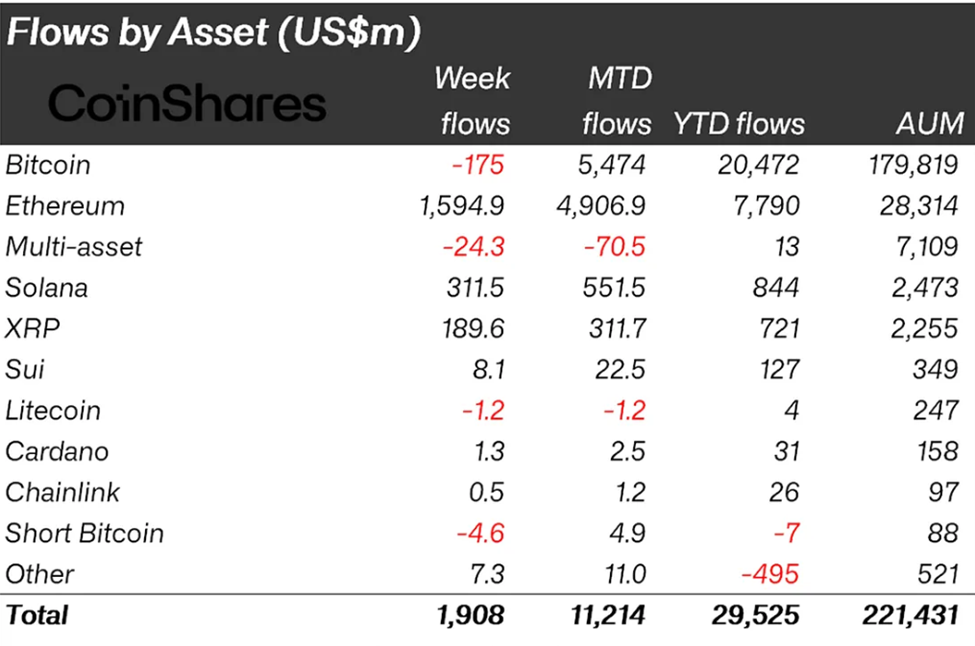

According to the latest CoinShares report, cryptocurrency inflows last week reached $1.98 billion. This is a significant increase from the $1.049 billion in the week ending July 19th.

This decrease occurred as Bitcoin recorded negative flows of $175 million. Meanwhile, Ethereum maintained the lead with $1.594 billion in inflows last week.

James Butterfill, CoinShares' Research Head, notes this as Ethereum's second-largest week, with year-to-date inflows exceeding the total for 2024.

"Ethereum recorded its second-strongest week with $1.59 million in inflows. Year-to-date Ethereum inflows have reached $7.79 billion, surpassing last year's entire amount." – Excerpt from CoinShares report

CoinShares executives point out that Bitcoin notably differs from the overall altcoin trend. Solana and XRP showed strong inflows. Butterfill suggests these results are driven by potential ETF expectations rather than a broad altcoin season.

"This raised questions about whether we are entering an altcoin season. These altcoin inflows may be driven by expectations surrounding potential US ETF launches rather than widespread enthusiasm." – Additional report note

Ethereum's prominent performance in last week's cryptocurrency inflows is unsurprising. Approaching its 10th anniversary, this altcoin has seen significantly increased institutional interest.

This includes Bit Digital's $1 billion Ethereum conversion and BlackRock's digital assets head joining Ethereum financial company Sharplink Gaming.

Ethereum, Institutional Preferred Coin… Accelerating Market Cycle

Additionally, BlackRock's Ethereum ETF inflows exceeded Bitcoin funds (IBIT) last week.

Andreas Brekken, CEO and founder of Sideshift.ai, attributed Ethereum's performance to the confidence of large-scale arriving institutions.

Similarly, MEXC's Senior Research Analyst Shawn Young emphasizes the accelerating momentum as Ethereum approaches $4,000. Like Brekken, Young mentions strong institutional demand and favorable macroeconomic background.

With 16 consecutive days of over $5 billion inflows into the US spot ETH ETF, Young notes Ethereum is increasingly viewed as the cornerstone of on-chain financial infrastructure.

"This growth reflects increasing confidence in Ethereum's utility, sustainability, and long-term viability. Especially as it's used for tokenization, stablecoins, and on-chain payments." – Statement shared with BeInCrypto

He emphasizes ETH's resilience during recent market declines, increasing dominance in cryptocurrency market cap, and leadership in capital rotation from Bitcoin to altcoins.

Technically, Ethereum maintained relative strength while preserving key support levels. Analysts suggest improved altcoin depth indicates broader market sentiment shifts.

Based on this, Young points to potential breakthrough to $4,500 if upcoming GDP and FOMC data trigger risk appetite rally. However, analysts warn macroeconomic downturn could lead to retreat to $3,300.

"Softer inflation data or dovish Fed language could reinforce views that rate hike cycles are ending. This could trigger risk appetite shifts across markets, typically bringing substantial benefits to the cryptocurrency sector." – He added

At the time of writing, Ethereum was trading at $3,886, rising over 3% in the past 24 hours.

Nonetheless, as ETF adoption accelerates and ETH's proportion in institutional portfolios increases, Ethereum is positioned to lead the next stage of cryptocurrency market expansion.