In the cryptocurrency market over the past 24 hours, approximately $235.48 million (about 344.4 billion won) worth of leverage positions were liquidated.

According to the currently aggregated data, short positions were overwhelmingly dominant among the liquidated positions, and looking at the 4-hour data, short position liquidations were prevalent on most exchanges.

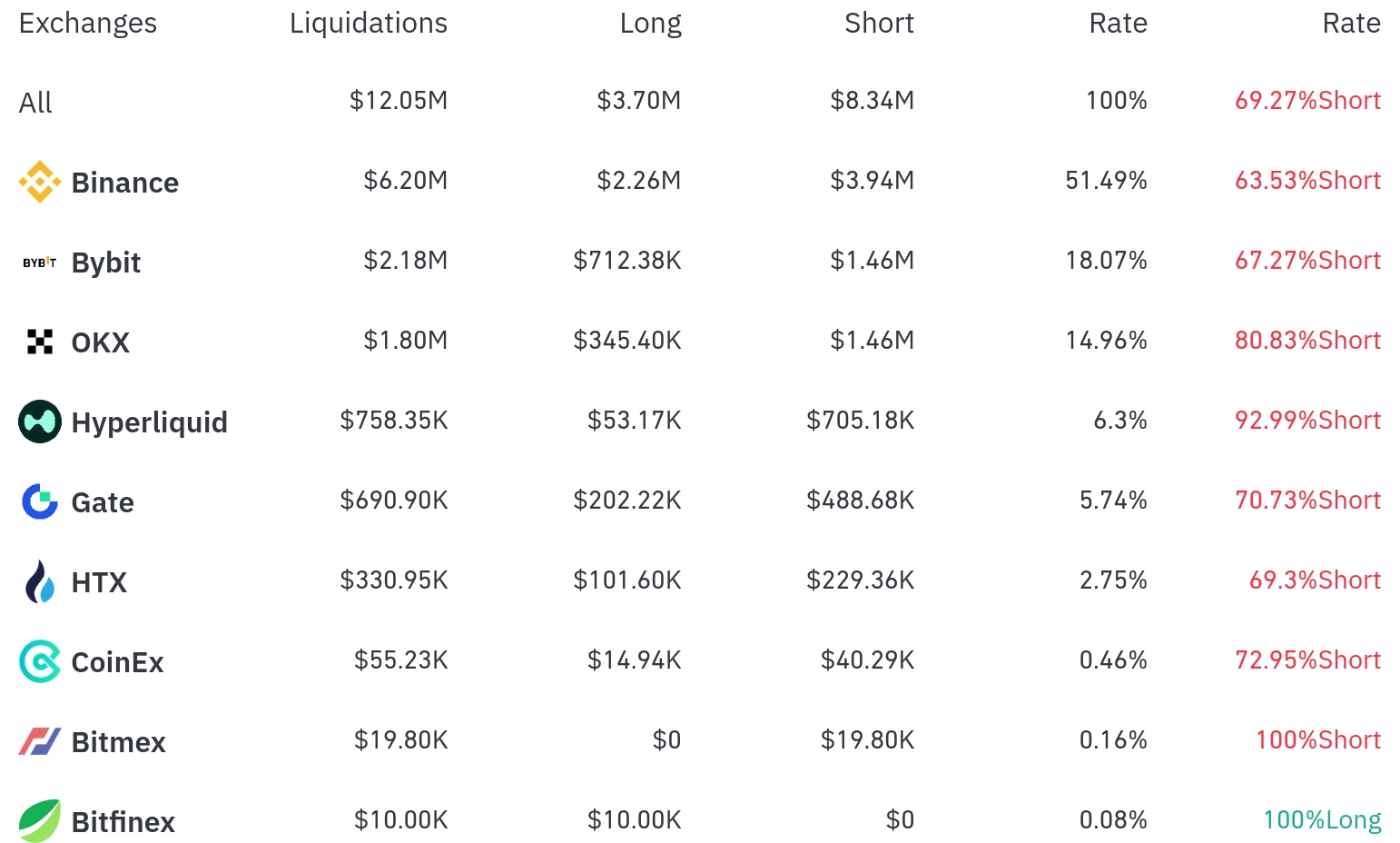

Over the past 4 hours, Binance had the most position liquidations, with a total of $6.2 million (51.49% of the total) liquidated. Among this, short positions accounted for $3.94 million, or 63.53%.

Bybit was the second-highest exchange for liquidations, with $2.18 million (18.07%) of positions liquidated, of which short positions comprised $1.46 million (67.27%).

OKX saw approximately $1.8 million (14.96%) in liquidations, with a very high short position ratio of 80.83%.

Notably, on Hyperliquid, the short position liquidation rate was overwhelmingly high at 92.99%, and on BitMEX, all liquidated positions were short positions.

By coin, Bitcoin (BTC) had the most liquidated positions. Approximately $72.17 million in Bitcoin positions were liquidated over 24 hours, with about $1.5 million liquidated in the 4-hour period. Particularly, the 4-hour short position liquidation amount was $1.47 million, overwhelmingly more than long positions ($26.42 million).

Ethereum (ETH) had approximately $98.59 million in positions liquidated over 24 hours, actually more than Bitcoin. With Ethereum's price rising 2.20% over 24 hours, pressure on short positions seems to have increased.

Solana (SOL) saw about $30.57 million liquidated over 24 hours, and among other major altcoins, XRP ($18.56 million) and Doge ($14.76 million) followed in liquidation amounts.

Particularly, the ENA Token experienced significant short position liquidations alongside a sharp 15.14% price increase, and PENGU (+6.02%) and SUI (+3.72%) also saw many short position liquidations with high price increases.

This liquidation data shows that with the recent overall uptrend in the cryptocurrency market, short position traders who anticipated a decline suffered significant losses. Notably, Bitcoin's price exceeded $118,000, and Ethereum recovered to the $3,850 range, highlighting the strength of major cryptocurrencies.

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leverage position when a trader fails to meet margin requirements. This large-scale short position liquidation can be interpreted as a signal suggesting the market's upward trend may be further reinforced.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>