Bitcoin's mining difficulty reached an all-time high of 127.6 trillion in August 2025, reflecting the continuous expansion of global computing power to protect the network.

However, despite increasing technical challenges, miner profitability is quietly rising. Analysts say this could signal a new phase in the BTC market cycle.

Bitcoin Mining Difficulty at All-Time High

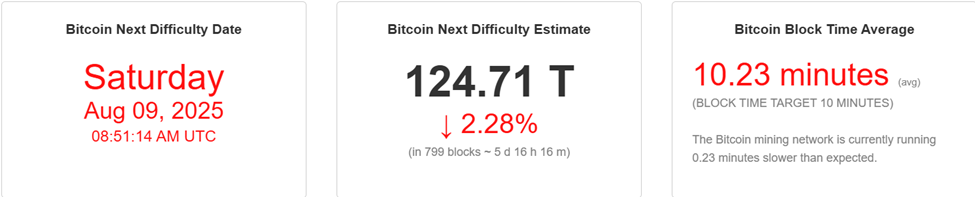

The next mining difficulty adjustment is expected on August 9th, anticipated to slightly decrease to 124.71 trillion.

This adjustment aims to bring the average block time back to the 10-minute target from the current 10 minutes and 23 seconds.

These periodic readjustments are essential to Bitcoin's design, maintaining consistent issuance and network stability despite hash rate fluctuations.

Interestingly, the higher Bitcoin mining difficulty has not squeezed miners' profitability.

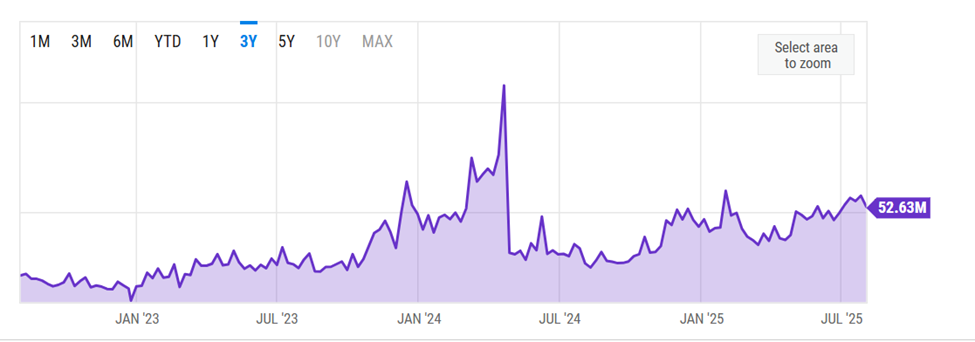

In fact, network data shows miner revenue reached a post-halving high of $52.63 million per exahash per day.

"Bitcoin miner revenue is currently at $52.63 million, decreased from yesterday's $56.35 million but increased from $25.64 million a year ago. This represents a -6.61% decrease from yesterday and a 105.3% increase from a year ago." – ychart.com analysts noted.

This is a strong signal considering rising energy costs and an increasingly competitive mining environment.

In a recent post, Bitcoin mining analysis company Blockware Intelligence highlighted this difference.

"Positive outlook for Bitcoin mining? BTC/dollar increasing faster than mining difficulty. Over past 12 months: > BTC/dollar +75% > Mining difficulty: +53%. Bitcoin miners' profit margins are expanding." – company statement.

Rising Profitability… Bull Market Signal

Historically, this dynamic of BTC price rising faster than mining difficulty occurs in the early stages of a bull market cycle. Similar patterns were observed in mid-2016 and 2020, preceding major price increases.

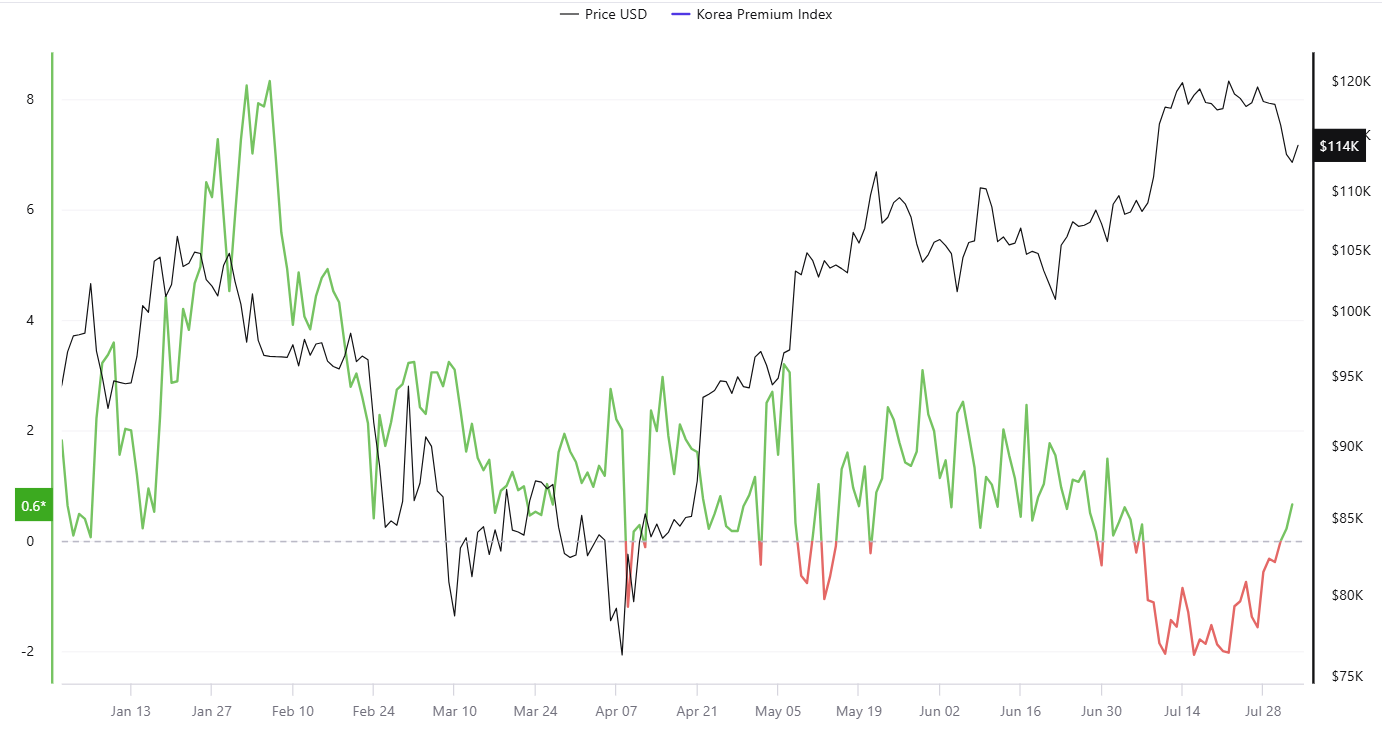

The increased profitability reflects deeper demand dynamics, with the current Korean Kimchi Premium reaching +0.6%, indicating strong regional demand for BTC.

The Kimchi Premium represents the price difference between local exchanges and global spot markets.

Combined with more efficient ASIC machine deployment and increased institutional mining investment, this suggests a healthy mining sector and optimism about Bitcoin's medium-term trajectory.

Beyond miner profitability, Bitcoin's scarcity narrative remains valid. Over 94% of the total 21 million BTC have already been mined, and the pioneering cryptocurrency's stock-to-flow ratio is currently around 120, double that of gold.

This long-term scarcity positions Bitcoin as a hedge against inflation and a defense against currency devaluation. Short-term price movements remain modest.

However, the broader market has not yet priced in the network's improved fundamentals. Bitcoin has retreated below $115,000 since its July peak, indicating a temporary disconnect between on-chain technical health and investor sentiment.

Analysts attribute this divergence to macroeconomic headwinds, trade policies, and changing capital flows. Meanwhile, miners appear to be ahead of the rest of the market.

The combination of rising difficulty, increasing margins, and strong regional demand could mark a turning point in the mining economy and Bitcoin's broader cycle. If history repeats, the network's robust growth may soon be reflected in price.