A whale investor who bet on the XRP price drop was caught off guard by the market rebound, suffering massive losses. The investor held multiple short positions using excessively high leverage, with XRP causing the largest losses.

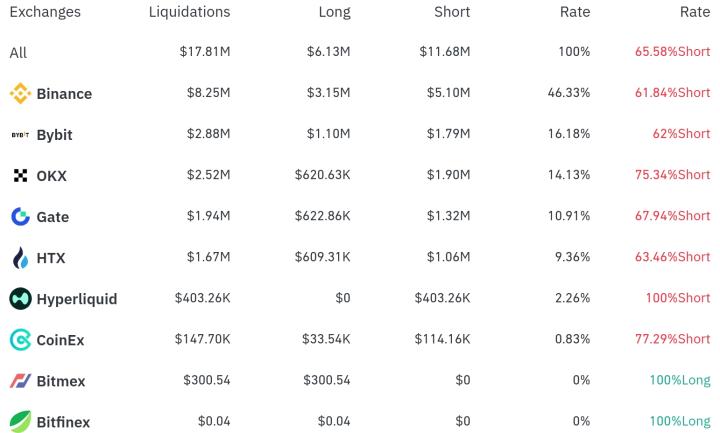

According to the on-chain analysis platform Onchain Lens, an anonymous trader '@qwatio' held extremely high-risk short positions on Hyperliquid platform with 40x leverage on BTC, 25x on ETH, 20x on SOL, and 20x on XRP. However, when the XRP price broke through $2.894, the position was forcibly liquidated, resulting in losses exceeding $650,000. The total position size was approximately $18.6 million.

This whale has a history of significant losses. In June, they were liquidated six times in just three days on Hyperliquid, losing a total of $10 million, and in July, most of their $334 million short positions were eliminated, with cumulative losses exceeding $25 million. Their available funds dropped from $16.3 million to just $67,000.

Previously, the investor gained attention by establishing 50x long positions on BTC and ETH in March and began large USDC deposits just before the US released its strategic cryptocurrency reserve asset list, leading to speculation about potential insider trading.

This case stands as a representative example showing that excessive leverage strategies can be fatal even for whale investors. Analysis suggests that failure to close short positions during XRP's price recovery led to massive losses.

Get news in real-time...Go to Token Post Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>