In the past 24 hours, approximately $87.8 million worth of leverage positions were liquidated in the cryptocurrency market.

According to the currently aggregated data, short positions dominate the liquidated positions, indicating that short position investors suffered significant losses amid market uptrends.

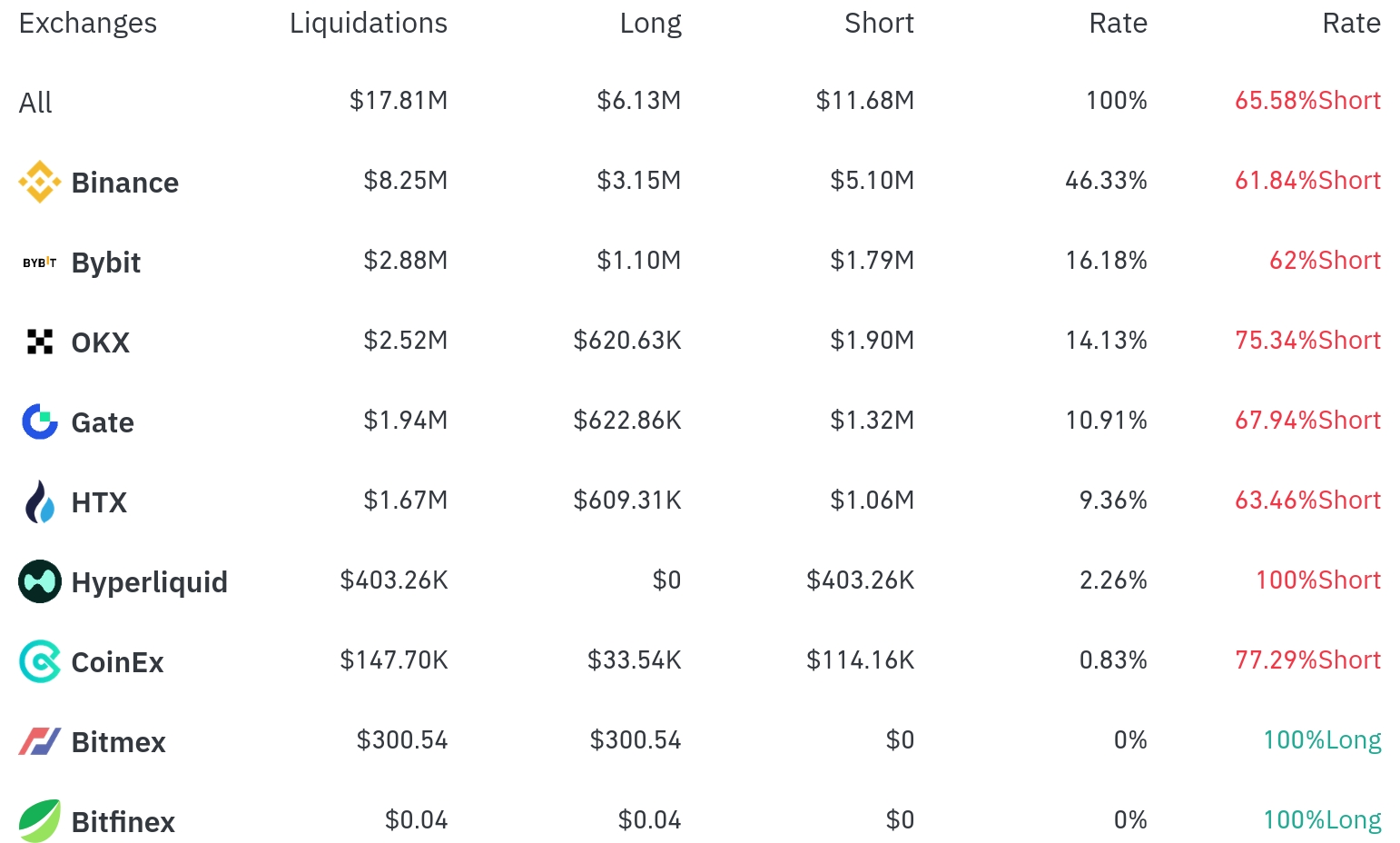

Binance experienced the most position liquidations over the past 4 hours, with a total of $8.25 million (46.33% of the total) liquidated. Notably, short positions accounted for $5.1 million, representing 61.84%.

Bybit was the second-highest exchange with liquidations, with $2.88 million (16.18%) of positions liquidated, with short positions also accounting for $1.79 million (62.00%).

OKX saw approximately $2.52 million (14.13%) in liquidations, with an even higher short position ratio of 75.34%.

Notably, on Hyperliquid, all liquidated positions ($403,260) were short positions, while on BitMEX, a small-scale liquidation occurred entirely in long positions.

By coin, ETH recorded the most liquidations. Approximately $41.52 million in ETH positions were liquidated in 24 hours, with $31.83 million from short positions. In the 4-hour timeframe, $6.03 million in short positions and $1.51 million in long positions were liquidated. ETH showed a 2.77% price increase.

BTC had about $29.28 million in positions liquidated in 24 hours, with $27.44 million from short positions. Bitcoin is currently trading at $114,351, rising 0.82% in 24 hours.

XRP experienced significant liquidations of $9.05 million, with $7.71 million from short positions, alongside a 5.79% price increase.

SOL recorded $4.22 million in liquidations while rising 1.20%, and Doge saw $3.77 million in liquidations with a 2.75% increase.

Notably, the ENA Token recorded $4.99 million in liquidations with a substantial 11.85% increase, of which $3.68 million were short position liquidations.

The key characteristic of this data is the large-scale liquidation of short position investors while the cryptocurrency market shows an overall upward trend. Particularly with the continued upward momentum of ETH and BTC, an optimistic market sentiment has formed, further expanding the losses of short position investors.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>