Interest in XRP is cooling down, and major on-chain indicators are forecasting short-term weakness.

As the overall market sentiment weakens, these factors suggest that XRP's price may fall deeper in upcoming trading sessions.

XRP Traders Withdraw $222 Million… Fear Signal

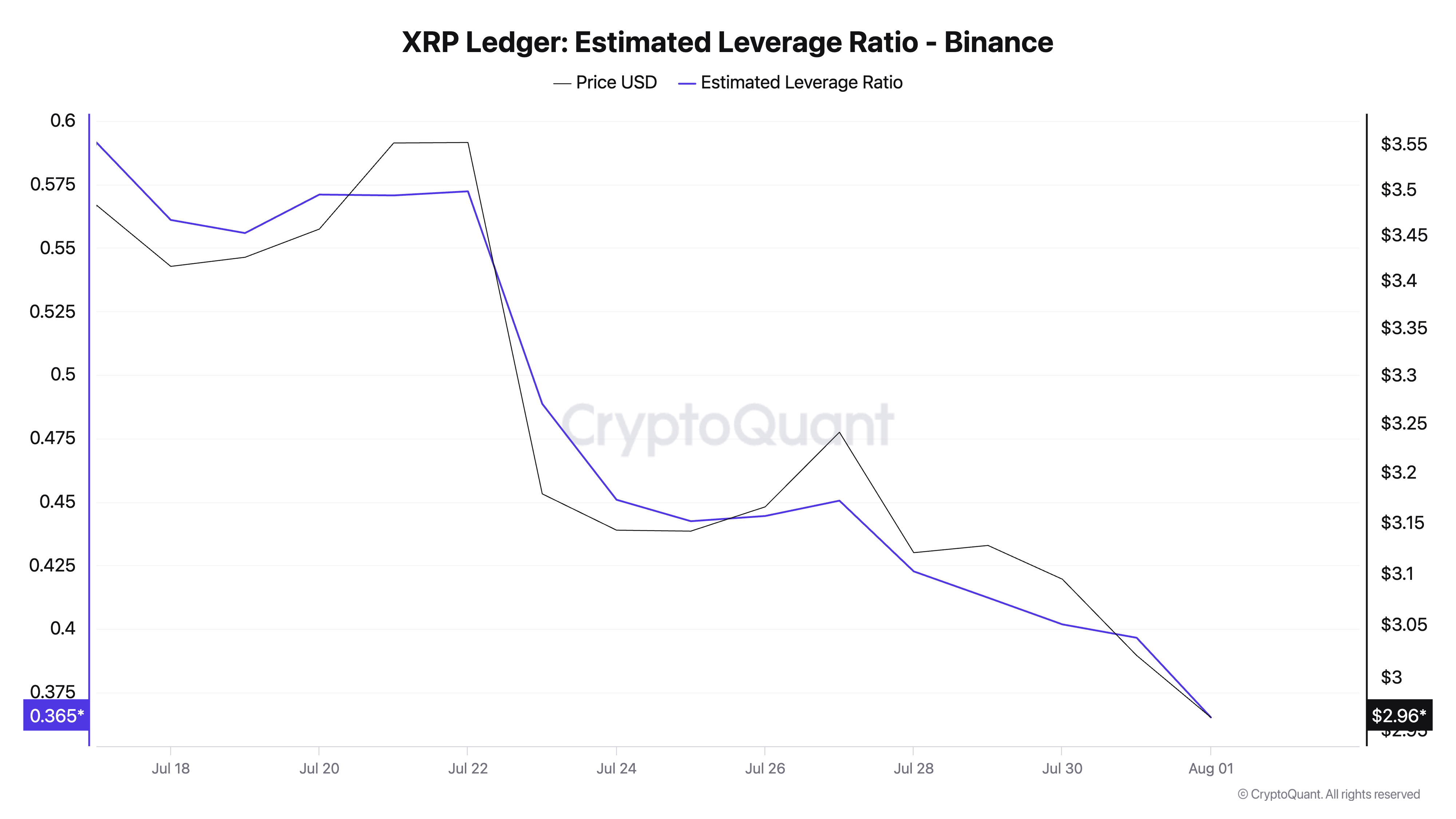

The declining estimated leverage ratio (ELR) of XRP confirms that investor confidence is decreasing and risk preference is reducing on major exchanges like Binance. According to Cryptoquant, the ELR is currently 0.36, recording the lowest weekly close in the past month.

The asset's ELR measures the average leverage amount traders use when executing trades on cryptocurrency exchanges. It is calculated by dividing outstanding commitments by the exchange's reserves for that currency.

XRP's declining ELR indicates that traders' risk appetite is decreasing. This suggests that investors are becoming cautious about the token's short-term outlook and avoiding high-leverage positions that could amplify potential losses.

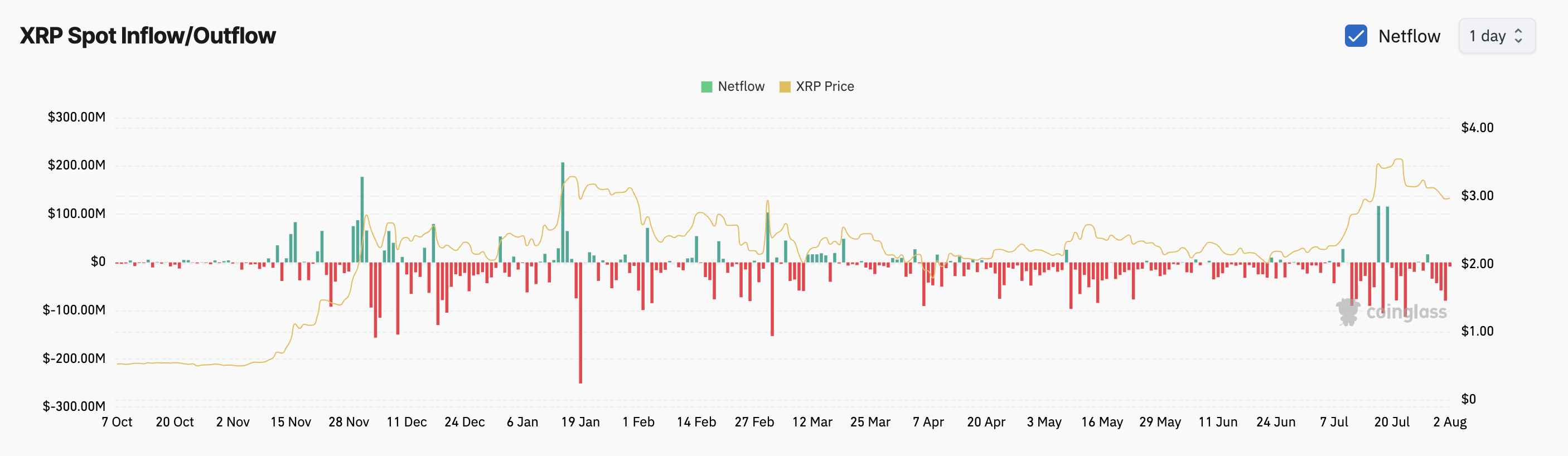

This trend is no different among spot market participants. According to Coinglass data, XRP has recorded a negative net outflow exceeding $222 million since July 29, indicating continued selling dominance and weak buying pressure.

When an asset records a negative spot net outflow, traders are selling their holdings and realizing profits, with few buyers to replace them.

These trends could worsen XRP's current downtrend, potentially increasing supply as demand for the asset decreases.

XRP Decline Approaches $2.71… Possibility of Breaking $3.39

As selling pressure increases, XRP risks plummeting to $2.71. If this support level is not maintained, the altcoin could fall more sharply to $2.50.

Conversely, if buying momentum strengthens, there is a possibility of breaking through the $3 price level. Successfully crossing this threshold could pave the way for a rally to $3.39.