Stellar (XLM)'s recent price movement is experiencing downward pressure and causing concern among investors. After a 97% price surge earlier this month, Stellar now faces the risk of losing those gains.

The next few days will primarily depend on broader market movements, which will play a crucial role in determining altcoin recovery.

Stellar Investors Reducing Positions

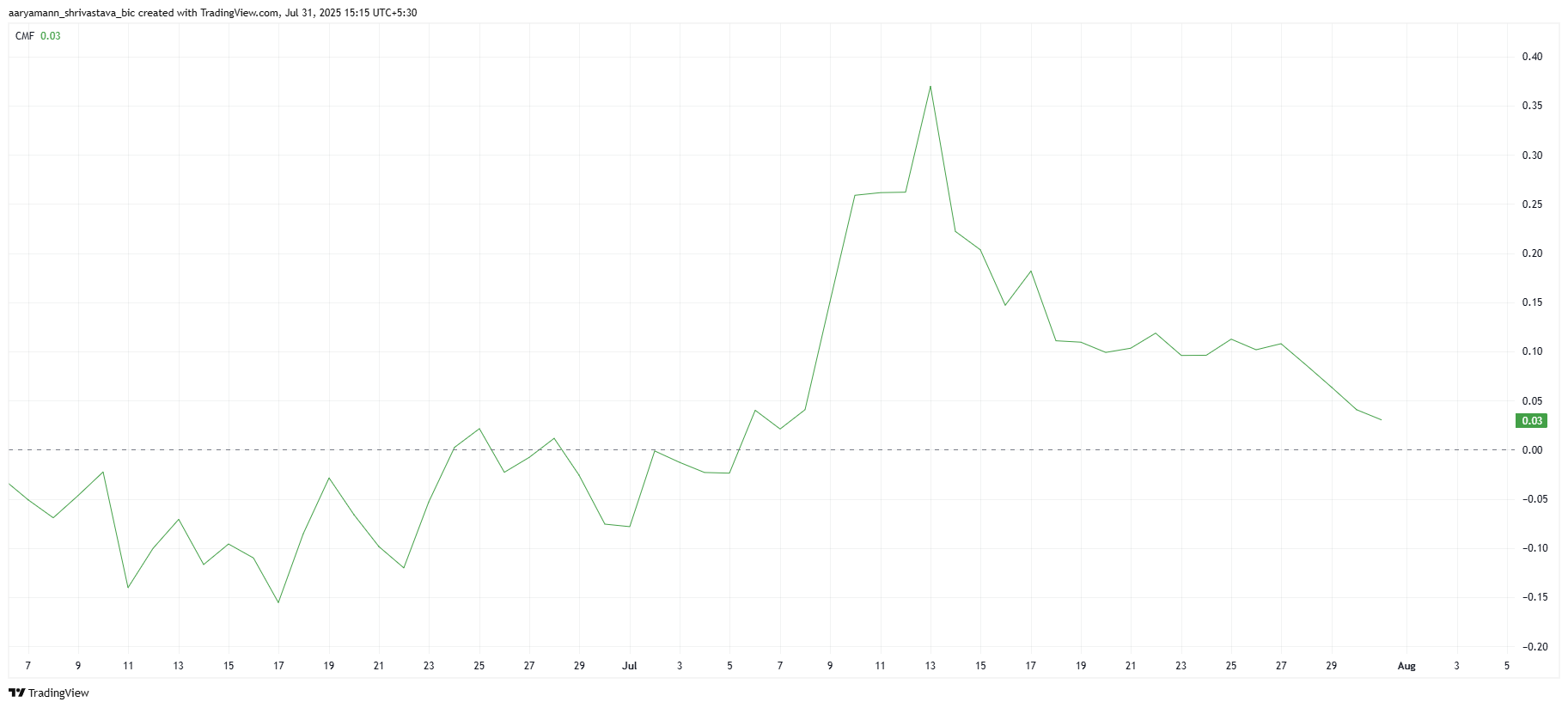

The Chaikin Money Flow (CMF) indicator is showing a sharp decline and is currently at a 3-week low. This indicates increasing outflows from Stellar, which is a negative signal for the asset.

The increased outflow is causing traders to lose confidence in Stellar's short-term outlook, impacting price movements. While the CMF remains in positive territory, it risks sliding into negative territory.

If the CMF slips into this area, it would signal that outflows are exceeding inflows, which could further drive down XLM's price.

Want more token insights? Subscribe to editor Harshi Notariya's daily crypto newsletter [here].

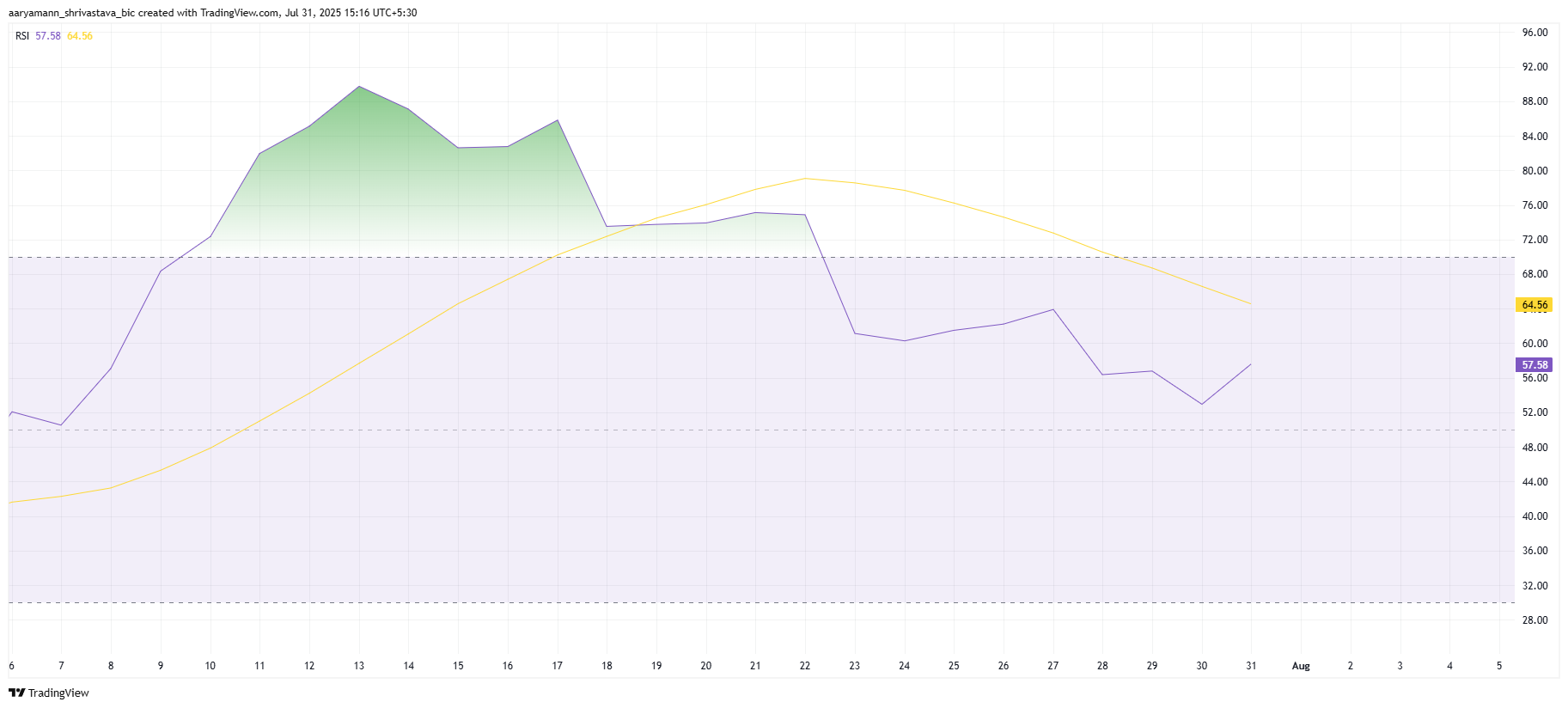

Despite the downtrend, there are still some bullish signals in the broader market. Stellar's Relative Strength Index (RSI) remains above the neutral 50.0 level, suggesting that upward momentum has not completely disappeared.

The RSI shows a slight upward trend, indicating continued buying interest in the market, especially when compared to broader market signals. The cryptocurrency market's ongoing positive momentum could help mitigate some of Stellar's outflows.

XLM Price Needs Upward Movement

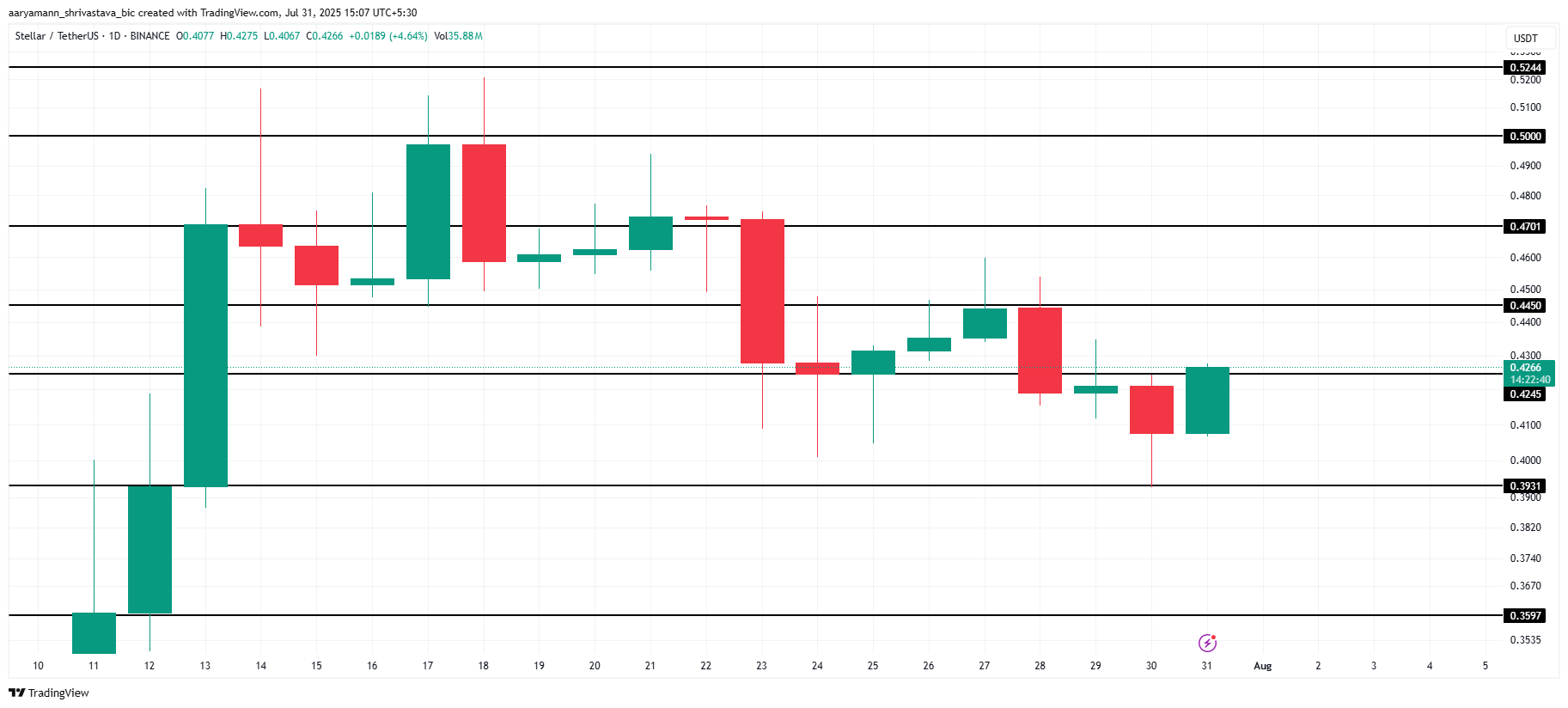

The XLM price is currently at $0.426 and attempting to maintain support at $0.424. The decline over the past two weeks threatens to reverse the significant gains from earlier this month.

If outflows continue and selling pressure increases, Stellar's price could drop to $0.393, which is a critical support level. Losing this support could push XLM's price even lower to $0.359, effectively erasing most of the recent gains and further impacting investor confidence.

Conversely, if broader market conditions remain positive, XLM could find support at $0.393, which would prevent further decline.

The only way to completely invalidate the bearish scenario is for XLM to recover and establish $0.445 as support, though this seems unlikely under current market conditions.