XRP price has been trapped in a narrow range for several days. After reaching a monthly high of $3.65 earlier this month, it has cooled down. Since then, it has dropped by about 14% and is currently trading near $3.13. Last week, it showed only a slight 5% increase.

This adjustment has made traders cautious. However, new data suggests that the accumulation of quiet buying pressure could lead to an XRP price increase if the right signals align.

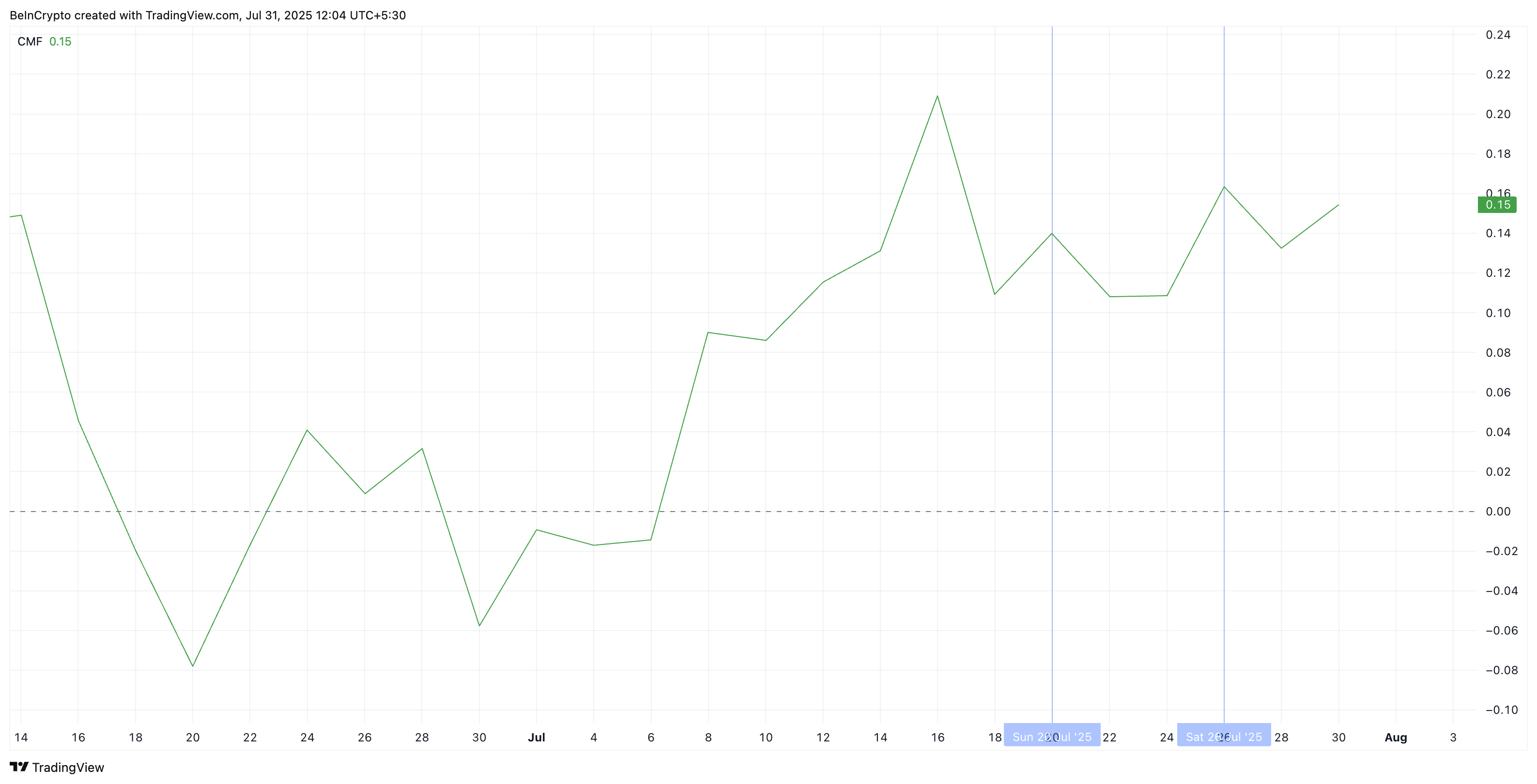

Chaikin Money Flow Needs Strong Momentum to Confirm Uptrend

One key signal to watch is the Chaikin Money Flow (CMF). This indicator combines price movement and trading volume to track whether funds are flowing into or out of the token.

From July 20 to July 26, the CMF of XRP price recorded a higher low despite the price falling from $3.60 to $3.13. This difference suggests that large wallets have been buying and increasing their holdings despite the price decline.

Token TA and Market Update: Want more of these token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

However, the CMF is currently around 0.15. For the XRP rally to gain momentum, it needs to definitively break through this level and record another higher high. This would signal strong fund inflow and move the market closer to a potential XRP price breakout.

In short, smart money is buying gradually, but more conviction is needed to safely push XRP above the bullish momentum.

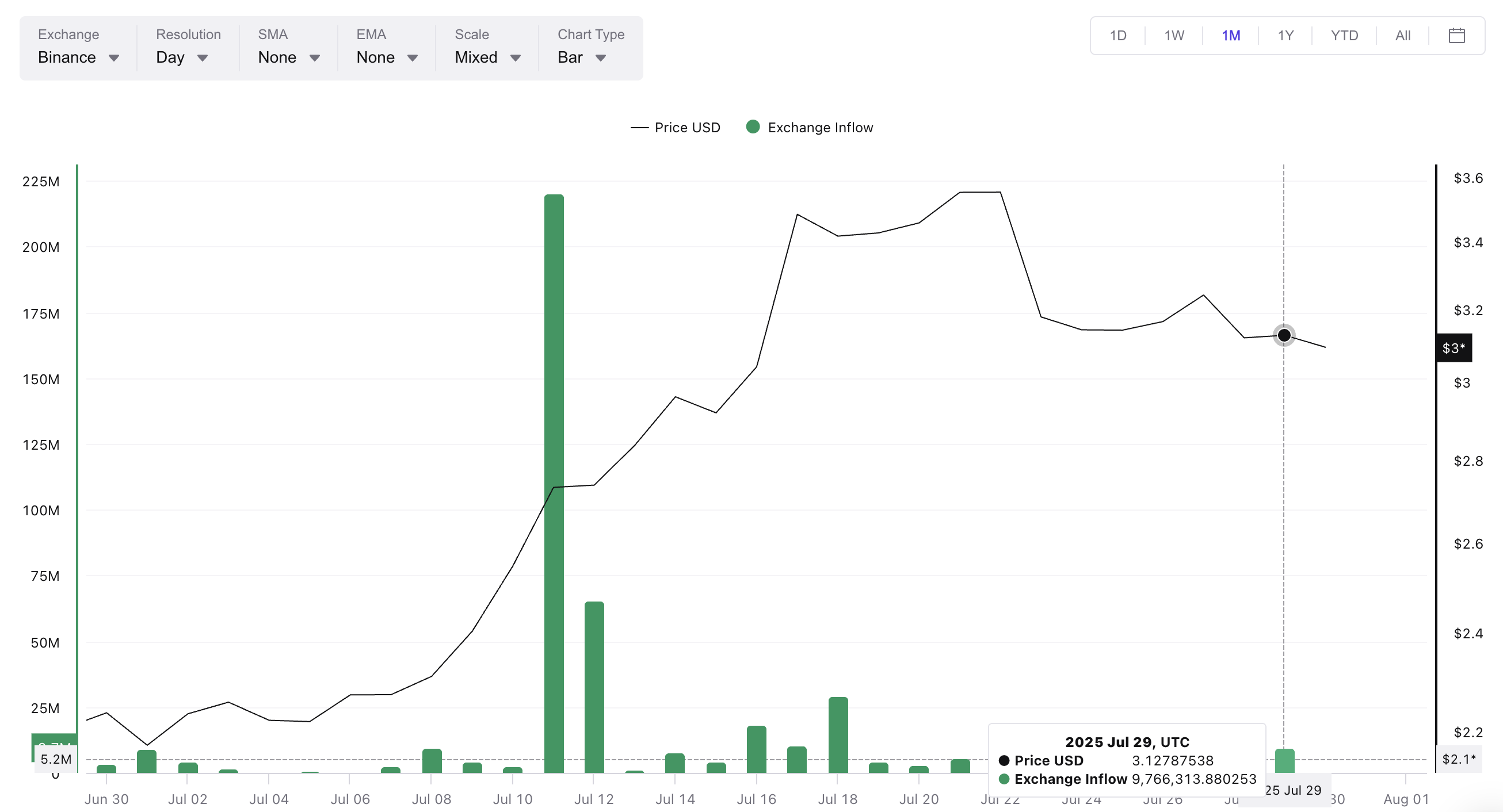

Exchange Inflows Quiet... Immediate Selling Pressure Decreases

Latest data shows that XRP's exchange inflows were minimal for most of July. The only major surge occurred on July 11, when 220 million XRP flowed into trading platforms. Since then, inflows have mostly remained low. The latest data on July 29 shows only 9.7 million XRP moved to exchanges while XRP was trading near $3.12.

Low inflows are generally a good sign of market stability. This suggests that large holders are not rushing to sell XRP.

If inflows remain low for an extended period, it means supply pressure at exchanges is easing. This allows new demand to have a stronger impact on price. This aligns well with the slow but positive reading of the Chaikin Money Flow, showing that while buying activity is cautious, selling interest is also suppressed.

If this trend continues, it could help the XRP price maintain its current range and prepare for a potential upward movement, especially if a bullish pattern emerges in the next few days as described later in this article.

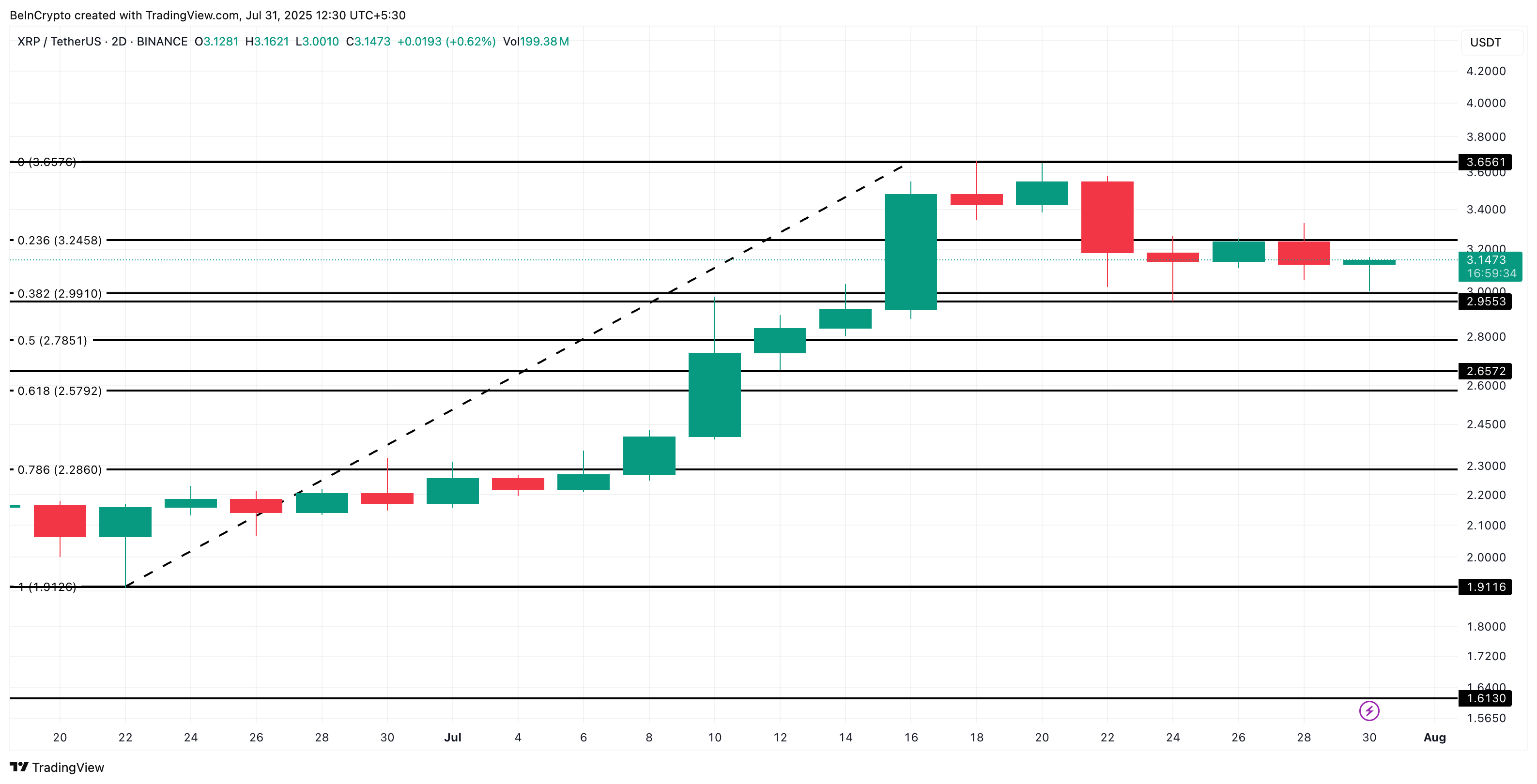

Bullish Pattern Suggests XRP Price Increase Potential

The 2-day price chart shows XRP forming an ascending triangle. This is a bullish pattern where higher lows form pressure below a horizontal resistance line. We are using the 2-day chart to minimize range-bound movement.

The XRP price appears to be trading around the midpoint of the pattern, but key Fibonacci levels reveal the range that must be broken for an aggressive upward movement.

A clean break above $3.24 could quickly push it to $3.65. Beyond that, XRP would move into price discovery mode with almost no resistance.

However, if the XRP price falls below the $2.95-$2.99 level, the major support range revealed in both charts would lose the foundation of the short-term bullish hypothesis.