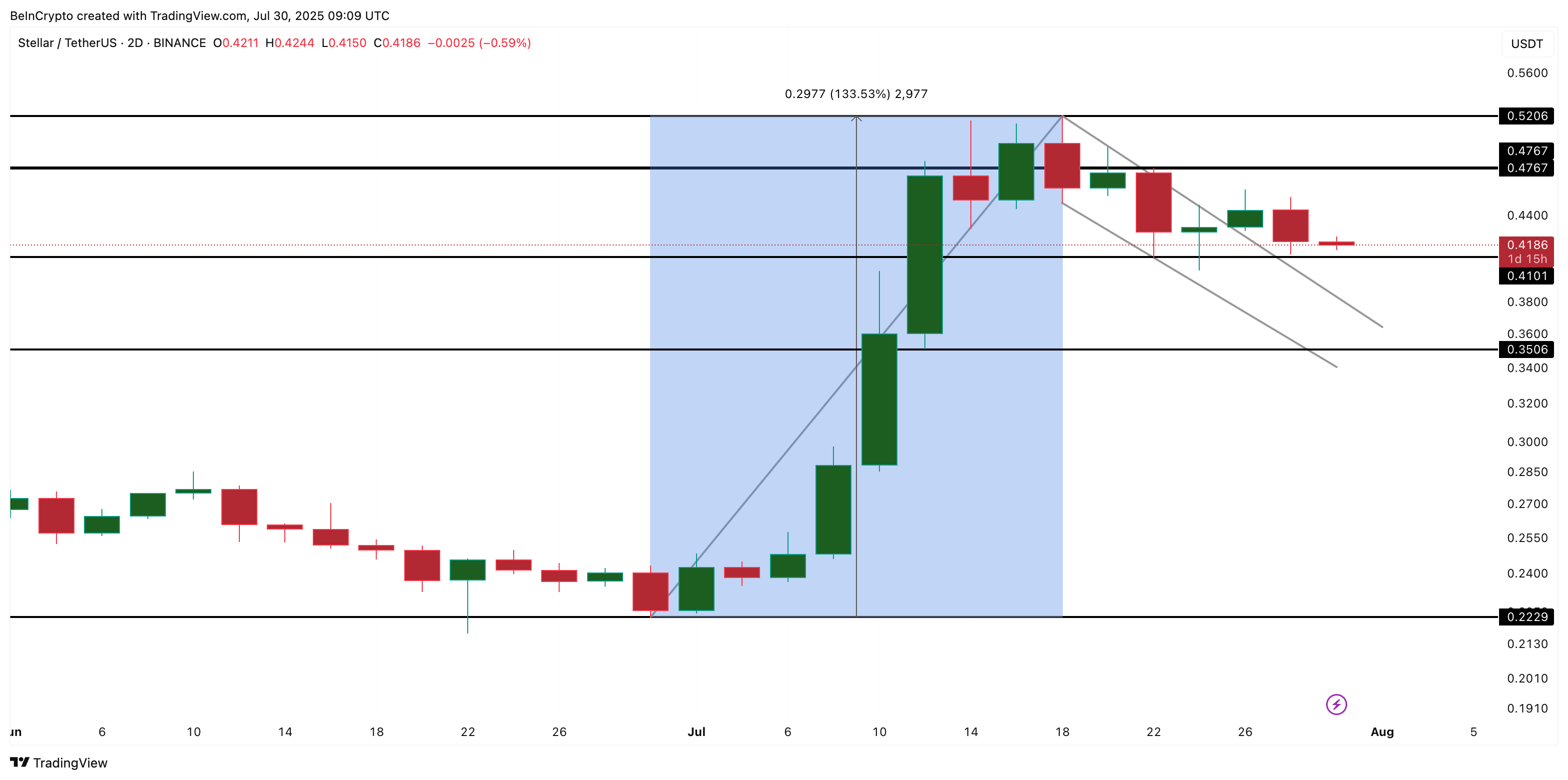

Stellar (XLM) showed strength in July, rising 77% this month. However, it has declined by almost 10% over the past 7 days.

The XLM price broke through the rising flag pattern for two days. This is usually a pattern that signals another rise. However, the candles mostly turned red afterward. Without new buying pressure, it appears unlikely to escape the downward trend.

Net Inflow, Only Tailwind Weakening

Exchange net outflows played a significant role in XLM's recent rise. Early this month, coins leaving exchanges exceeded those entering, reducing supply and strengthening the upward momentum.

Over the past week, this trend has noticeably weakened, with net outflows approaching neutral levels. The lack of continuous withdrawals suggests long-term holders are no longer applying new buying pressure, and the breakout is not receiving significant support.

Token Technical Analysis and Market Update: Want more of these token insights? Subscribe to the daily crypto newsletter here.

Weak Capital Flow... Increasing Concerns

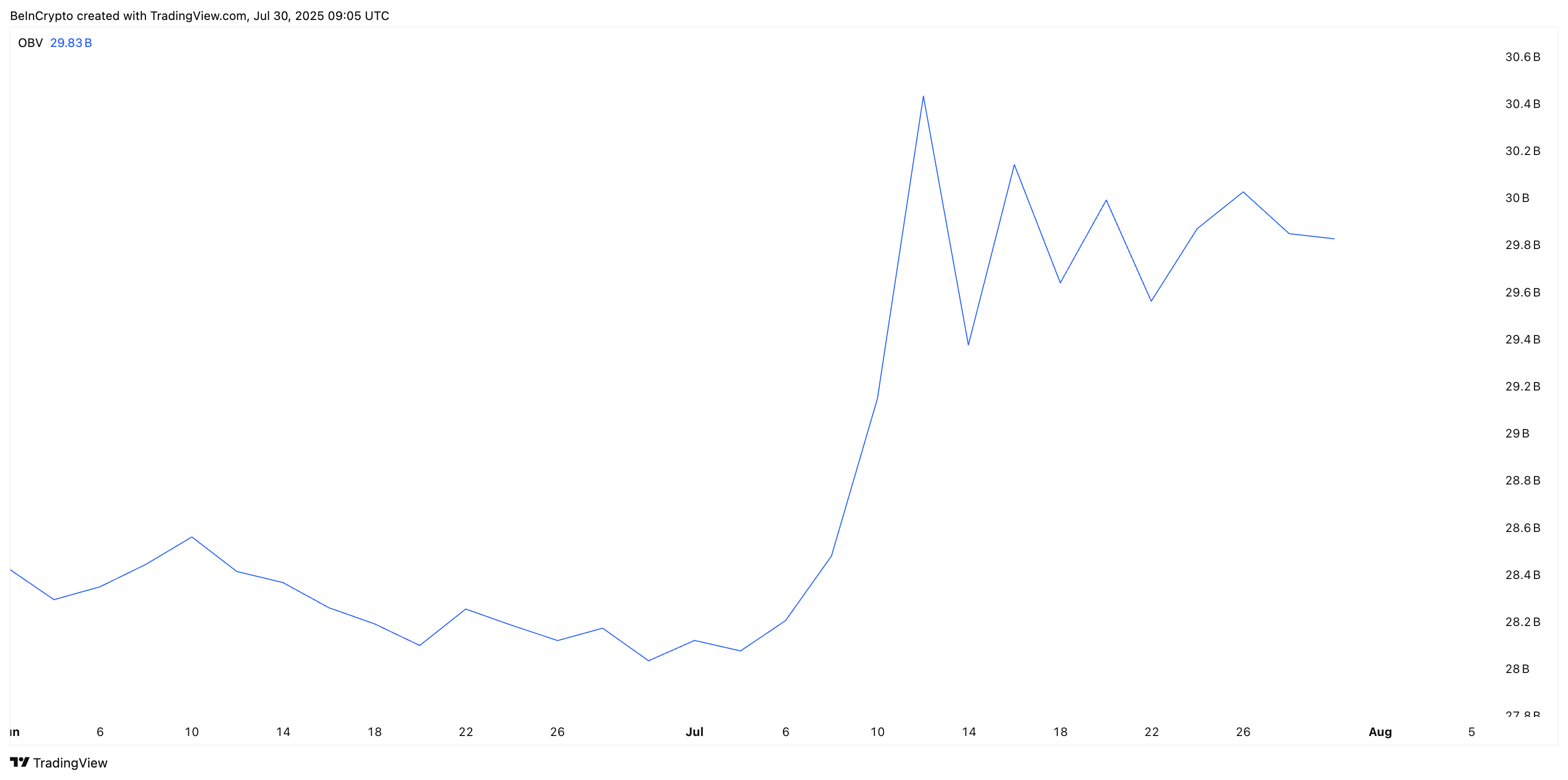

Two-day volume data reinforces this weakened momentum. The On-Balance Volume (OBV), which tracks cumulative buying and selling pressure, is declining despite the XLM price breakout, showing that large buyers are not confidently intervening.

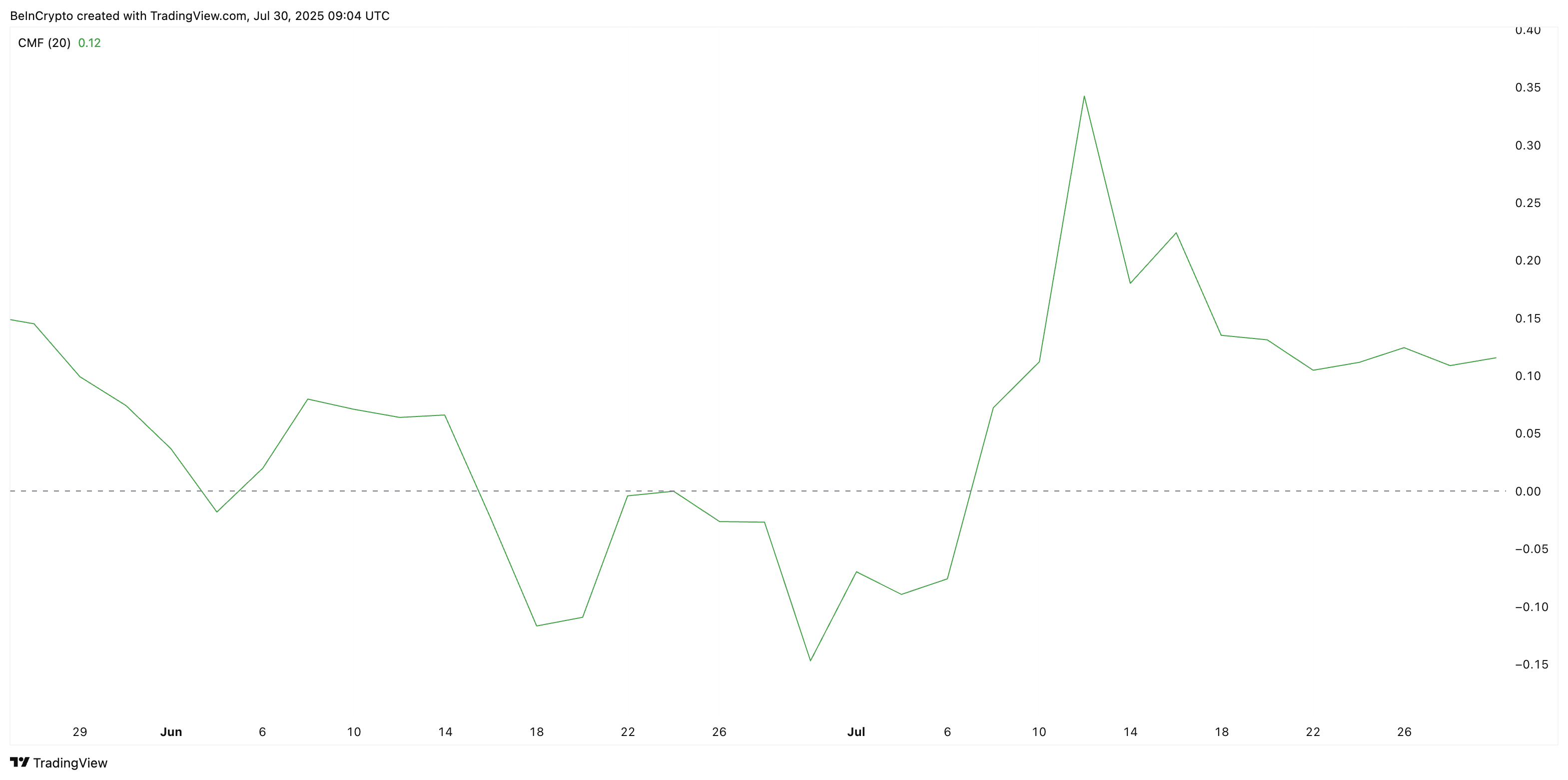

Similarly, the Chaikin Money Flow (CMF) has sharply dropped from 0.35 in early July to about 0.12 currently. The CMF measures actual money flowing in or out of an asset, and this decline indicates weakening demand.

Both indicators suggest a lack of capital support necessary to extend the upward breakout to higher levels.

Stellar (XLM) Price Above Flag... Clear Invalidation Level

The XLM price is currently above the rising flag breakout line, trading near $0.41. However, the momentum is fragile. If it falls below $0.41, the Stellar (XLM) price will re-enter the pattern, and falling below $0.35 would erase nearly half of the 133% rise that formed the flagpole, invalidating the breakout structure.

For the bullish trend to return, the XLM price needs a decisive movement above $0.47, supported by strong inflows and new trading volume. Otherwise, the recent breakout risks ending as another failed attempt toward a new high.