Ethereum celebrated its 10th anniversary on July 30th. This was an important milestone that breathed new life into the entire ecosystem. The network's native token, ETH, nearly doubled in the past two months, reaching a local high of $3,800 in July from around $1,500 in April.

This rise coincided with Ethereum's overall on-chain activity revival, increasing stablecoin trading volume, and institutional demand for ETH coins. Amid this, some of Ethereum's early meme coins saw rises driven by whale speculation and retail interest.

Shiba Inu

Shiba Inu, one of Ethereum's early meme coins, saw a price surge in July. This was due to the broader Layer-1 (L1) ecosystem rising as it celebrated its 10th anniversary.

From June 22 to July 21, SHIB's price rose almost 50%. This was achieved riding a wave of new optimism and increased on-chain activity related to the meme market's revival.

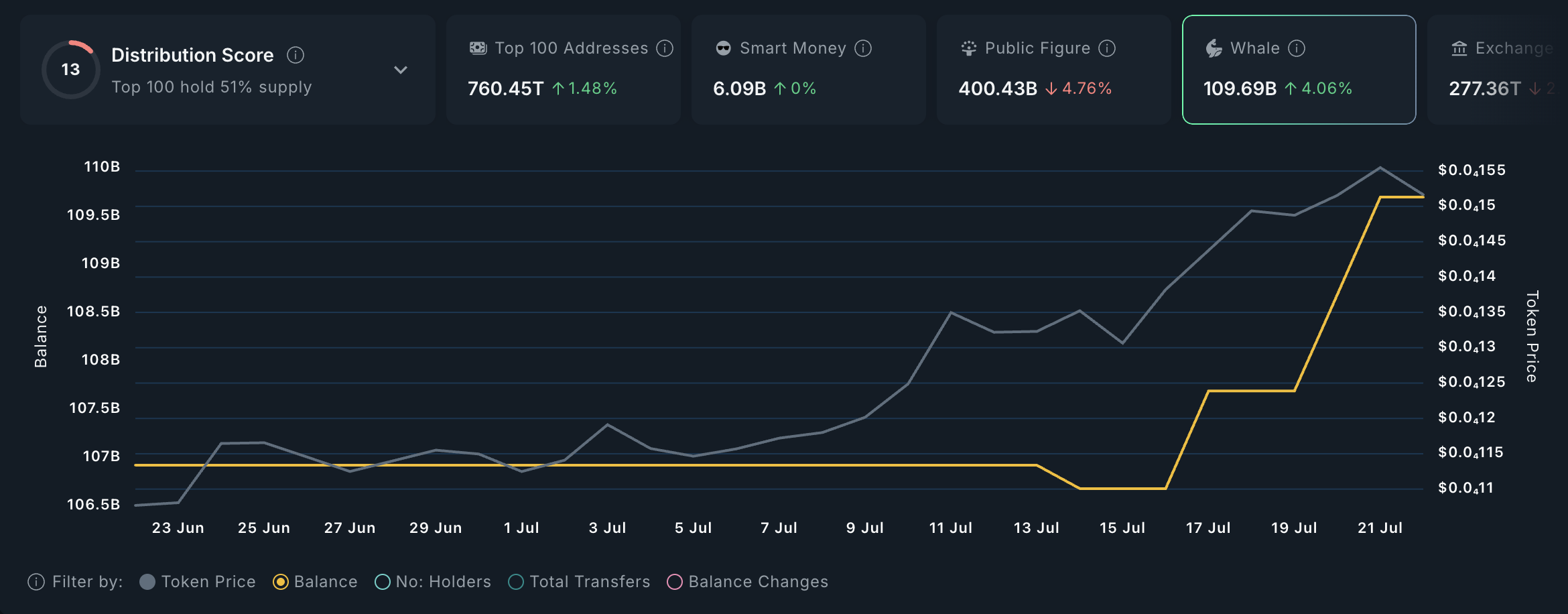

This rise was triggered by a sharp increase in whale accumulation. Wallets identified by Nansen as holding over $1 million in coins increased their SHIB holdings by 4% during this month, helping drive the price up.

At the time of writing, this group of SHIB investors holds 10.969 billion tokens.

This accumulation trend among major holders pushed SHIB to a cycle high of $0.00001597 on July 22nd.

However, as the overall market sentiment cooled, the meme coin fever began to subside. SHIB is currently trading at $0.00001313, having dropped 16% from its recent high.

Shiba Inu Facing August Downturn? Decline Warning

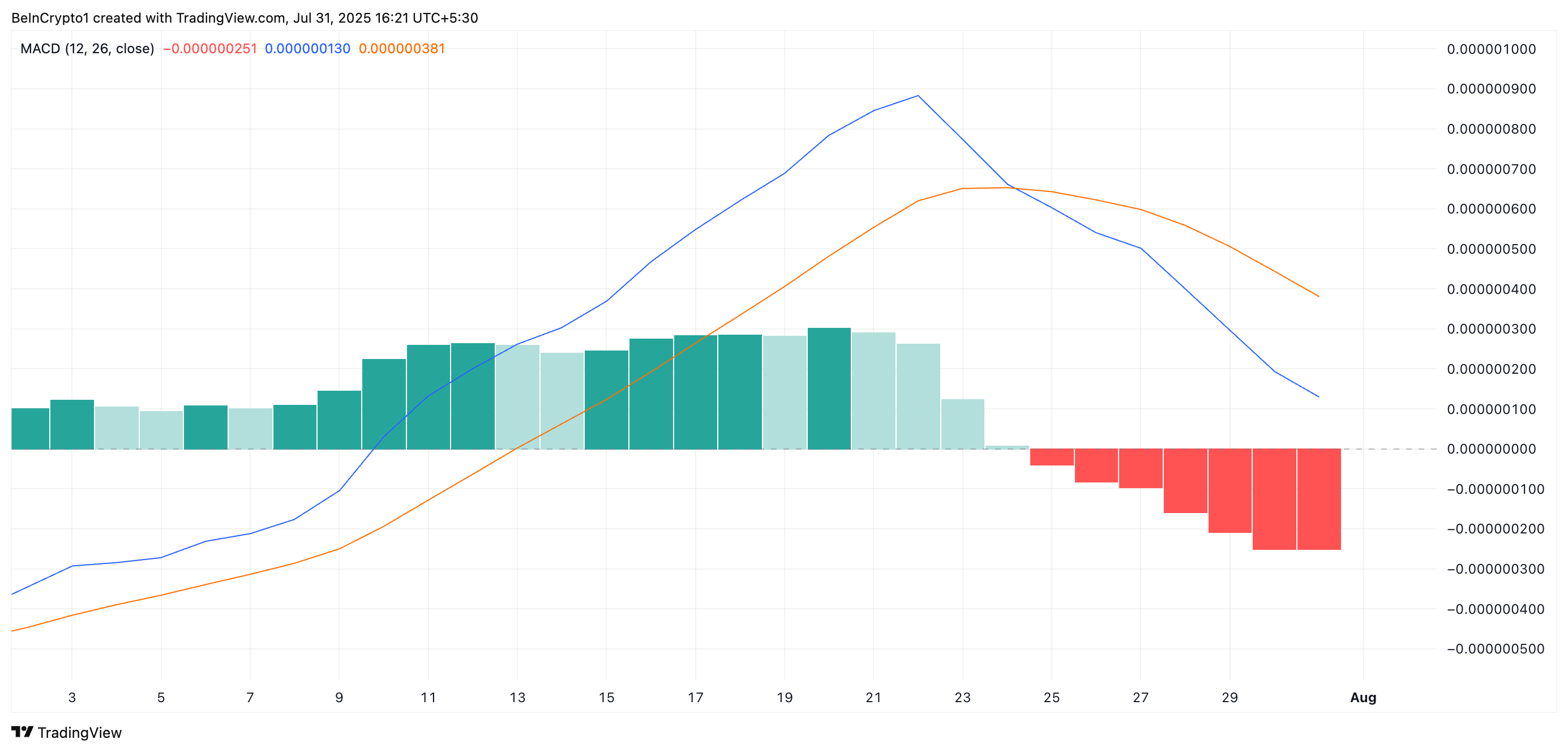

The Moving Average Convergence Divergence (MACD) indicator's reading confirms a bearish bias for the altcoin. Currently, SHIB's MACD line (blue) is below the signal line (orange), indicating weakening buying pressure in the spot market.

The MACD indicator identifies price movement trends and momentum. It helps capture potential buy or sell signals through crossovers between the MACD and signal lines.

Like SHIB, when the MACD line is below the signal line, it indicates bearish momentum. Traders are viewing this setup as a sell signal. Therefore, as August begins, it could intensify downward pressure on meme coins.

In this case, the price could drop to $0.00001108.

Conversely, if new demand for meme coins emerges in August, it could reverse the current downtrend and rise above $0.00001354.

FLOKI

FLOKI, another early Ethereum-based meme altcoin launched in June 2021, recorded a rise riding the strength wave of early July.

According to readings on the FLOKI/USD daily chart, the token began steadily rising from June 23rd and reached a local high of $0.0001577 by the end of July.

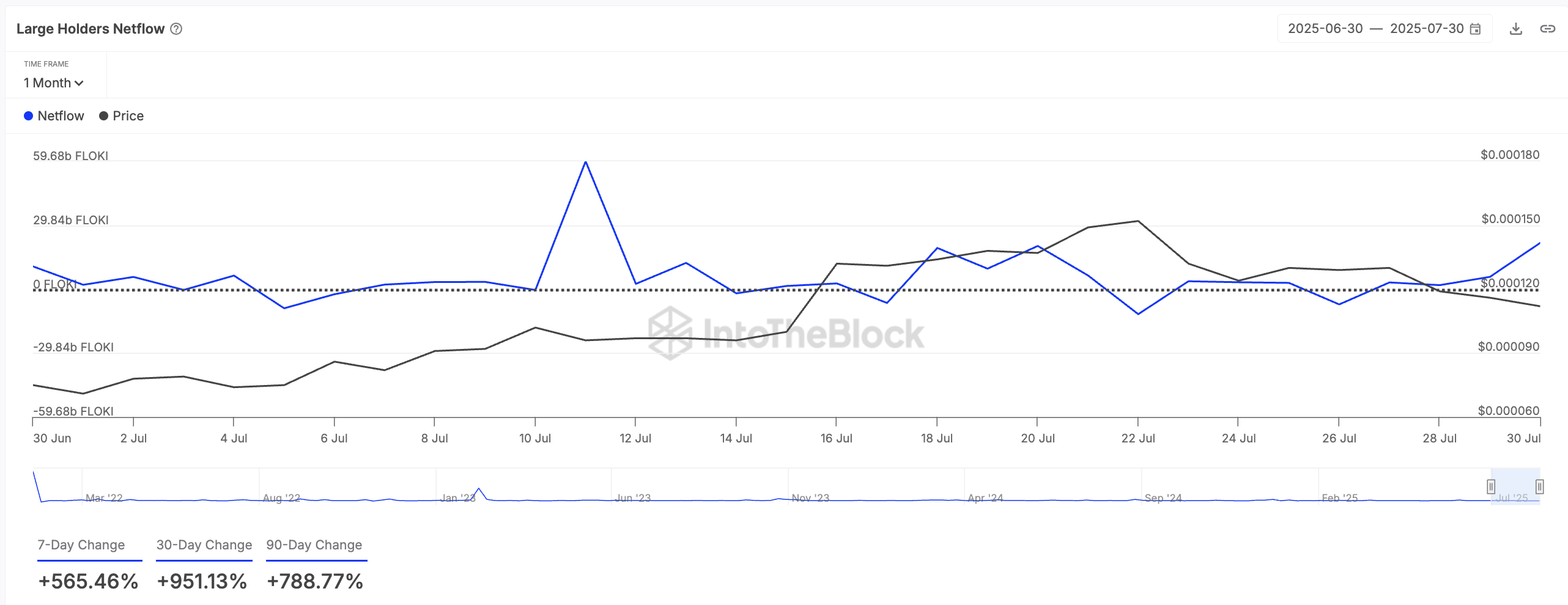

This rise was primarily driven by a strong increase in whale accumulation, evidenced by a 951% increase in large holder net inflows last month.

Large holder net inflow measures the difference in the amount of tokens bought and sold by whales during a specific period. Such a surge indicates strong whale accumulation, suggesting increased confidence or bullish outlook for the asset.

While a wave of profit-taking subsequently dropped the price by 21%, whale activity did not stop. Instead, large holder net inflows surged over 500% in the past seven days, suggesting big players see the dip as a buying opportunity.

If this trend continues, FLOKI could rise to $0.0001399.

However, if whale accumulation stops and they begin taking profits, FLOKI's price could drop further to $0.0001007.