July was a historic month for the cryptocurrency market. Trading activity reached astronomical levels, with the global cryptocurrency market capitalization surpassing $4 trillion for the first time.

However, this enthusiastic rise triggered profit-taking, causing short-term corrections in several digital assets by the end of July. Nevertheless, large holders, often called cryptocurrency whales, show no signs of backing down. Instead, they are rotating capital into tokens they believe will record gains in August.

Cardano (ADA)

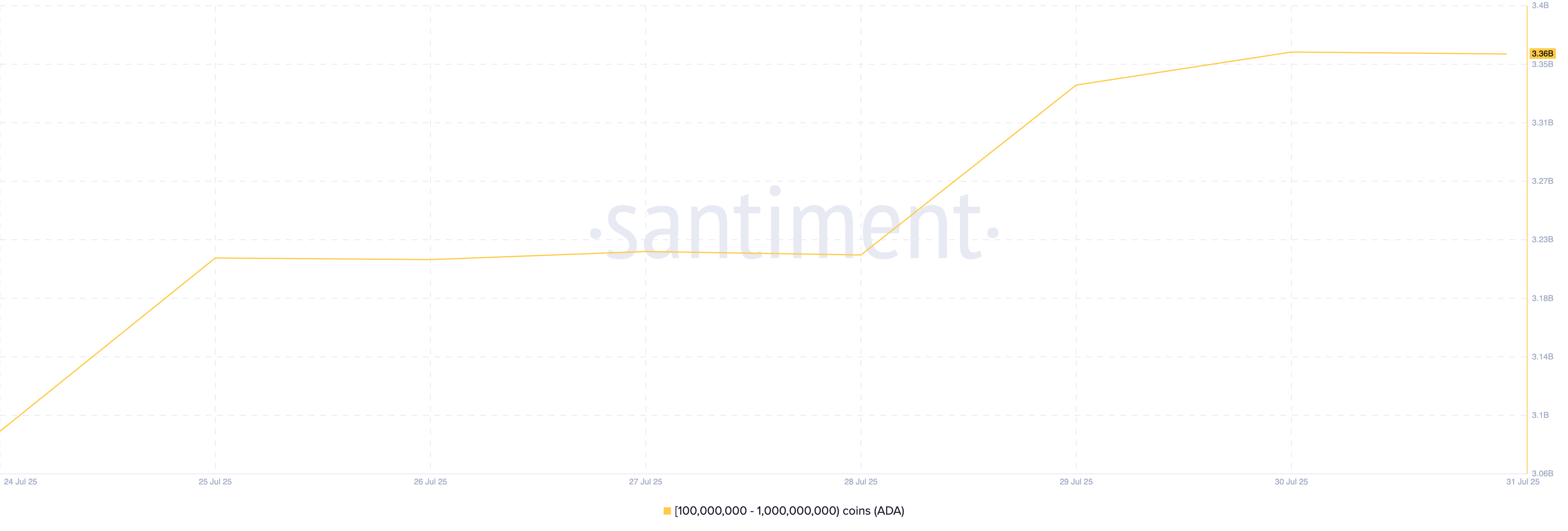

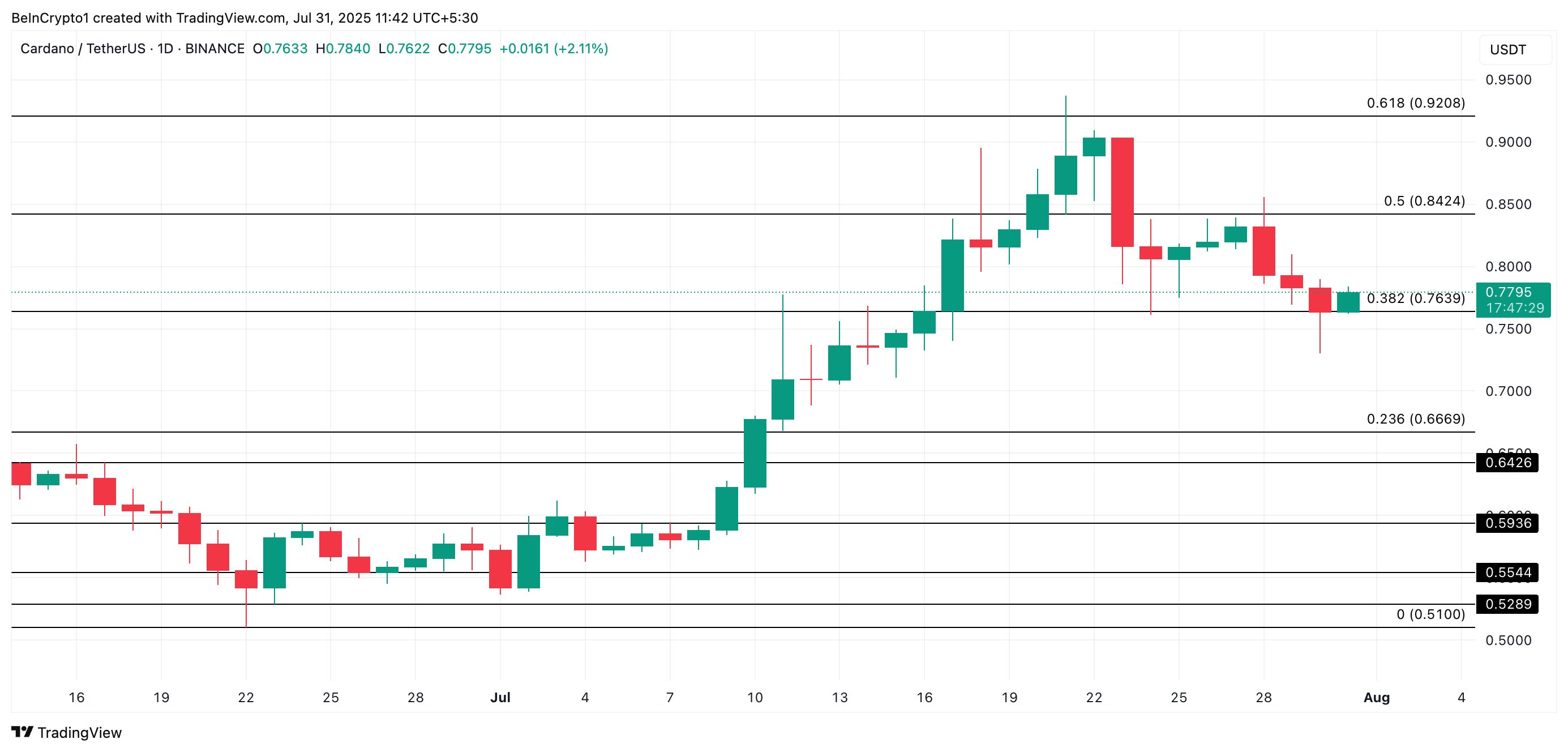

Layer-1 (L1) token Cardano (ADA) has emerged as the top choice among cryptocurrency whales aiming for profits in August. According to on-chain data, large holders with 100 million to 1 billion ADA have accumulated 270 million tokens since July 24, worth over $210 million at current market prices.

This accumulation occurred amid a recent ADA price correction. The altcoin has fallen from its cycle high of $0.93 on July 21 and is currently trading at $0.77. Despite this correction, the continued interest from high-net-worth investors indicates confidence in ADA's long-term prospects.

If their accumulation continues and offsets supply increases, it could stabilize ADA's price and halt the decline. In this case, the coin could start a reversal and rise to $0.84.

Token Technical Analysis and Market Updates: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

Conversely, if whale demand decreases, ADA could extend its decline, falling below $0.76 and potentially dropping to $0.66.

TRON (TRX)

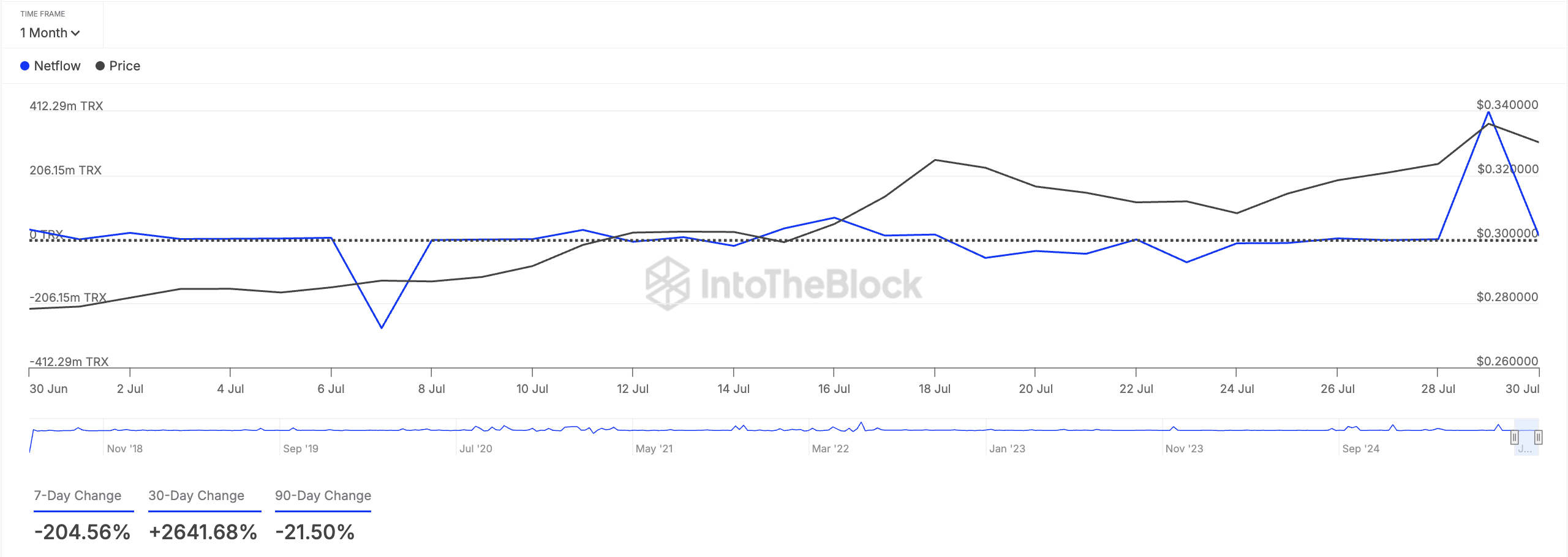

TRX has recorded a 24% price increase, moving within an ascending channel since June 22. By July 29, this altcoin reached a six-month high of $0.35, driven by increased whale accumulation.

According to IntoTheBlock data, this represents a large holder net inflow increase of over 2,600% last month.

Large holder net inflow measures the difference between tokens bought and sold by whales during a specific period.

When an asset's large holder net inflow shows a positive surge, wallets holding over 1% of the circulating supply are accumulating more coins. This suggests increasing confidence among these key holders and implies potential continued TRX price increases if they maintain demand.

In this scenario, TRX could extend its upward trend and rise to $0.35.

However, a resumption of profit-taking activities would invalidate this upward outlook. If market demand decreases, the altcoin's price could fall below $0.30 and trade at $0.29.

Solana (SOL)

SOL's 2% price correction last week provided an opportunity for whales to buy. Many are expecting a rebound in August. For reference, SOL had reached a peak of $206.18 on July 22 before declining.

Currently trading at $180.67, this popular altcoin has fallen 12% since then.

However, whale wallets holding over $1 million in SOL are not hesitating. In fact, they increased their holdings by 6.4% over the past week, using the recent decline as an entry point.

If this accumulation trend continues through August, it could reignite broader bullish sentiment for the coin. If retail traders join in, SOL's price might resume its upward trend and attempt to recover levels above $190.

Conversely, if selling pressure persists, SOL's price could slip below the $180 support level and test the $176.33 level.