Ethereum ($ETH) is concluding July with over 60% growth. However, August 2025 could be challenging for ETH. The market is revealing several hidden signals of potential sharp price adjustments.

According to recent data and expert analysis, there are four key warning indicators that need careful examination.

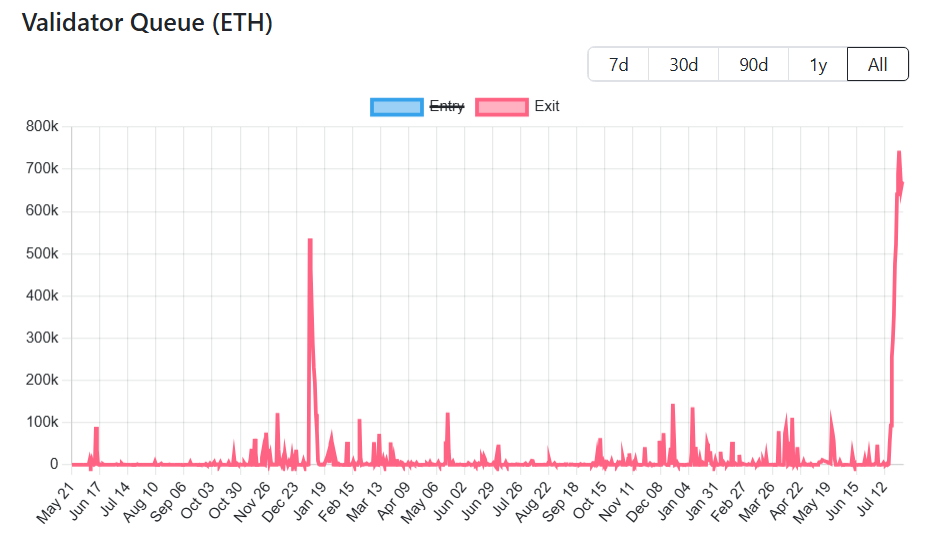

1. Unstaking Queue Exceeding 700,000 ETH

The first warning signal is that over 700,000 ETH are in the unstaking queue, which is at its highest level in four years, according to ValidatorQueue data.

This suggests many users and institutions are preparing to withdraw staked ETH to realize profits or reallocate assets.

A week ago, BeInCrypto reported 350,000 ETH were waiting, valued at approximately $1.3 billion. Now that number has doubled.

Notably, the exit queue is much larger than the entry queue. Over 700,000 ETH are waiting to exit, while only about 250,000 ETH are waiting to stake.

According to ValidatorQueue data, the unstaking delay will extend by about 9 days. This means substantial supply will be re-circulated as ETH approaches the strong resistance zone near $4,000.

"Validators are likely not leaving Ethereum but choosing exit to restake, optimize, or replace operators. Alternatively, it could be an intention to realize profits. It's natural to assume some stakers are preparing to sell, which could generate short-term selling pressure and potentially lead to a price correction." – Segment Lead at Everstake, everstake.eth mentioned.

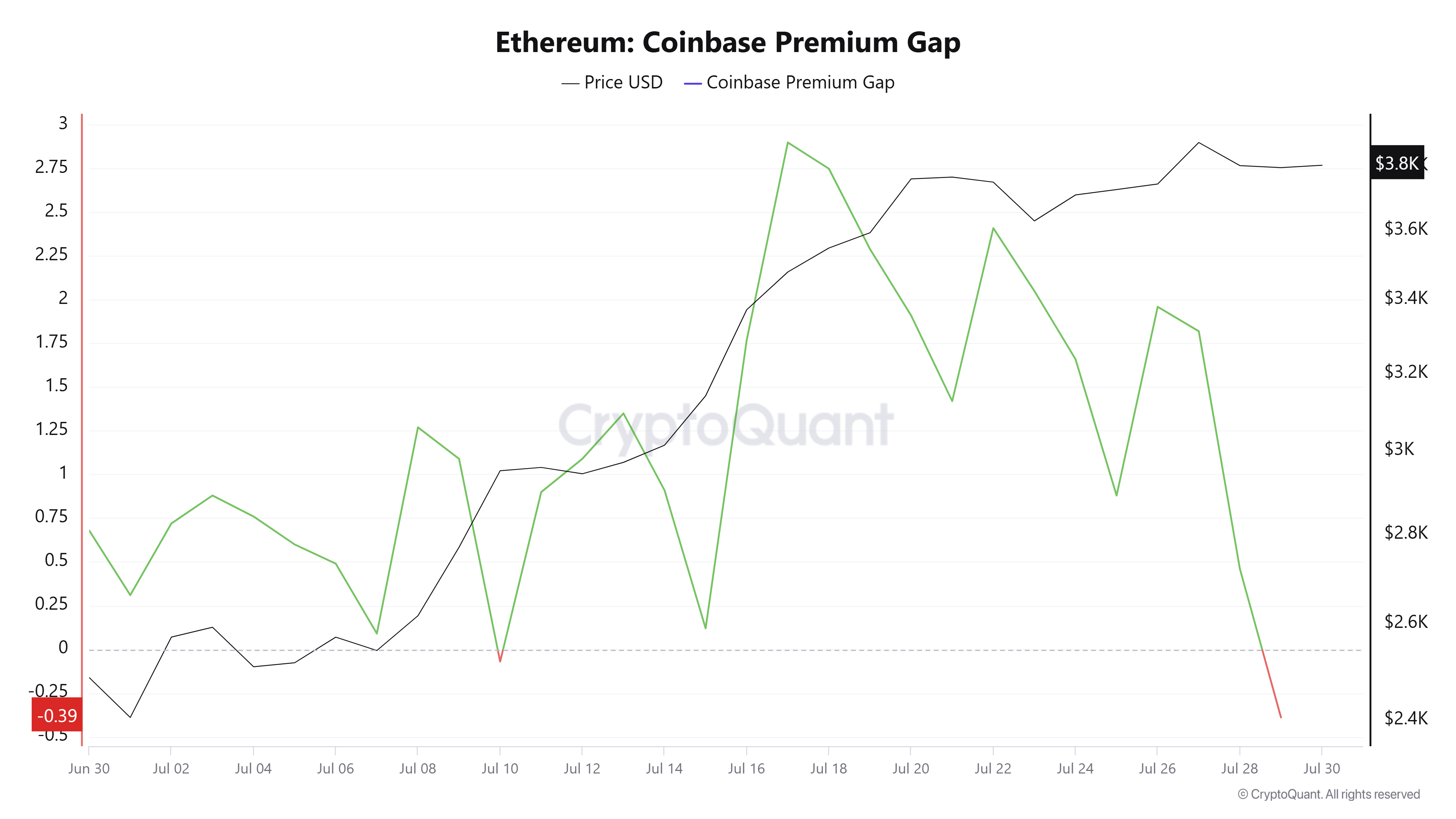

2. ETH Coinbase Premium Gap Turns Negative

According to CryptoQuant data, the second warning signal is that the ETH Coinbase Premium Gap turned negative at the end of July.

This indicator reflects the price difference between Coinbase and Binance and is often used to compare US investor demand with other global regions.

The Premium Gap was positive throughout July as ETH rose from $2,400 to nearly $4,000. However, it sharply dropped to negative by month-end, indicating decreased buying pressure from US investors.

At current price levels above $3,800, most retail and institutional investors who bought ETH in Q2 are in profit. This raises questions about whether they are now satisfied with their returns.

"US market demand is weakening. Caution is needed." – Analyst IT Tech said.

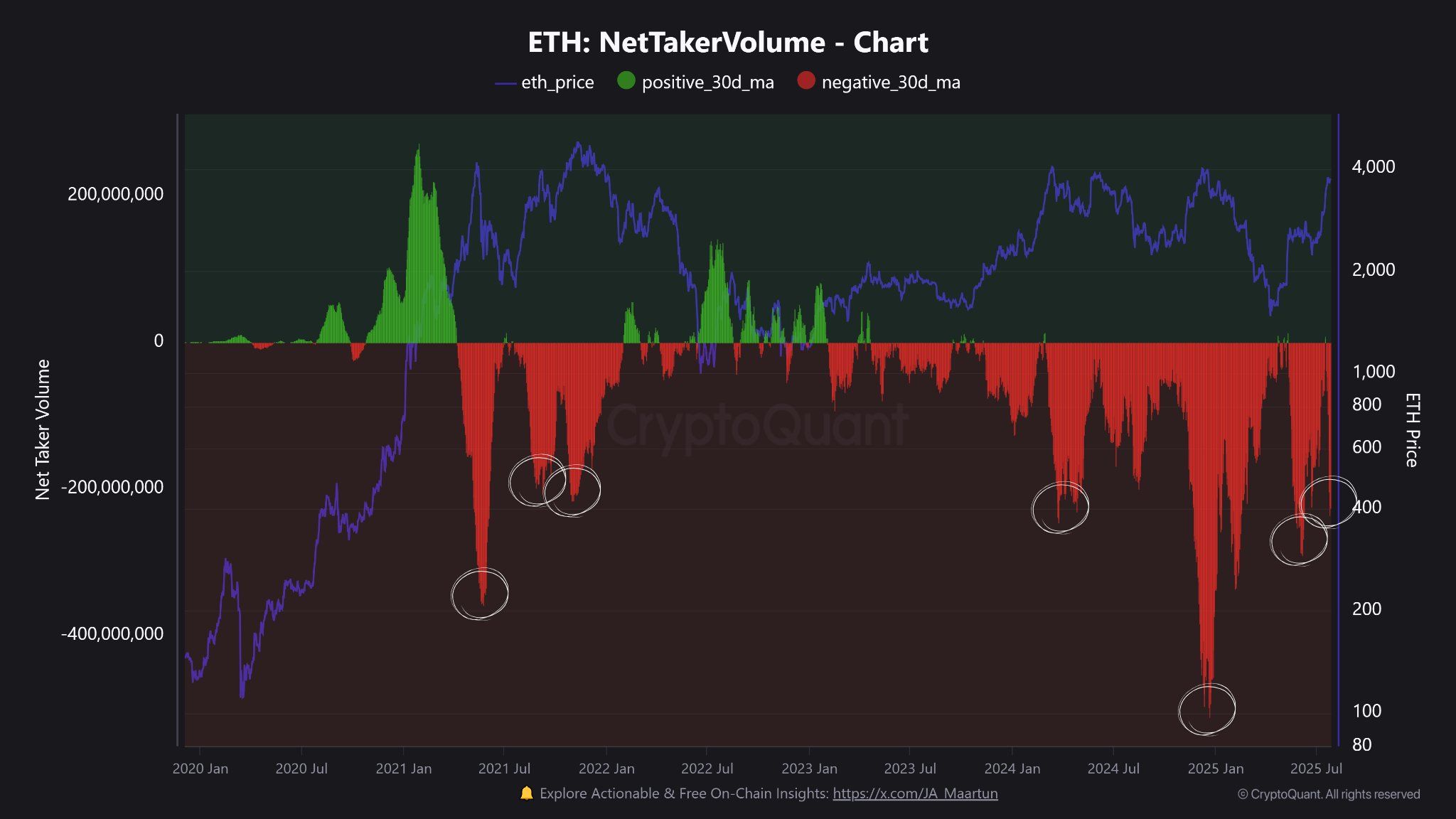

3. Net Taker Volume Turns Negative at $231 Million

Ethereum's net taker volume showed a negative figure of $231 million at the end of July, meaning sell orders significantly exceeded buy orders, according to analyst Maartunn.

Net taker volume reflects trader sentiment and tracks those actively placing orders, revealing whether buying or selling is dominant in the market.

The negative figure indicates net selling across exchanges, typically signaling bearish sentiment or capital outflow.

"Consistent sell-side attack. Taker sell volume exceeded taker buy volume by $231 million on a daily basis." – Maartunn said.

Historically, deep negative net taker volume coincides with major ETH price peaks. The current figure is not as extreme as the $500 million drop earlier this year but remains a notable warning signal.

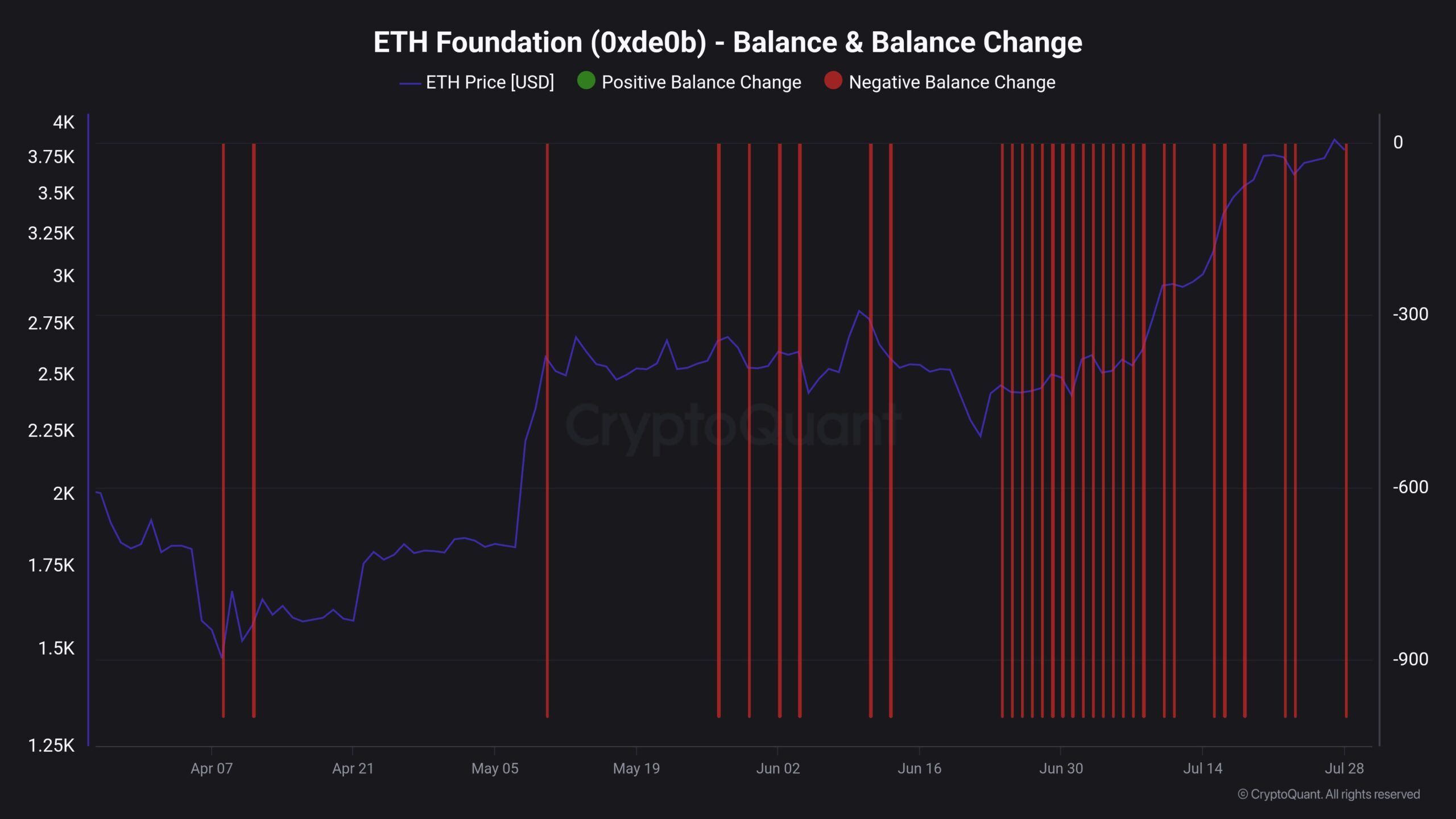

4. Ethereum Foundation Sells 25,833 ETH

The final warning signal is that the Ethereum Foundation has sold 25,833 ETH over the past few months, equivalent to nearly $100 million – according to Maartun.

This is significant. The Ethereum Foundation is one of the most influential institutions holding a substantial amount of ETH since the beginning.

These sales could fund development initiatives or financial management. However, combined with other declining signals, they create psychological selling pressure in the market.

"Is this a sign of belief? The Ethereum Foundation has been dumping 25,833 $ETH — almost $100 million — over the past few months. Follow actions, not words." – Maartun added.

Data shows the foundation intensified selling activity in July, during ETH's surge.

Despite these warning signals, Ethereum continues trading above $3,800. Institutional accumulation and Ethereum financial managers are maintaining high demand for ETH. It remains the most popular cryptocurrency asset after Bitcoin.