As July comes to an end, several important developments have emerged in the Bitcoin (BTC) market. In particular, profit-taking pressure is reappearing at the end of the month, raising concerns about the potential turning point in August.

According to market experts and on-chain data analysis, there are four major selling pressure causes that could soon shape Bitcoin's path. Let's examine each factor in detail.

1. Awakened 'Dormant Whale' Wallet Profit Realization

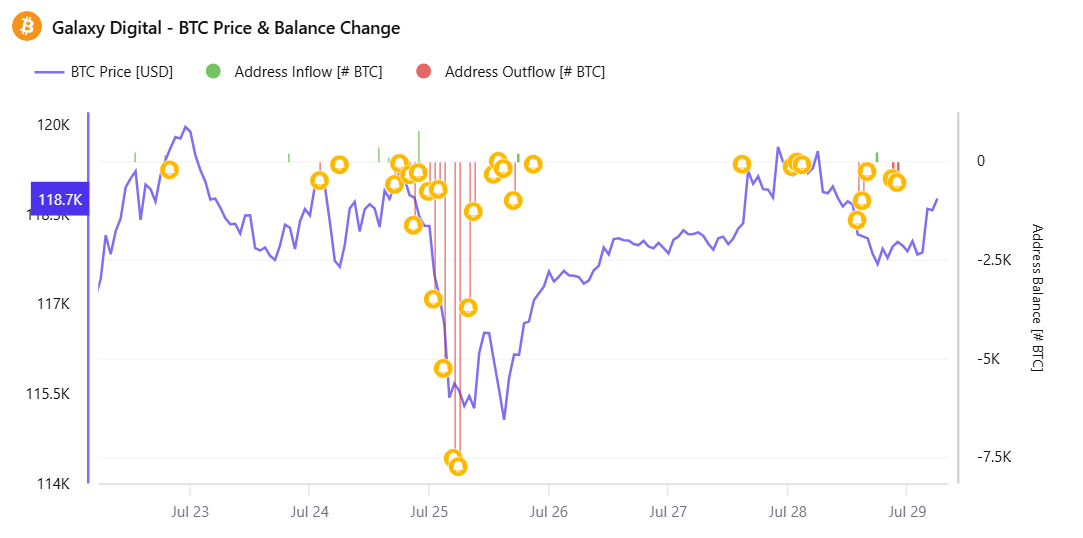

In early July, BeInCrypto reported that a whale wallet holding 80,000 BTC had awakened after more than 14 years. The selling activity of this whale wallet was facilitated by Galaxy Digital and slowed Bitcoin's upward momentum in the last week of July.

According to CryptoQuant data, large outflows from Galaxy Digital wallets often coincide with Bitcoin price adjustments. On July 29, LookOnChain detected more outflows, raising concerns about another potential sell-off.

"Is Galaxy Digital helping customers sell BTC again? In the past 12 hours, Galaxy Digital has transferred an additional 3,782 BTC ($447 million), mostly to exchanges." LookOnChain reported.

Additionally, BeInCrypto reported that two more dormant wallets that were inactive for 6 to 14 years have been activated. SpotOnChain recently reported that three dormant whale wallets, possibly related to a single entity, moved 10,606 BTC ($1.26 billion) after 3-5 years of inactivity.

With the increasing number of activated whale wallets, selling pressure is expected to increase as August approaches.

2. Long-Term Holder Selling Pressure Indicators

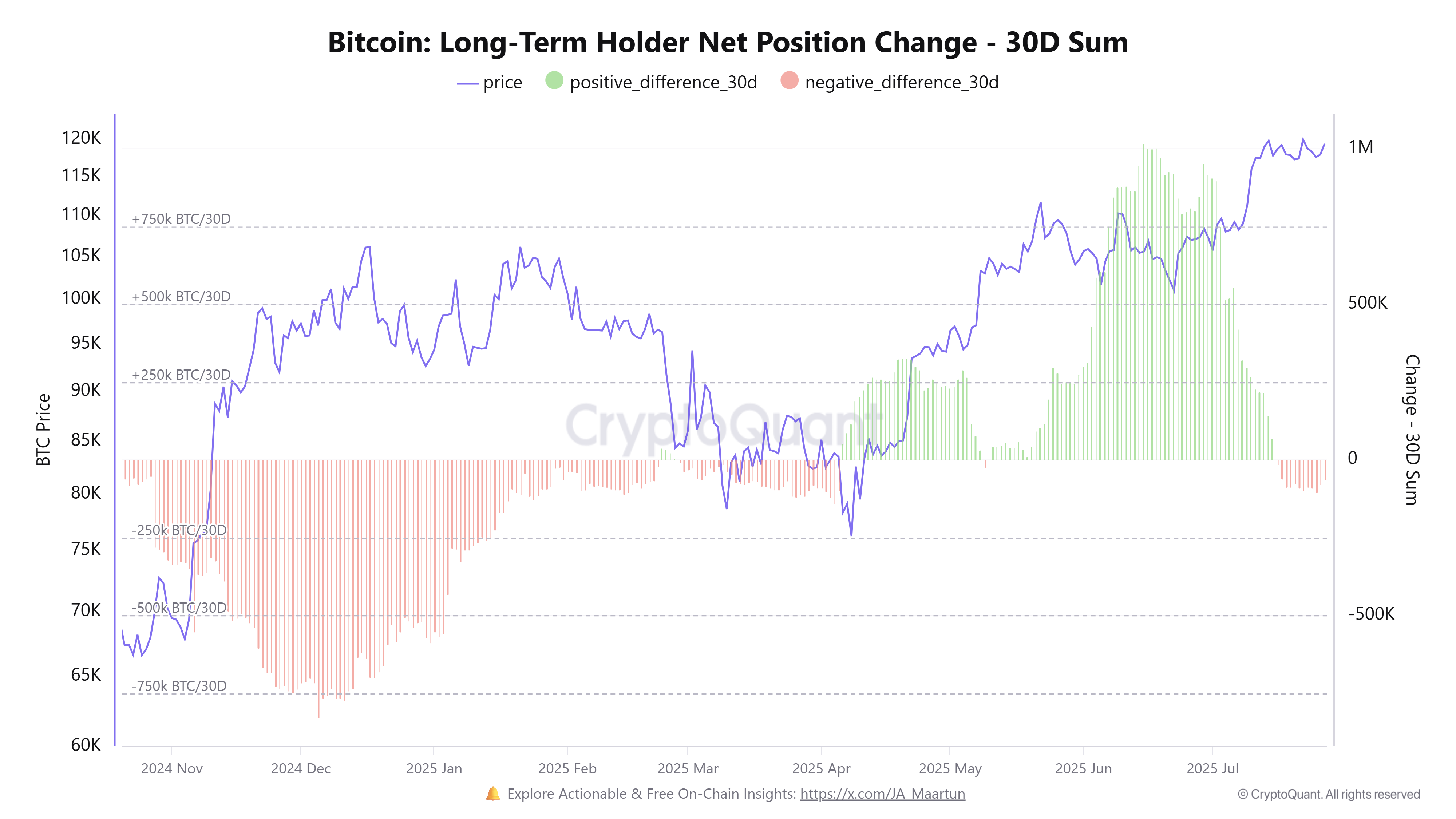

The second source of selling pressure is long-term holders (LTH), considered the backbone of the Bitcoin market.

According to a CryptoQuant report, LTHs began withdrawing funds when BTC remained at $120,000 in late July. This may reflect a cautious attitude of many investors seeking to avoid potential volatility and realize profits.

"Long-Term Holders (LTH) have started turning net negative at the $120,000 resistance. This is a historically significant psychological level. This change suggests that some investors who have weathered previous cycles are beginning to take profits." Analyst Burakkesmeci mentioned.

In Q1 2025, the long-term holders' net negative position pulled BTC below $75,000. If this group continues to sell, it could create substantial selling pressure that could increase the risk of a strong correction in August.

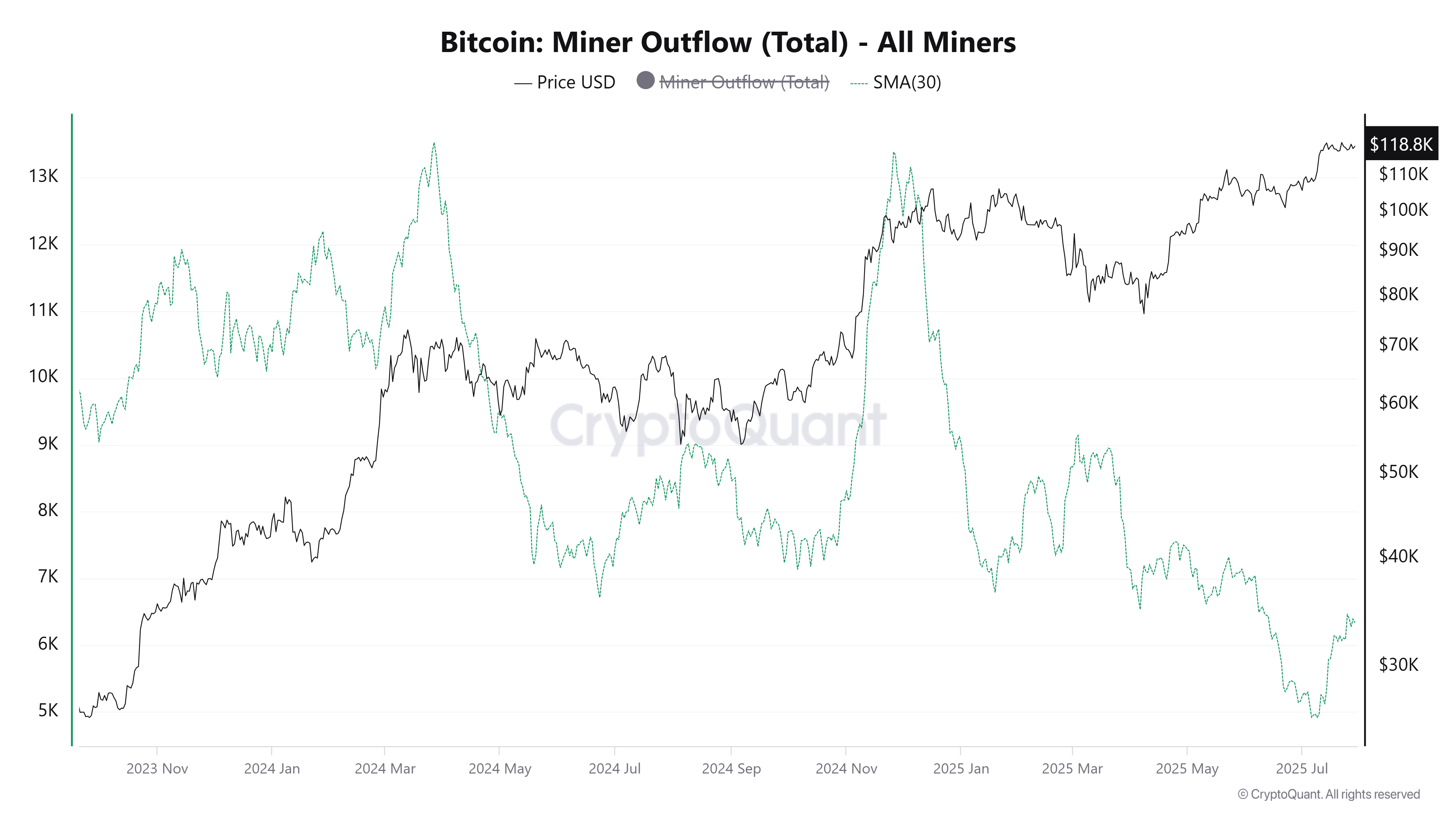

3. Increased Miner Outflows

The third factor is the increase in miner outflows, indicating selling pressure from Bitcoin miners.

According to CryptoQuant data, BTC outflows from miner wallets decreased throughout July and began to increase again. This change could indicate a trend reversal.

Miners sell when they need liquidity to cover operating costs or want to realize profits after a price increase. If this trend continues, it could amplify selling pressure when combined with whale and long-term holder activities.

"Average coin received per transaction sent from miners' wallets. If miners simultaneously transfer part of their holdings, it can trigger price declines." – Cryptocurrency on-chain platform CryptoQuant explained.

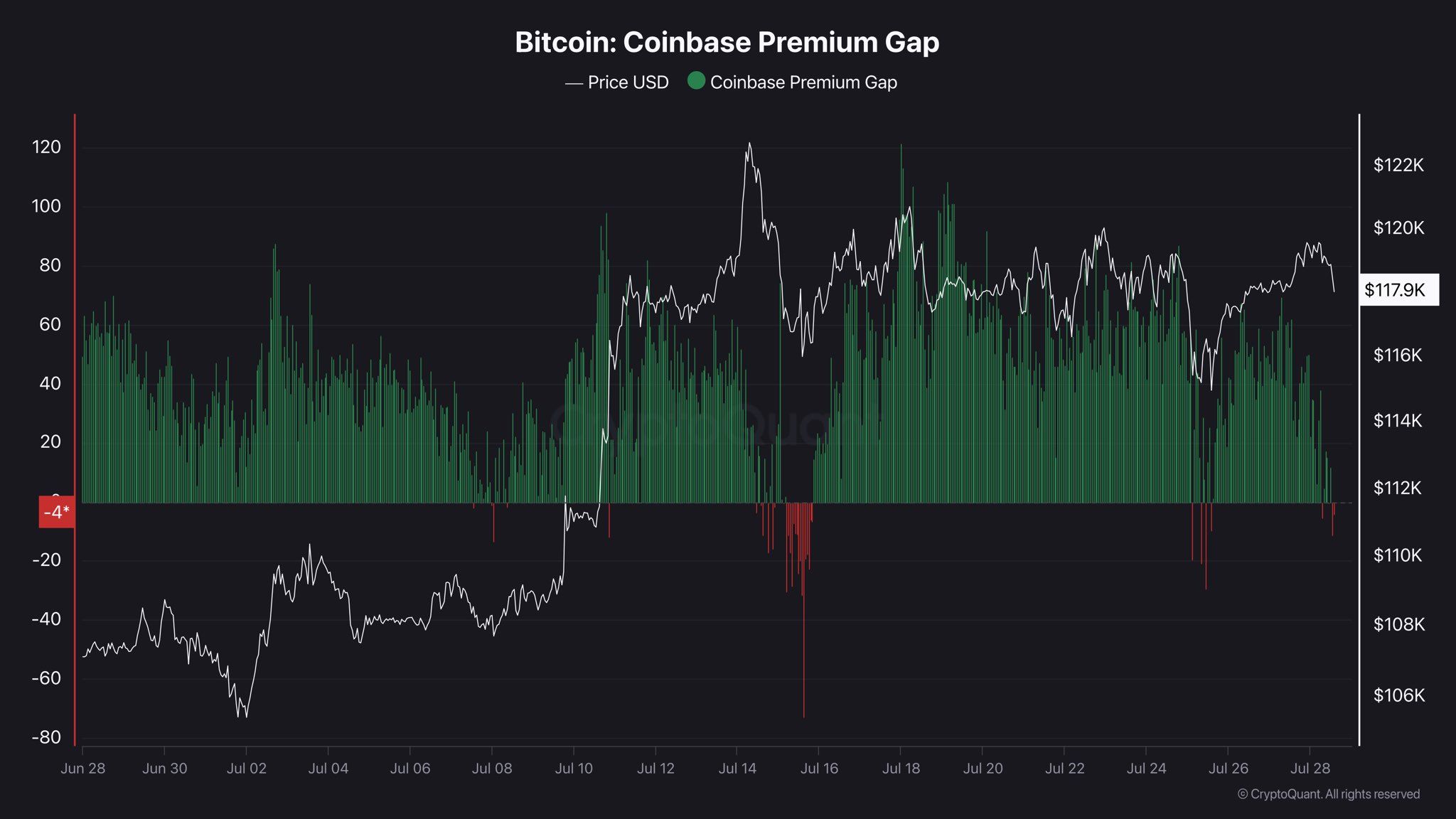

4. US Investor Selling Pressure

The Coinbase Premium indicator reflects the price difference between Coinbase and Binance. A negative premium means Bitcoin is trading at a lower price on Coinbase, indicating weakening demand or increased selling pressure in the US market.

This indicator essentially represents US investors' behavior. It was mostly positive but turned negative at the end of July.

"The Bitcoin Coinbase Premium gap has turned negative again. What does this mean? Demand in the US market is weakening. Caution is advised." – Analyst IT Tech mentioned.

Historically, a negative premium does not always cause a trend reversal. However, it often signals a slowdown in upward momentum. If selling pressure continues to accumulate, negative consequences may occur.

August MVRV Ratio Reversal Signal

Some analysts are taking a more cautious stance in August, especially after Bitcoin has recorded four consecutive months of gains.

According to statistics from the cryptocurrency derivatives data platform Coinglass, the third quarter is historically the period when Bitcoin prices show the weakest performance. Particularly, August is the month with the poorest performance within the third quarter.

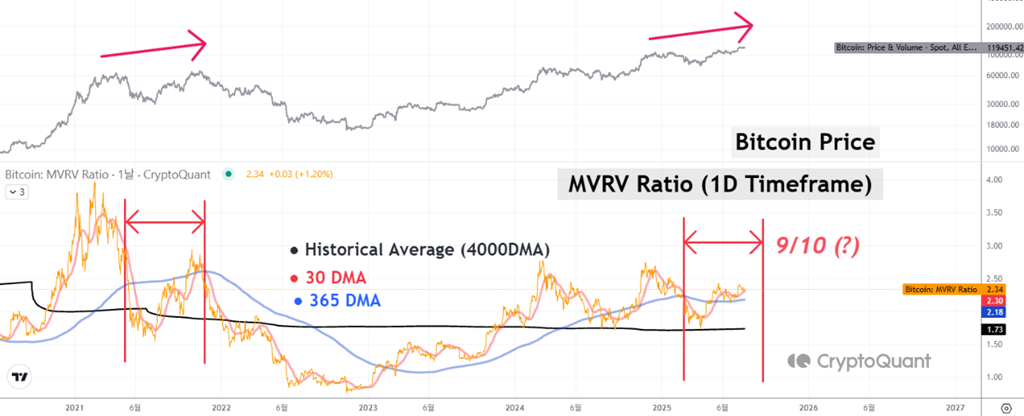

Yonsei, an analyst from the on-chain cryptocurrency platform CryptoQuant, pointed out that the MVRV (Market Value to Realized Value) ratio is approaching the cycle peak threshold. This signal may appear by the end of August.

During the 2021 cycle, the MVRV ratio formed a double peak that precisely predicted the market peak. If history repeats itself, August could indicate a local peak for Bitcoin, followed by a correction or consolidation phase.

"Simply put, we are entering a zone where optimism and caution must coexist. Let on-chain timing guide your strategy. Now is the time to enhance risk management and be agile." – Yonsei concluded.

Despite these concerns, Kaiko's latest report expressed confidence in Bitcoin's market depth. They believe the current selling pressure can be absorbed by the market.

"However, the strong liquidity profile, the market's ability to handle large orders, and the increasing demand from financial companies indicate the presence of sophisticated traders. These traders are less sensitive to price, which will have a positive impact on Bitcoin's price movements as we enter a volatile month." – Kaiko stated.

While whales, long-term holders, and miners can cause volatility, the current market structure can prevent a severe collapse.