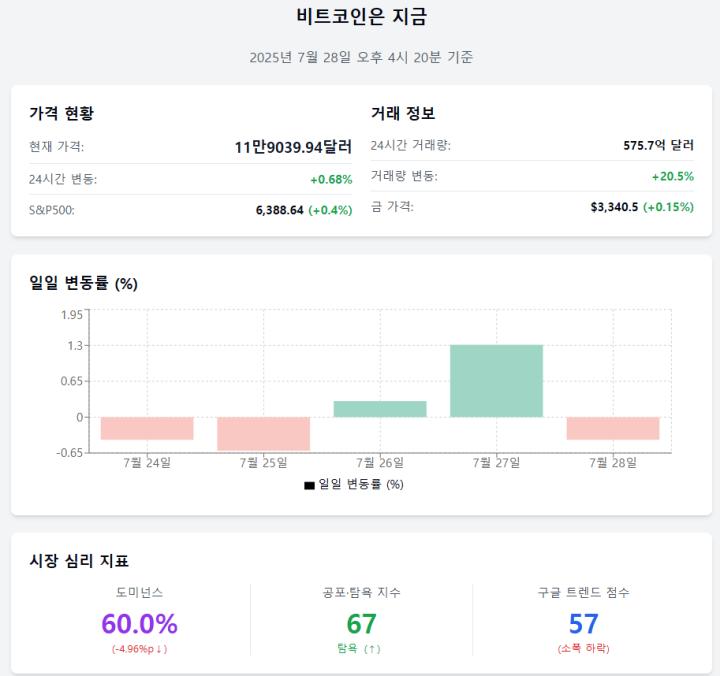

Bitcoin has recently entered a correction phase, maintaining stability between $117,261 and $120,000 over the past two weeks. These stagnant price movements are preventing Bitcoin from reaching a new all-time high (ATH).

However, investor behavior signals suggest there could be significant changes that might rewrite Bitcoin's historical price pattern in August.

Bitcoin Investors Send Positive Signals

The current Bitcoin sell-side risk ratio is 0.24, reaching a six-month high. However, this is far lower than the neutral threshold of 0.4 and closer to the low realization threshold of 0.1. This indicates that the market is consolidating, and investor behavior is stopping large-scale selling.

Historically, periods of low sell-side risk are signals of market bottom or accumulation stages, showing that investors are waiting for a favorable moment to push prices higher. This accumulation is important as it suggests Bitcoin is preparing for price volatility.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

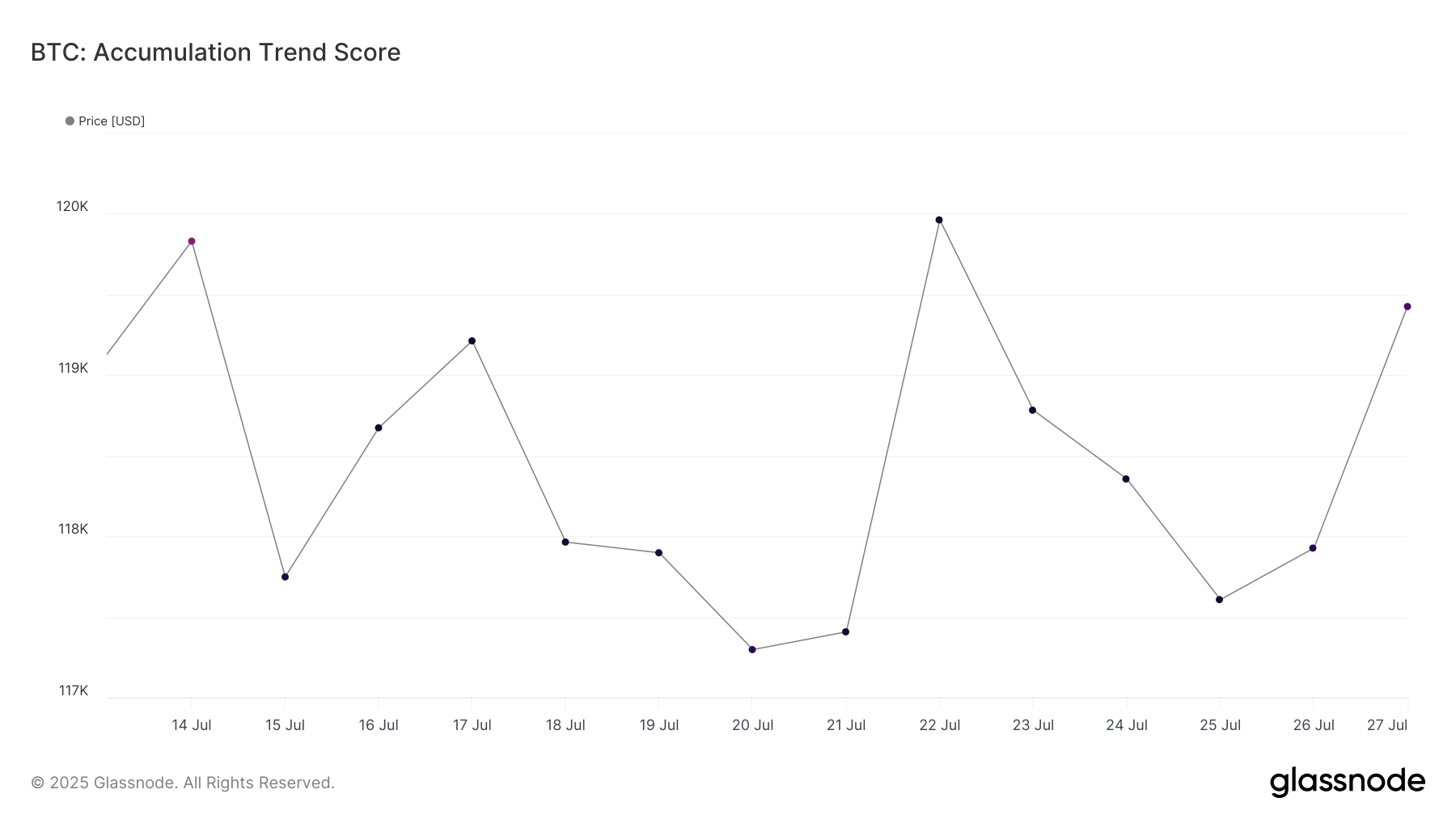

Bitcoin's accumulation trend score has been close to 1.0 over the past two weeks, indicating that large holders, including whales, are actively accumulating Bitcoin. This trend is crucial as these whales significantly impact cryptocurrency prices.

The closer the accumulation score is to 1, the stronger the upward momentum among institutional and high-net-worth investors. This can provide a solid foundation for Bitcoin to break through recent resistance levels.

Consistent accumulation by large institutions suggests growing confidence in Bitcoin's long-term value. This could lead to price increases as investors inject more capital into the market.

BTC Price Could Reach All-Time High Again

Bitcoin's price currently remains at $118,938, within the correction range between $117,261 and $120,000. While this range is stable, it has a high likelihood of breaking through $120,000 if investor sentiment remains strong.

Historically, August has been a weak month for Bitcoin, with a monthly mid-range return of -8.3%. However, considering the current accumulation trend and low sell-side risk, Bitcoin might deviate from its historical trend this year. If Bitcoin can secure $120,000 as a support level, it has a high probability of moving towards its ATH beyond $122,000.

However, the risk remains that unexpected market factors could cause investors to change their stance, potentially turning the market bearish. In such a case, Bitcoin could lose support at $117,261 and drop to $115,000, reversing the bullish narrative.