The Coinbase Premium Index in the Bitcoin (BTC) market, which shows the buying dominance of US investors, has turned negative for the first time in about two months. This index, which maintained a positive state for 62 days since May 29, is used as an important indicator of US spot demand. The conversion of this index, which reflects the price difference between Coinbase's Bitcoin/Dollar (BTC/USD) and Binance's Bitcoin/Tether (BTC/USDT), is being interpreted as a slight weakening of buying sentiment in the US market.

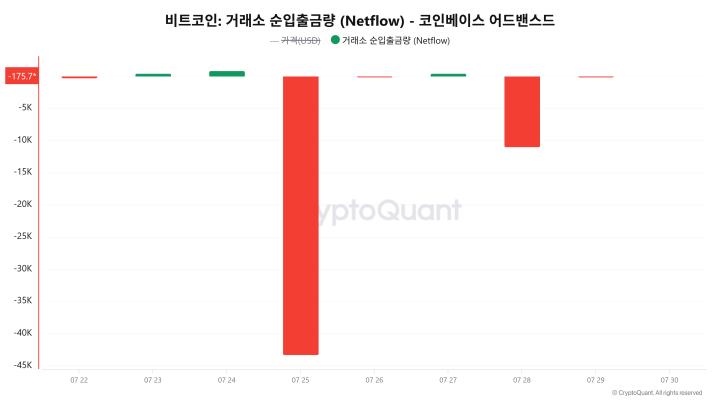

This change occurred immediately after the end of the longest record of 94 consecutive days of positive premium, implying that institutional buying of Bitcoin may have peaked. However, it is too early to view this as a simple investment contraction. On-chain analyst Boris Vest recently analyzed that the Bitcoin taker buy/sell ratio has dropped to 0.9. This figure reflects the prominent selling pressure from market makers.

Nevertheless, Bitcoin continues to maintain a solid price level above $115,000 (approximately 160.35 million won). This suggests that large passive buyers are entering the market, which can offset selling pressure. This movement is analyzed as more than a temporary price pullback, lending credibility to the view that the medium to long-term bullish trend remains valid.

The futures market is also showing a neutral stance. The funding rate for Bitcoin futures is currently 0.01, with no clear advantage on either the buy or sell side. This suggests that leverage is balanced, and the market may soon determine its direction.

While some are concerned about the wait-and-see attitude of US investors, the prevailing view is that the decline will be limited when considering the overall market liquidity and structural buying pressure. Attention is focused on whether Bitcoin's future momentum will be influenced by US spot market or global volatility, marking a potential turning point in its direction.

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>