BTC, Hovering Around $118,000 Ahead of 30-Day Interest Rate Announcement

Altcoins Maintain Subdued Trend Amid BTC's Stagnation

Cointelegraph: "BTC Has Potential for Further Increase"

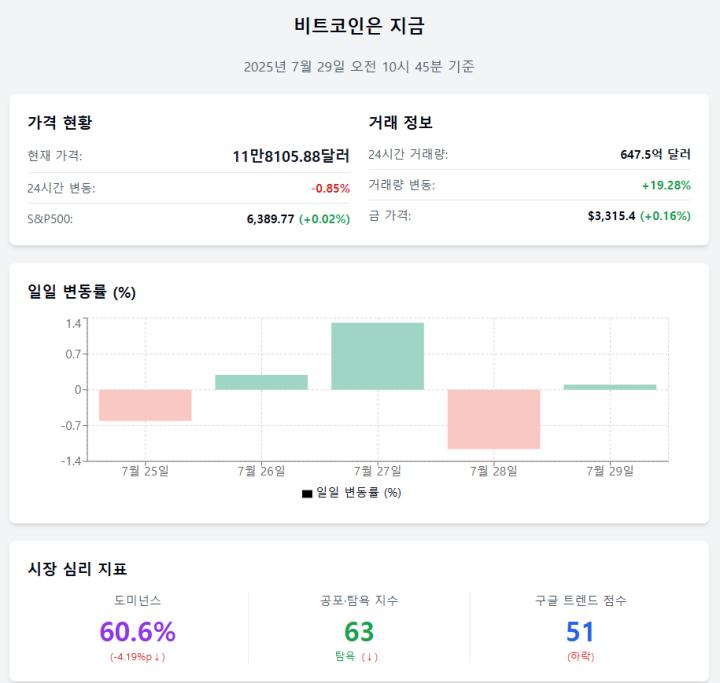

The U.S. Federal Reserve will hold the FOMC meeting from the 29th to 30th and determine the benchmark interest rate. Notably, Fed Chair Jerome Powell will hold a press conference on the 30th.

With expectations that the Fed will maintain the current interest rate, market vigilance is heightened, limiting the rise of the cryptocurrency market, including Bitcoin.

Even with the news that physical Bitcoin Exchange Traded Products (ETPs) have been approved in the United States, the market did not show significant fluctuations. Bitcoin maintained the $118,000 level, and most altcoins saw a slight decline.

◇Bitcoin = As of 4 PM on the 30th on Upbit, Bitcoin's price is 162.85 million won. Bitcoin's dominance is 61.51%.

According to on-chain analysis platform Sigbit, the long and short betting ratio in the Bitcoin futures market was 48.90% and 51.10%, respectively.

Cryptocurrency media Cointelegraph analyzed that selling pressure and a wait-and-see attitude among investors continue. However, they positively assessed that Bitcoin is maintaining the $110,000-$115,000 range.

The media stated, "If this price range is maintained, an upward breakthrough can be expected," and "Especially if sufficient liquidity is injected in the $112,000-$115,200 range, it could become a catalyst for the next upward trend."

◇Rising Coins = As of 4 PM on the 30th on Upbit, Quark Chain (QKC) recorded the largest increase, rising by about 13%.

Quark Chain is a project promoting a P2P trading system. Launched with a focus on blockchain's scalability, it introduced 'sharding' technology for fast data processing. It uses a Proof of Staked Work (PoSW) consensus algorithm, combining Proof of Work (PoW) and Proof of Stake (PoS).

◇Fear and Greed Index = The digital asset Fear-Greed index provided by Alternative is at 74 points, entering the 'Greed' stage. The greed stage is characterized by high price volatility and trading volume, indicating a potential price increase. Caution is advised for selling due to the high possibility of short-term peak formation.

The Relative Strength Index (RSI) for cryptocurrencies provided by Sigbit is 50.3, recording a 'neutral' state. RSI measures the relative strength between upward and downward price pressures and indicates the overbought and oversold levels of a specific asset.

Reporter Seung-won Kwon ksw@blockstreet.co.kr

![[Coin Market] Bitcoin Maintains Tension Ahead of FOMC Regular Meeting](https://img.blockstreet.co.kr/photo/2025/07/30/20250730000016_0800.png)