As July comes to an end, traders and investors will focus on August. They will pay attention to various US economic signals that could impact their portfolios.

The US economic signals this week are particularly important because Bitcoin (BTC) is watching the $120,000 mark.

US Economic Indicators Affecting Bitcoin This Week

The cryptocurrency market is rising today. Bitcoin is leading the surge as it approaches $120,000. However, whether this optimism is sustainable depends on how the US economic signals unfold this week.

Consumer Confidence

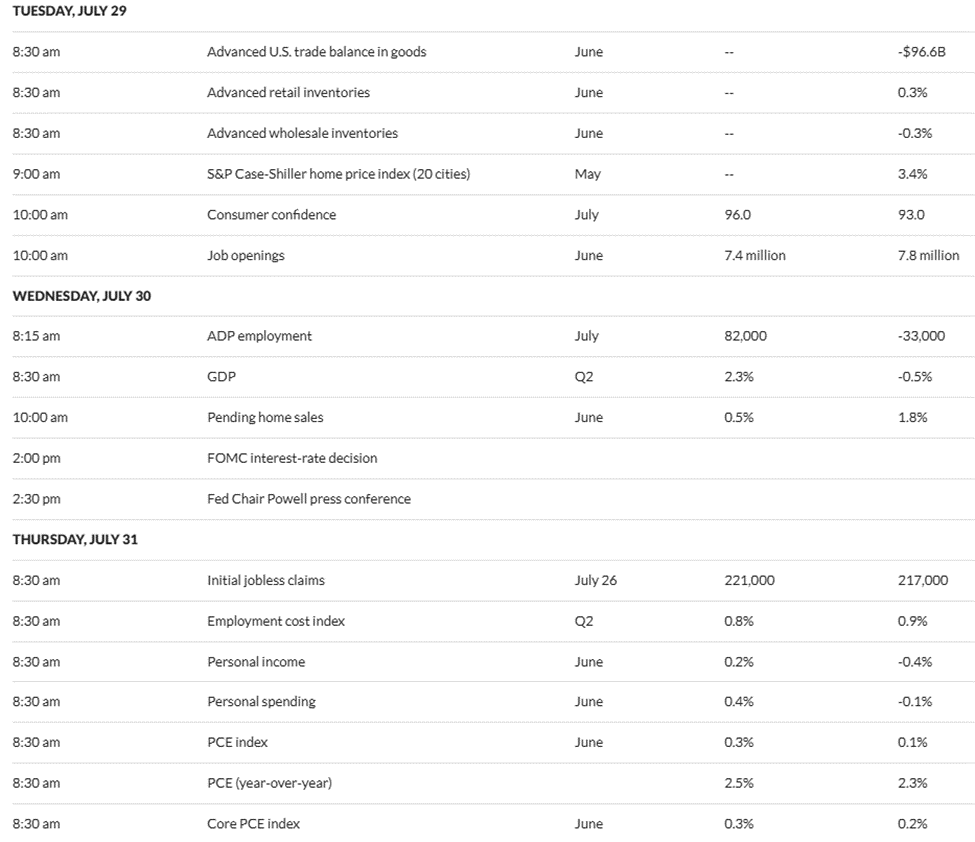

The consumer confidence report marks the beginning of the US economic signals this week. It is scheduled to be released on Tuesday. The Conference Board's consumer confidence index dropped to 93.0 in June 2025, a decline of 5.0 points from May's 98.0.

According to MarketWatch data, the median forecast is 96.0, suggesting economists are more optimistic about July. However, consumers are growing concerned due to Trump's tariffs.

"Consumers will find it difficult to regain confidence in the economy unless they are assured that trade policies will stabilize, for example, that inflation will not worsen." – Joanne Hsu, Director of Consumer Research, reported by Reuters.

This erosion of confidence reduces risk appetite. Pessimistic consumers prefer safe options like bonds or cash rather than investing in speculative assets like Bitcoin.

If July's consumer confidence exceeds expectations, it could boost risk appetite and support cryptocurrencies.

Employment Report

US labor data is one of the most critical macro factors for Bitcoin in 2025. This week's US economic signals, including several employment reports, will expose Bitcoin to volatility.

The Job Openings and Labor Turnover Survey (JOLTS) report and job openings will be released on Tuesday by the Bureau of Labor Statistics (BLS).

JOLTS

The June JOLTS report is scheduled for Tuesday and is expected to be lower than the 7.8 million recorded in May. According to economists surveyed by MarketWatch, US job openings, hiring, and turnover data could reach 7.4 million.

Despite the expected decline, the 7.4 million figure still exceeds the multi-month low of 7.192 million recorded in March. Nevertheless, it remains a key highlight of this week's US economic indicators.

ADP Employment

Another labor market data to watch this week is the July ADP Employment Report. While the BLS report is more comprehensive and widely recognized as the official measure, the June 2025 private sector employment showed a decrease of 33,000.

This figure was far below economists' expectations of a 95,000 increase, suggesting a slowdown in employment. According to MarketWatch data, economists expect an increase of 82,000 in July, which is still lower than the previous figure.

Initial Jobless Claims

Another labor market data among this week's US economic signals is the initial jobless claims to be released on Thursday. This weekly employment data highlights the number of US citizens who applied for unemployment insurance last week.

Initial jobless claims were 217,000 for the week ending July 19. However, economists expect up to 221,000 claims for the week ending July 26, anticipating a better outlook.

An increase in jobless claims could indicate economic weakness, increasing the likelihood of the Fed adopting a more accommodative monetary policy.

These changes could weaken the dollar and enhance Bitcoin's appeal as an alternative asset. However, if the claims increase is considered a temporary fluctuation, the impact on Bitcoin may be limited.

Meanwhile, analysts note that a robust labor market combined with persistent inflation could keep interest rates high. However, signs of a cooling employment sector could moderate the Fed's path.

Non-Farm Payrolls

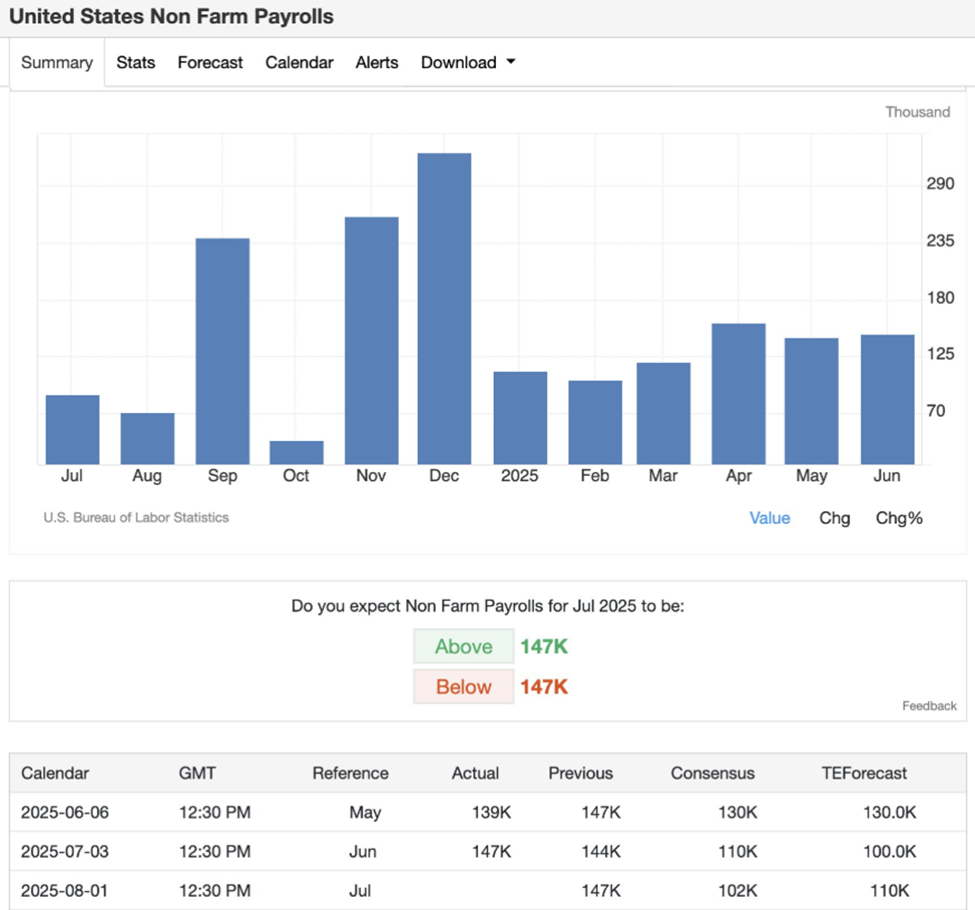

The US employment report, or July 2025 Non-Farm Payrolls (NFP), is scheduled for release on Friday. The economy added 147,000 jobs in June, following 139,000 in April. Meanwhile, the unemployment rate dropped from 4.2% in May to 4.1% in June.

According to MarketWatch data, economists expect the US unemployment rate to increase to 4.2% with job losses of 102,000, reflecting the potential economic impact of Trump's tariffs.

Strong job growth could prompt the Fed to maintain its current monetary policy or even consider tightening, which could strengthen the US dollar and suppress Bitcoin.

However, if economic concerns lead the Fed to adopt a more accommodative approach, Bitcoin could benefit as investors seek alternative stores of value.

Analysts suggest that the challenging US employment situation occurs as employers gradually adapt to frequent schedule adjustments while seeking clarity on White House trade policies.

FOMC Rate Decision

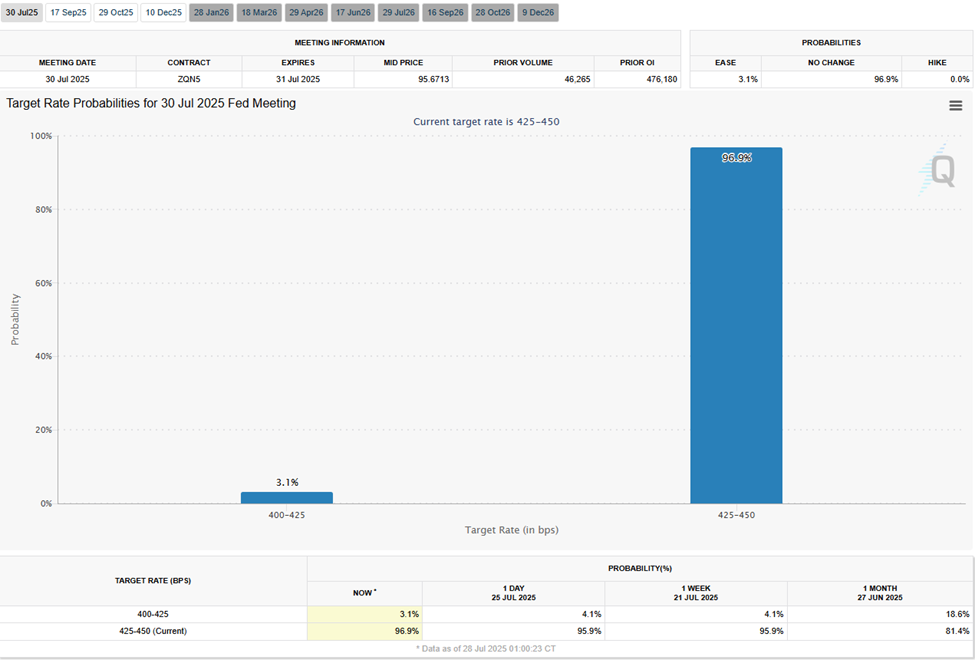

Meanwhile, this week's US economic signals focus on Wednesday's FOMC rate decision. This economic indicator comes after the US Consumer Price Index (CPI) rose to 2.7% in June.

The FOMC meeting minutes on July 9th suggested potential interest rate cuts this year, with policymakers agreeing that inflation has eased but remains "somewhat high". Additionally, uncertainty about the outlook has decreased but not disappeared.

However, it is still uncertain whether the Federal Reserve will cut rates on July 30th. According to data from the CME FedWatch tool, rate bettors believe there is a 96.9% probability that the Fed will maintain rates between 4.25% and 4.50%.

"More interesting is Powell's press conference. Trump met with Powell a few days ago, and he is expecting the Fed to be accommodative. Some other Fed board members are also calling for lower rates, so this press conference will be a critical turning point." A user observed.

In fact, in addition to the FOMC rate decision, traders and investors will carefully look for signals about the Fed's future outlook through Federal Reserve Chair Jerome Powell's speech.

If Powell hints at a September rate cut, it could spark market optimism. However, if he makes statements similar to the previous FOMC meeting, the cryptocurrency market could experience a sharp correction.