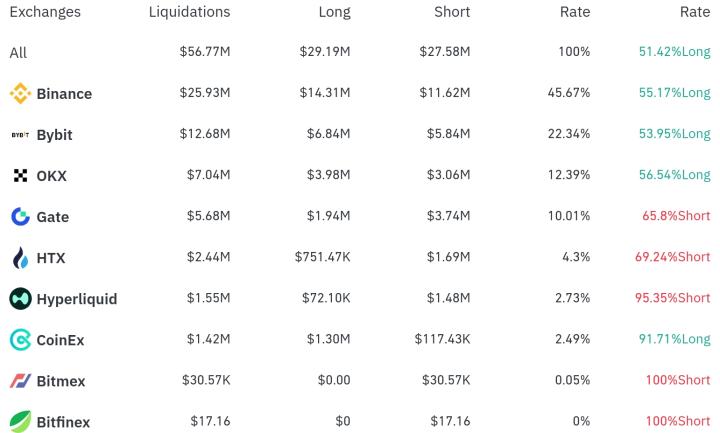

Bitcoin (BTC) briefly dropped below $117,000 (approximately 162.63 million won) at the beginning of this week, showing a short-term decline. During the weekend, as internal liquidity in the $117,000-$119,000 (approximately 162.63-165.41 million won) range was absorbed, long positions worth about $100 million (approximately 139 billion won) were forcibly liquidated. Such liquidity absorption is typically interpreted as a precursor to a directional change.

Nevertheless, the 100-day exponential moving average (EMA) on the 4-hour chart continues to serve as a short-term support line, partially limiting downward pressure. Accordingly, some traders are leaning towards the possibility of a resumption of the upward trend, but the overall market sentiment remains mixed.

Currently, Bitcoin is setting a short-term target around $122,000 (approximately 169.58 million won). According to the coin price data platform CoinGlass, there are approximately $2 billion (about 2.78 trillion won) worth of short position liquidation volumes accumulated near this price range. If this level is breached, a sharp increase due to liquidation shock cannot be ruled out.

However, the seasonal characteristics of the summer off-season and technical indicators suggest that it is difficult to be optimistic about the continuation of the upward trend. The decline in the Relative Strength Index (RSI), outflows from spot Bitcoin ETFs, and low trading volumes all indicate that buying momentum is weakening. These signals increase the possibility of a short-term correction at this mid-third quarter point.

The release of the Federal Open Market Committee (FOMC) minutes scheduled for this Wednesday and potential positive cryptocurrency-related statements from the White House could be crucial variables influencing future direction. The market currently has expectations for policy changes or a favorable stance due to these events. Particularly, as former President Trump continues to maintain a cryptocurrency-friendly attitude, he is being viewed more as a potential additional upward momentum provider rather than a political risk factor.

Experts continue to warn of high volatility and emphasize the need for careful observation of fund inflow and outflow trends and global macro indicators.

Get real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>