In the past 24 hours, approximately $56.77 million (about 8.29 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

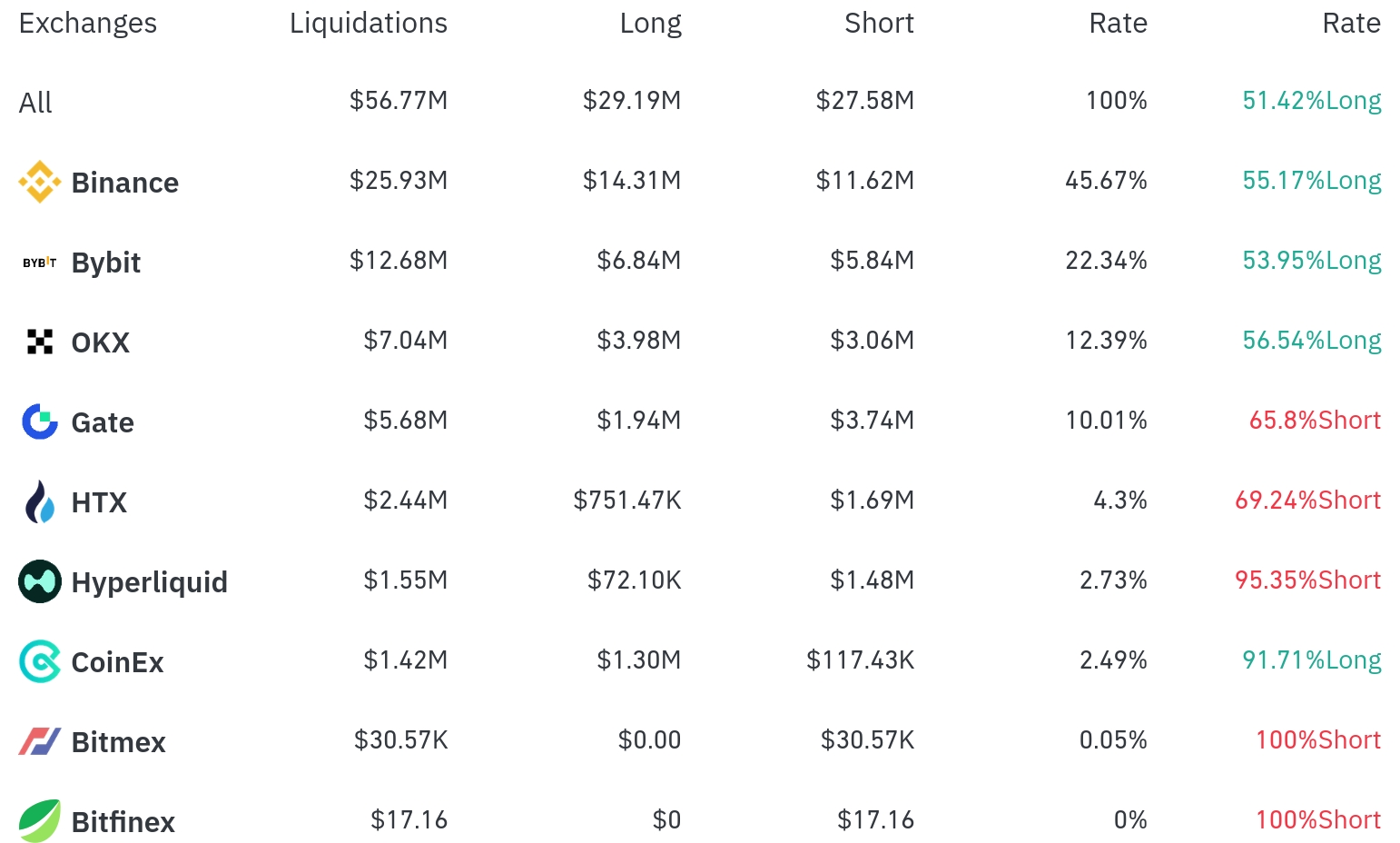

According to the currently compiled data, long positions accounted for $29.19 million, representing 51.42% of the total liquidations, while short positions were $27.58 million, accounting for 48.58%.

Binance experienced the most position liquidations in the past 4 hours, with a total of $25.93 million (45.67%) liquidated. Among this, long positions accounted for $14.31 million, or 55.17%.

Bybit was the second-highest exchange with liquidations, with $12.68 million (22.34%) of positions liquidated, of which long positions were $6.84 million (53.95%).

OKX saw approximately $7.04 million (12.39%) in liquidations, with long positions at 56.54%.

Notably, Gate, HTX, and Hyperliquid exchanges showed significantly higher short position liquidation rates at 65.8%, 69.24%, and 95.35% respectively. Particularly, BitMEX recorded 100% short position liquidations.

By coin, Ethereum (ETH) had the most liquidated positions. In 24 hours, approximately $131.91 million in Ethereum positions were liquidated, with 4-hour data showing $3.87 million in long position and $10.66 million in short position liquidations.

Bitcoin (BTC) had about $43.88 million in positions liquidated over 24 hours, with 4-hour data showing $1.56 million in long position and $2.77 million in short position liquidations.

Solana (SOL) saw approximately $27.08 million liquidated in 24 hours, with liquidations primarily in long positions ($2.42 million) alongside a 5.11% price drop.

Dogecoin (DOGE) experienced $17.18 million in liquidations over 24 hours with a significant 6.47% price drop, with 4-hour data showing $1.53 million in long position and $0.86 million in short position liquidations.

Notably, FARTCOIN Token showed high volatility with a sharp 16.82% price drop and approximately $12.20 million in liquidations over 24 hours. Additionally, many altcoins like ENA (-9.58%), AVAX (-9.24%), PEPE (-8.97%), SUI (-8.37%) experienced massive liquidations with significant price declines.

In contrast, TRON was the only coin recording a 7.26% price increase, with much more liquidations in short positions ($1.37 million) over 4 hours.

This liquidation data demonstrates a significant increase in bidirectional volatility in the recent cryptocurrency market, with long and short position liquidation ratios showing more balance than before. Particularly, the pronounced downtrend in the altcoin market has resulted in numerous long position liquidations.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>