In the cryptocurrency market over the past 24 hours, approximately $223.9 million (about 326.1 billion won) worth of leveraged positions were liquidated.

According to the currently compiled data, long positions accounted for 69.35% of the liquidated positions, while short positions recorded 30.65%.

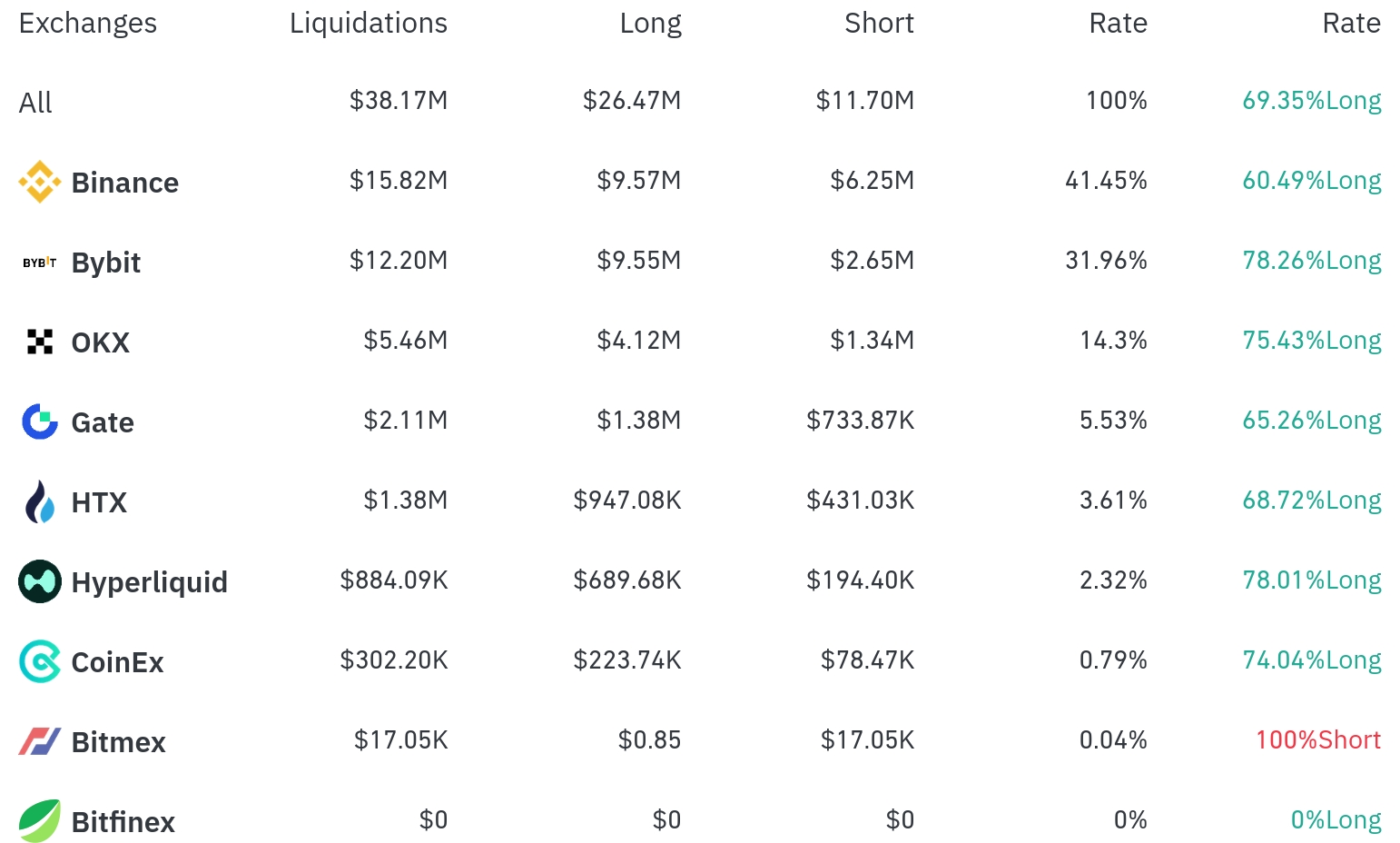

Binance experienced the most position liquidations over the past 4 hours, with a total of $15.82 million (41.45%) liquidated. Among these, long positions accounted for $9.57 million, or 60.49%.

Bybit was the second-highest exchange for liquidations, with $12.20 million (31.96%) of positions liquidated, of which long positions comprised $9.55 million (78.26%).

OKX saw approximately $5.46 million (14.3%) in liquidations, with long positions at 75.43%.

Notably, BitMEX saw almost all liquidations occur in short positions, with a relatively small total liquidation amount of around $17,000.

By coin, Ethereum (ETH) had the most liquidated positions. Approximately $94.32 million in ETH positions were liquidated over 24 hours, with $64.91 million in long positions and $29.41 million in short positions. Over 4 hours, $5.04 million in long positions and $4.11 million in short positions were liquidated.

Bitcoin (BTC) saw about $39.26 million in positions liquidated over 24 hours, with long positions at $26.25 million and short positions at $13.01 million. Over 4 hours, $1.96 million in long positions and $0.91 million in short positions were recorded.

Solana (SOL) had approximately $17.95 million liquidated over 24 hours, followed by XRP ($16.58 million) and Doge ($15.84 million) among other major altcoins.

A notable coin was ENA, which experienced a significant liquidation of $8.40 million along with a 11.39% price drop over 24 hours. Meme coins like FARTCO (-6.61%), PEPE (-5.43%), and 1000PEI (-5.44%) also saw substantial liquidations with significant price declines.

TRON (TRX) was the only coin that rose 4.18% over 24 hours, with short position liquidations more than three times higher than long positions (short $2.55 million vs long $0.79 million). This suggests that investors holding short positions incurred losses as the price unexpectedly increased.

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leveraged position when a trader fails to meet margin requirements. This large-scale liquidation can be seen as an indicator of increased volatility in the recent cryptocurrency market.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>