Bitcoin ($BTC) hits $120,000, signaling massive selloffs from institutional investors.

This article is machine translated

Show original

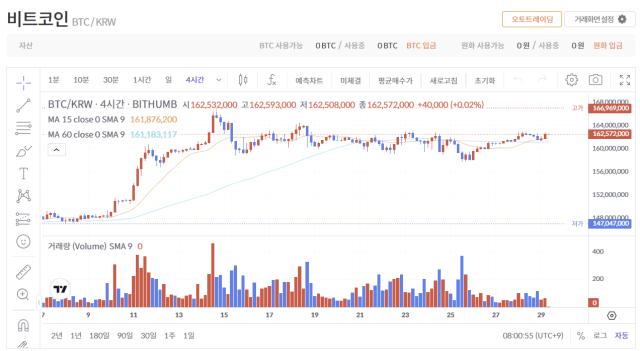

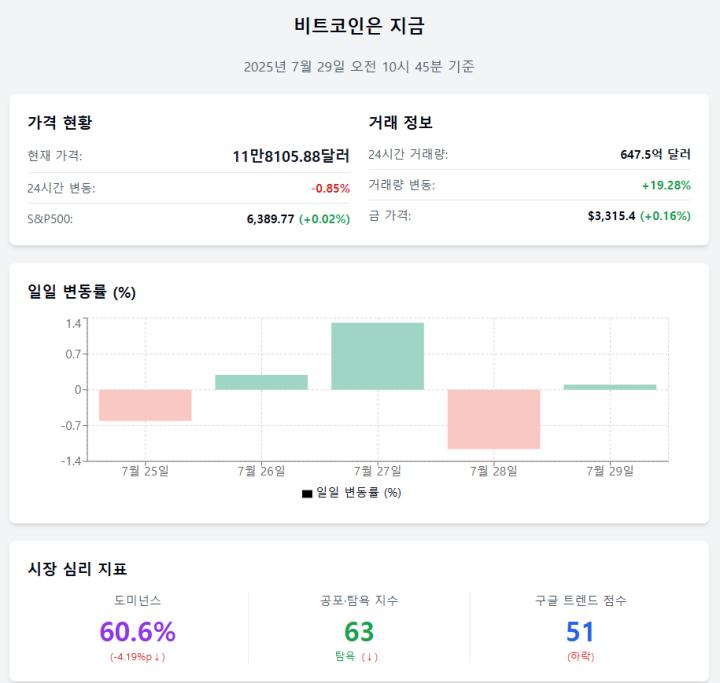

As Bitcoin (BTC) is on the verge of breaking through $120,000 (approximately 166.8 million won), some long-term holders' profit-taking movements are sending complex signals to the market. This selling that emerged during the sharp rise is drawing industry attention on whether it is a natural phenomenon due to simple profit recovery or a harbinger of a larger adjustment.

On-chain analysis firm CryptoQuant analyzed that long-term holders are reducing their net holdings at Bitcoin's key resistance level, effectively "switching to net selling". Particularly, it was revealed that Galaxy Digital, a major US cryptocurrency financial firm, disposed of approximately 80,000 BTC, raising concerns about institutional investor exodus. The psychological market impact is not insignificant, especially considering this appears to be a movement of structured funds rather than general investor profit-taking.

CryptoQuant diagnosed that Galaxy Digital's selling approach could potentially trigger additional selling by other large wallets. There is a precedent where simultaneous selling by major holders at market peaks has previously led to subsequent price crashes, which explains the sensitive reactions to this movement.

Declining demand from US investors has also emerged as a cautionary factor. CryptoQuant pointed out, based on the Coinbase Premium Index's downward trend, that US-based traders are not actively purchasing Bitcoin. While the premium (US exchange price - global price) remains in positive territory, it has contracted compared to periods when prices were below $105,000 (approximately 145.95 million won), suggesting US investors are adopting a passive strategy of waiting for adjustment periods rather than buying at peaks.

However, despite these cautionary signals, not all eyes are focused solely on decline. Steve Gregory, founder of cryptocurrency trading firm Vtrader, still analyzes Bitcoin's fundamentals as a bullish market structure. Based on recent global liquidity indicators and trade prospects, he claimed that "breaking through $139,000 (approximately 192.71 million won) is possible within this week", suggesting further potential for peak ascent.

Gregory particularly noted that the ratio of global M2 (broad money supply) to Bitcoin supply has set an all-time high. With global M2 reaching approximately $5.7 million (approximately 7.923 billion won) per Bitcoin, perceptions are spreading that Bitcoin can be viewed as an indicator of financial liquidity.

The market remains tense as Bitcoin's future price movement depends on the intensity of long-term holders' selling and the potential recovery of US demand. However, some analyses suggest strong upward momentum remains based on liquidity, with the balance between selling and buying emerging as a key variable determining future direction.

Sector:

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content