As the New York stock market showed mixed trends, the virtual asset market also entered a period of adjustment. With major virtual asset prices falling across the board, Bitcoin (BTC) retreated to the $117,000 range.

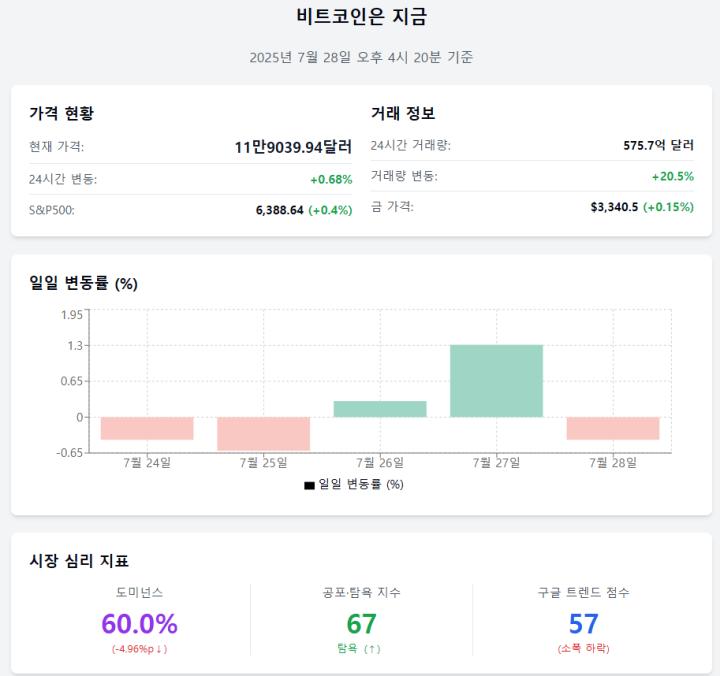

According to Coinmarketcap, a global virtual asset market information site, as of 8 am on the 29th, BTC was traded at $117,871.71, down 1.43% from 24 hours earlier. At the same time, the altcoin leader Ethereum (ETH) recorded $3,785.76, down 2.03%. XRP dropped 3.45% to $3.13, and SOL fell 2.96% to $183.46.

Related Articles

- Bitcoin Rises with US-EU Tariff Agreement, Altcoins Also Rebound [Decenter Market Conditions]

- Strategy Raises 2.7 Trillion to Purchase BTC Even in Downturn [Decenter Market Conditions]

- Altcoins Plummet, Warnings of "Bubble Concerns Across Market" [Decenter Market Conditions]

- Bitcoin Temporarily Recovers to $120,000 Range, Showing Upward Trend Again [Decenter Market Conditions]

The domestic market also showed weakness. At the domestic exchange Bithumb, BTC recorded 162,508,000 won, down 0.06% from the previous day. ETH was traded at 5,218,000 won, down 0.7%, and XRP was down 1.89% to 4,319 won.

On this day, the New York stock market showed mixed trends despite the news of a trade agreement between the United States and the European Union (EU), and the virtual asset market also showed signs of adjustment. This is interpreted as reflecting investors' cautious sentiment as the 'Big Week' approaches, with the most important events of the year concentrated. The 'Magnificent 7' major tech companies, including Meta, Microsoft, Amazon, and Apple, are scheduled to announce their earnings this week, and the Federal Reserve's July Federal Open Market Committee (FOMC) meeting is also planned.

The Fear and Greed Index from virtual asset data analysis company Alternative.me rose 2 points from the previous day to 75 points, indicating a state of 'greed'. This index means that the closer it is to 0, the more investment sentiment is suppressed, and the closer it is to 100, the more market overheating is indicated.

- Reporter Kim Jung-woo

< Copyright ⓒ Decenter, reproduction and redistribution prohibited >