In recent weeks, the Bitcoin Dominance Index (BTC.D), which measures Bitcoin's market share in the overall cryptocurrency market, has recorded a sharp decline of 6.30%.

According to technical analysts, this could be an early signal of an "Alt Season" expected to unfold within 3-6 months.

Bitcoin Dominance Decline... Alt Season Imminent?

Based on observations from several famous market analysts, BTC.D is experiencing significant structural changes.

In particular, Bitcoin dominance has formed a "bearish cross" on the 3-week timeframe. This is considered a key technical indicator suggesting a potential trend reversal.

Moreover, BTC.D has officially broken through the 3-year uptrend line. This is widely recognized as one of the strongest signals that Bitcoin's market strength is weakening.

"Bitcoin dominance has lost its 3-year uptrend. This is the biggest signal of an Alt Season and the upcoming parabolic pump," said Ash Crypto.

Veteran trader Merlijn pointed out that the current market setup is proceeding similarly to the 2021 "playbook", when a major altcoin season occurred. According to him, Bitcoin dominance has entered "stage 4", which is a clear breakdown stage that opens the way for capital rotation into altcoins.

Once this transition is fully realized, there is a high likelihood of a strong capital rotation cycle from Bitcoin to other altcoins.

Another key indicator emphasized is the ETH/BTC pair. In the context of BTC.D's decline, many experts believe Ethereum will lead the next altcoin market growth.

In recent weeks, ETH has shown strength compared to BTC. This suggests that capital is gradually moving away from Bitcoin. Investors appear to be seeking higher returns in lower market cap assets.

Furthermore, crypto investor Ted argued that Ethereum and many altcoins could experience significant growth in the next 3-6 months. Short-term corrections might be to "shake out" weak hands, but the structural trend suggests that the altcoin market is preparing for a cyclical rally.

Short-term Obstacles for Altcoin Season

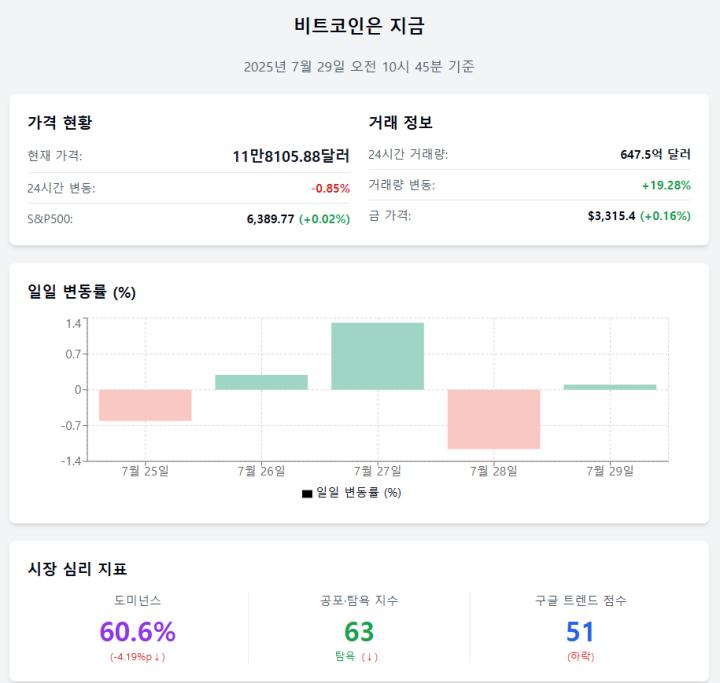

However, not everyone agrees that the Alt Season will start immediately. Some analysts argue that BTC.D is still within the 60-61% demand zone, which could serve as a strong support level for Bitcoin to maintain its market share in the short term.

Analyst Crypto Candy emphasized that unless BTC.D definitively falls below this zone, altcoins may continue to struggle and see their growth slow down.

"As long as the 60-61% zone is maintained, we might not see proper momentum in altcoins. Additionally, we could see slow movements and corrections in altcoins during this period," the analyst said.

Therefore, investors are advised to be patient and closely observe short-term price movements and capital flows. Altcoin growth may not happen overnight and could change gradually as the market slowly transitions from Bitcoin dominance to a more diverse asset rotation cycle.