Bitcoin (BTC) is reaching a new turning point. The convergence of technical breakthrough, a large-scale trade agreement between the United States and the European Union, and an increase in money supply (M2) is sending positive signals to both traditional finance and cryptocurrency markets. Market experts suggest that if this trend continues, Bitcoin could potentially rise to $130,000 (approximately 180.7 million won).

An anonymous analyst 'Doctor Profit' assessed that Bitcoin has broken through the long-term downward resistance line since its 2021 peak. This resistance line had been suppressing the upward trend for the past four months, and its clear breakthrough on the monthly chart is interpreted as a signal that a bullish market could fully emerge. While Doctor Profit considers this a sign of "entering the next phase", he also diagnoses that the market has not yet fully reflected this upward momentum.

This upward trend was also boosted by the massive trade agreement suddenly announced by President Trump and European Commission President Ursula von der Leyen. Signed on July 27, this agreement includes $750 billion worth of US energy exports and $600 billion worth of EU infrastructure investments, providing strong stimulation to the US stock market and cryptocurrencies like Bitcoin. Immediately after the announcement, Bitcoin surged from $114,500 (approximately 159.2 million won) to over $119,000 (approximately 165.41 million won), and Binance Coin (BNB) broke through its all-time high of $850 (approximately 1.181 million won).

Another hidden bullish factor is the increase in M2 money supply. Doctor Profit pointed out that despite the Federal Reserve's continued tightening policy, M2 has already increased by 2.3% compared to the beginning of the year in 2025. Particularly in May and June, it increased by 0.63% each month, supporting market liquidity. Referencing past data, he mentioned that BTC tends to rise 30-35% for every 1% increase in M2, analyzing that Bitcoin has room to rise an additional 15-17.5% from the current point. In this case, BTC's target price would be $130,000 (approximately 180.7 million won).

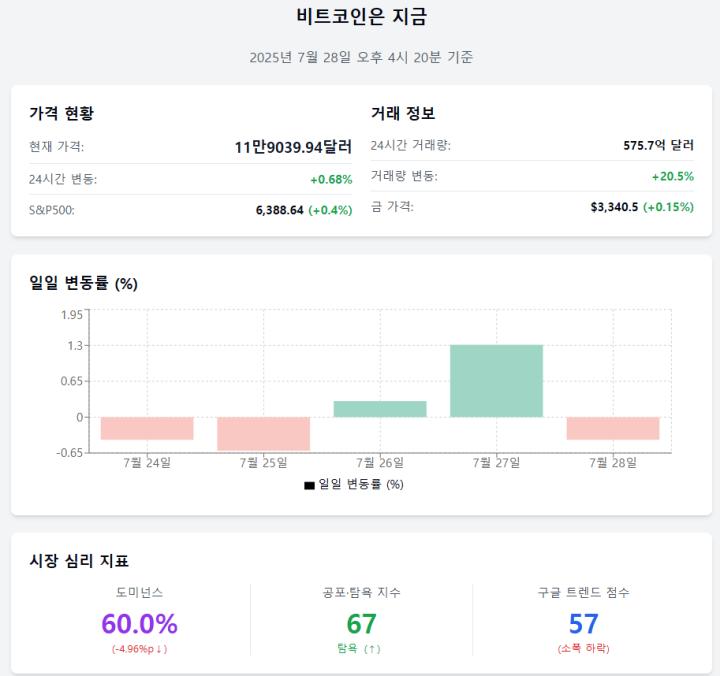

Currently, Bitcoin is trading at $119,389 (approximately 165.81 million won), up 0.9% from the previous day, and has risen 11.3% in the past month and 75.6% this year. While short-term performance might seem somewhat slow compared to some altcoins like Ethereum (ETH), the assessment is that Bitcoin's fundamental core remains solid.

Particularly, capital inflows into Bitcoin spot ETFs managed by major issuers including BlackRock are exceeding new mining volumes, playing a role in supporting BTC prices through supply shortage. Additionally, with a high possibility of further interest rate freezes at the upcoming Federal Reserve FOMC meeting in two days, liquidity conditions are expected to improve further.

As uncertainty across the market diminishes and Bitcoin's upward conditions align multi-layeredly from technical, policy, and liquidity perspectives, experts are already focusing on the $130,000 mark.

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>