SHIB once led the upward trend with a sharp rise, but it appears to have given back most of its gains by the end of July. It temporarily broke through the key resistance level of $0.000015, raising expectations, but the rebound did not last long, and the current price has retreated to around $0.0000135. This is interpreted as a signal that the overheated market expectations quickly turned into disappointing selling.

SHIB's recent decline shows a clear failed breakout pattern on the chart along with the collapse of multiple support levels in a short period. In particular, trading volume is increasing during the downtrend, while the RSI indicator has sharply dropped from an overbought state to a neutral level. This signals a technical bearish reversal, suggesting that more investors are urgently trying to sell, even at the cost of losses. Currently, the main support levels are at $0.0000125 and $0.0000113, and analysts suggest that if these levels are not maintained, there is a high possibility of entering a short-term sharp decline phase.

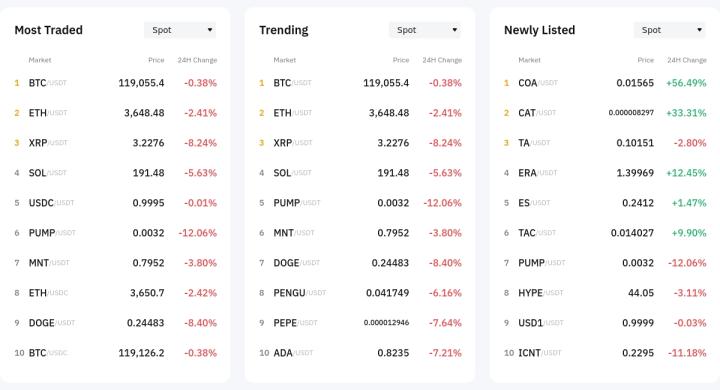

Doge's situation is not optimistic either. It recently plummeted by 22%, surprising investors. It formed a short-term peak above $0.28 but quickly retreated to $0.24. In this process, trading volume also rose in tandem, confirming the intensification of selling pressure. The sharp drop immediately after the RSI exceeded 70 shows that buying sentiment disappeared despite the overheating warning. Given that Doge has represented the flow of speculative assets, this sharp decline may lead to a market-wide psychological contraction beyond a short adjustment.

In contrast, ETH is showing a differentiated trend. After breaking through the $2,700 resistance line, it has been rising sharply and is approaching $3,900, leading the bullish market. Particularly, the continuous trading volume is supported by institutional and whale investors' long-term buying sentiment. Although the RSI has been slightly adjusted from the overbought zone, it is stably maintaining the upper support line between $3,200 and $3,600.

While other altcoins are experiencing a decline due to profit-taking, ETH continues its steady upward trend and is re-emerging as a relatively strong asset in the market. If it continues to defend its current position, breaking $4,000 is considered a realistic scenario. This proves that investors are focusing on larger, safer assets during uncertain phases. Analysts suggest that it is forming long-term upward expectations based on structural strengths different from volatile meme coins.

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>