Spot Market Trading Volume Analysis: Bitcoin and Ethereum Slightly Steady, DOGE and XRP Sharply Decline... COA and CAT New Listings Surge

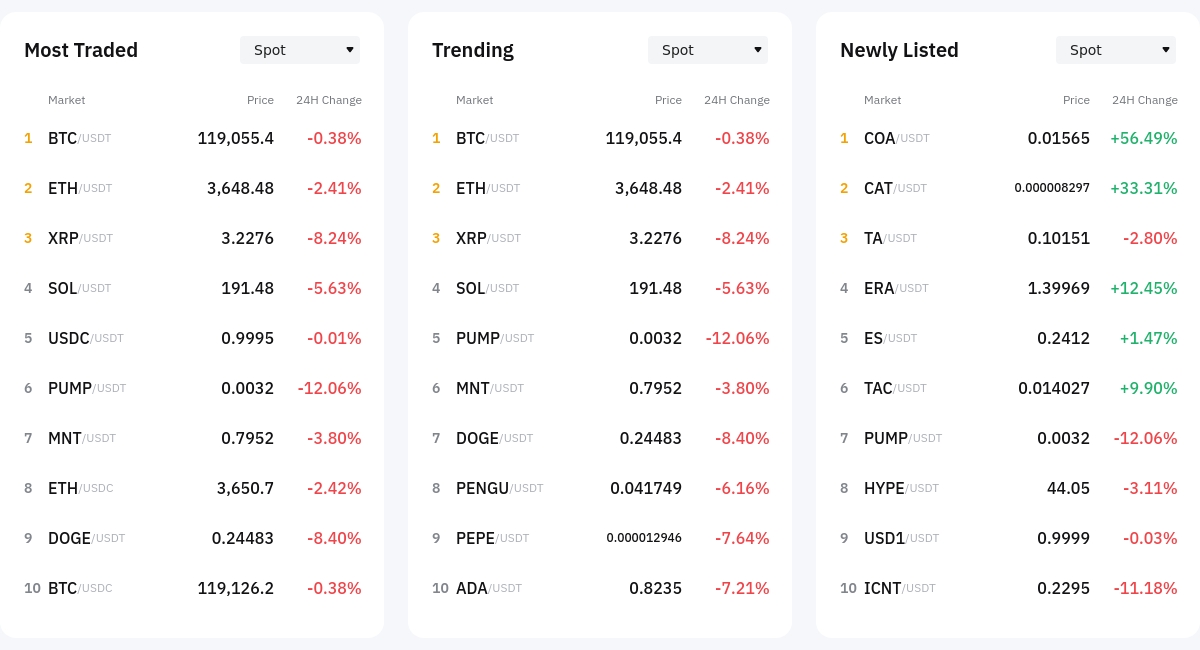

In the cryptocurrency spot market, while an overall weak trend continues, some altcoins and newly listed tokens showed strong volatility. In particular, Bitcoin (BTC/USDT) slightly declined to $119,000, down 0.38%, and Ethereum (ETH/USDT) also fell 2.41% to $3,648.48, experiencing downward pressure. According to Bybit, amid the decline of major assets, Ripple (XRP/USDT) dropped significantly by 8.24% to $3.2276, and Dogecoin (DOGE/USDT) also fell 8.40% to $0.24483, showing a contraction in investment sentiment.

Solana (SOL/USDT) recorded a 5.63% decline to $191.48, supporting the correction trend across major altcoins. Among mid-to-small cap coins, PUMP/USDT dropped 12.06% and was included in the trending list, while the representative meme coin PEPE/USDT fell 7.64%, and ADA/USDT dropped 7.21%, continuing the downward trend.

In contrast, exceptional rises were seen in newly listed tokens. COA/USDT surged 56.49% to $0.01565, and CAT/USDT also rose 33.31% to $0.000008297. Another new token, ERA/USDT, increased 12.45%, and TAC/USDT rose 9.90%. These tokens showed short-term surges due to liquidity inflow effects and are analyzed as investors exploring market directions amid overall market adjustments.

Price Trend Distribution Analysis: 281 Declining Assets... Market Maintains Weak Trend

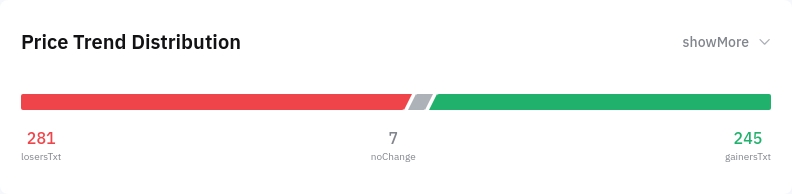

Among total trading assets, 281 assets recorded a decline, while 245 assets rose, showing a similar distribution. Only 7 assets showed no price movement, indicating that most assets demonstrated a clear direction. This distribution result shows that the market is leaning towards a weak trend, and the few rising assets are largely due to individual news or new listing effects.

With the declining range slightly dominant over the rising range, particularly concentrated in the -5% to -15% adjustment interval. This suggests that risk aversion is operating rather than a single sharp decline, implying a complex interplay of selling sentiment and liquidity contraction. From an investor perspective, a conservative approach is valid, and it is necessary to first confirm trend stability rather than expecting a short-term rebound.

Trending Sector Analysis: 'Play To Earn' and Non-Fungible Token Sectors Decline Over 5%... All Sectors Decline Simultaneously

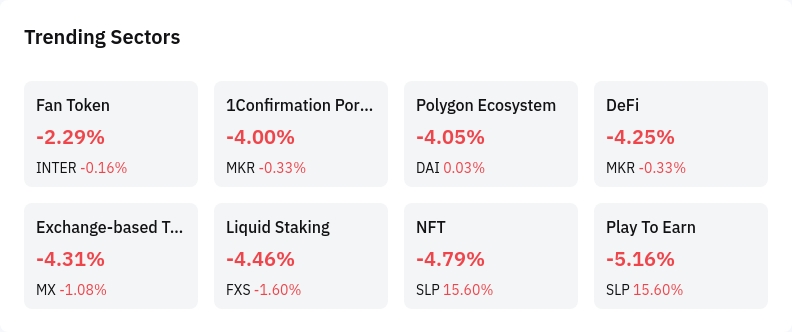

In this market, all major sectors simultaneously showed a decline, strongly indicating a risk asset avoidance trend. The sector with the largest average decline was 'Play To Earn', falling 4.16% from the previous day. However, SLP (Smooth Love Potion) within this sector recorded an exceptional rebound, rising 15.60%.

The Non-Fungible Token sector also showed a -4.79% decline, but was partially buffered by SLP's strength. The Liquid Staking sector declined 4.46%, with its representative token FXS (Frax Share) falling 1.60%. The Decentralized Finance sector and the 1Confirmation Portfolio sector, which overlap, declined 4.25% and 4.00% respectively, affected by the overall market weakness.

Additionally, Exchange-based Tokens sector declined 4.31%, and the Polygon Ecosystem fell 4.05%. Particularly, the fact that reliable assets in DeFi and infrastructure-centered sectors also underwent collective adjustments suggests that a structural upward trend may be delayed for the time being. Currently, amid industry-wide weakness, the market continues to depend on individual momentum, with limited signs of trend reversal.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>