Major cryptocurrencies are collectively declining. Market volatility is increasing as high-leverage positions continue to be liquidated.

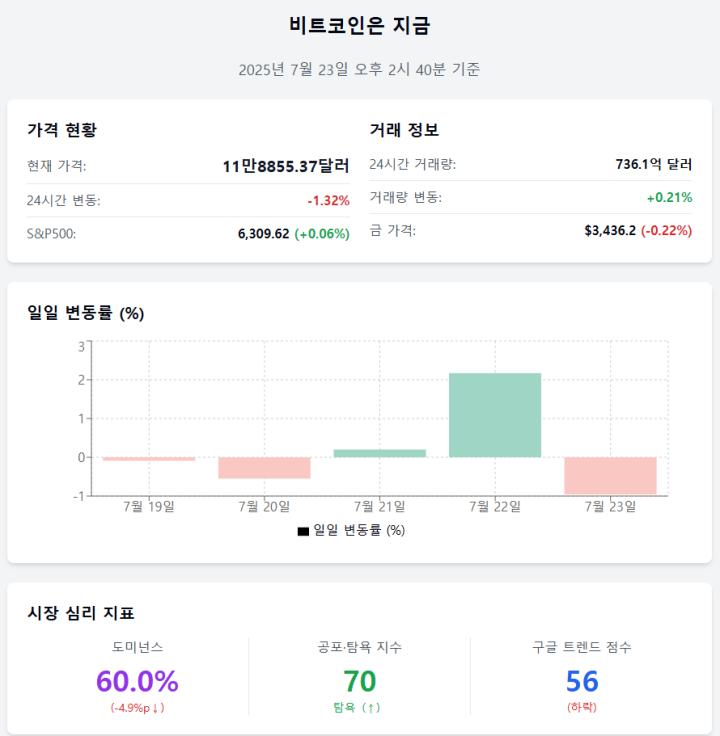

According to CoinMarketCap, a global cryptocurrency market tracking site, as of 8 AM on the 24th, Bitcoin (BTC) is trading at $118,570.84, down 1.07% from the previous day. Ethereum (ETH) recorded $3,608.35, a 2.99% drop. XRP, which had recently risen sharply, saw an even steeper decline. XRP is trading at $3.176, a steep 9.97% drop. Solana (SOL) recorded $189.35, down 6.43%.

Related Articles

- Bitcoin Temporarily Recovers to $120,000 Line... Rising Again [Decenter Market Conditions]

- Trump Media Bought $2 Billion Worth of Bitcoin [Decenter Market Conditions]

- Strategy Holding 60,000 Bitcoins Says "Will Buy Again" [Decenter Market Conditions]

- Genius Law Passes US House and Senate... XRP Approaching All-Time High [Decenter Market Conditions]

The domestic market is mixed. At the same time, BTC is up 0.64% at 161,917,000 won on Bithumb. ETH recorded 49,360,000 won, up 0.22%. XRP is down 3.58% at 4,342 won, and SOL has fallen 1.03% to 258,200 won.

Cointelegraph reported that approximately $500 million in liquidations occurred in the cryptocurrency market that day. Coinglass, a cryptocurrency data analysis firm, analyzed that "both long and short leverage positions are very high" and that "liquidity liquidation is likely".

Particularly in the altcoin market, excluding BTC, overheating signals were also detected. On-chain data analysis firm Glassnode warned in its newsletter on the 23rd (local time) that "signs of a bubble are appearing across the altcoin market" and that "the unprecedented open interest is likely to expand price volatility". According to Glassnode, the open interest in derivatives for the top 4 altcoins by market capitalization exceeded $40 billion as of the 22nd. Glassnode pointed out that "excessive leverage makes the market more vulnerable and amplifies upward and downward volatility".

The Fear and Greed Index from alternative.me, a cryptocurrency data analysis firm, rose 2 points from the previous day to 74 points, indicating a state of 'greed'. This index means that the closer it is to 0, the more investment sentiment is suppressed, and the closer it is to 100, the more it indicates market overheating.

- Reporter Do Ye-ri

< Copyright ⓒ Decenter, unauthorized reproduction and redistribution prohibited >