As Bitcoin (BTC) approaches its all-time high, analysis suggests an unusually low inflow of Bitcoin to exchanges. This signals that investors are choosing long-term holding over short-term selling, demonstrating high market confidence.

On-chain analyst Arab Chain from CryptoQuant reported on July 23 that the 'Bitcoin Flow Pulse (BFP)' remains at a very low level. This means that despite Bitcoin approaching $123,091 according to CoinMarketCap, major holders are not moving their assets to exchanges. In the past, large volumes would move to exchanges near such peaks, creating selling pressure, but currently, no such movement exists, interpreted as a strong holding signal.

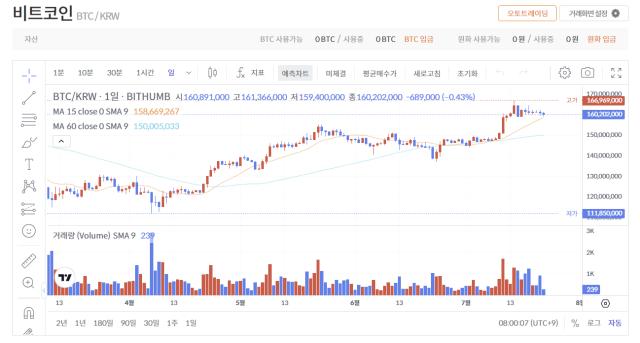

In fact, Bitcoin's price has risen 16.2% over the past month and 8.9% over two weeks. However, after reaching its all-time high, it has entered a correction phase over the past nine days. The current price is fluctuating between $118,042 and $120,222, encountering resistance near $123,000.

From a technical analysis perspective, CryptoVizArt pointed out that if the $113,000-$116,000 level collapses, a deeper correction could potentially push the price down to the Fibonacci support zone between $107,000 and $111,000.

Meanwhile, there's a clear temperature difference between individual and whale trading behaviors on exchanges. CryptoQuant analyzed that individual investors' selling pressure has intensified on Binance. Small investors' exchange inflows are increasing, and the Net Taker Volume has turned negative, suggesting they anticipate a decline.

In contrast, institutional and whale investors appear to be buying at lower prices. Yesterday, approximately $200 million worth of Bitcoin was moved outside exchanges, absorbing downward selling pressure. This pattern is similar to what was observed when Bitcoin surged from $78,000 to $111,000 earlier this year.

The market is currently in a tug-of-war between long-term holders' firm conviction and short-term profit-taking forces. While confident signals like exchange inflow exist, the potential for switching to altcoin profits or intensifying selling pressure suggests continued short-term volatility.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>