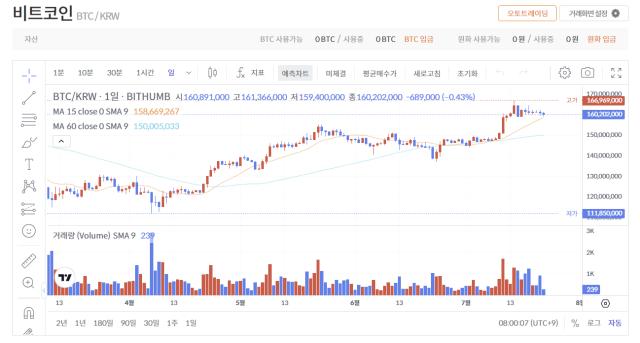

Bitcoin (BTC) is currently breaking through 163 million won and maintaining a stable trend. It is leading the market's upward movement with a 0.17% increase over 24 hours.

On July 22nd, the first comprehensive cryptocurrency policy report is expected to be released at the White House, which will include the status of digital asset holdings and Bitcoin acquisition strategies. Particularly, with expectations that the United States will discuss a bill to acquire up to 1 million BTC over the next 5 years, market anticipation is growing.

Bitcoin is maintaining a solid support line in short-term technical analysis, and further price increases are anticipated.

Ethereum (ETH) is currently trading at 5.24 million won, up 1.55% over 24 hours. With continued institutional investor inflows, a positive momentum is forming, and it is maintaining a clear advantage amid the altcoin market's strong performance.

Ripple (XRP) is currently trading at 4,922 won, up 2.71% over 24 hours. Increased on-chain trading activity, technical integration, and accumulation in the derivatives market are driving the XRP rally. Particularly, with the number of active addresses reaching a new high, market participation is also increasing. The Bollinger Bands' contraction suggests potential price volatility, with gradual increases expected if resistance levels are broken.

Solana (SOL) is trading at 280,000 won, joining the overall altcoin market's upward trend. The expansion of market risk appetite and expectations of policy clarity in the United States are having a positive impact.

Cryptocurrency experts stated, "The current price trends of Bitcoin and major altcoins demonstrate market maturity and continued institutional investor participation," and predicted that "additional upside potential will be significant once the U.S. policy direction is confirmed".

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>