Bitcoin price rise stops just below $120,000, and the cryptocurrency market is hovering as it shifts to altcoins. This stagnation occurred after BTC approached its all-time high following a recent rally.

However, the momentum of Bitcoin is decreasing due to demand saturation and increasing selling pressure, and concerns about a potential reversal are growing.

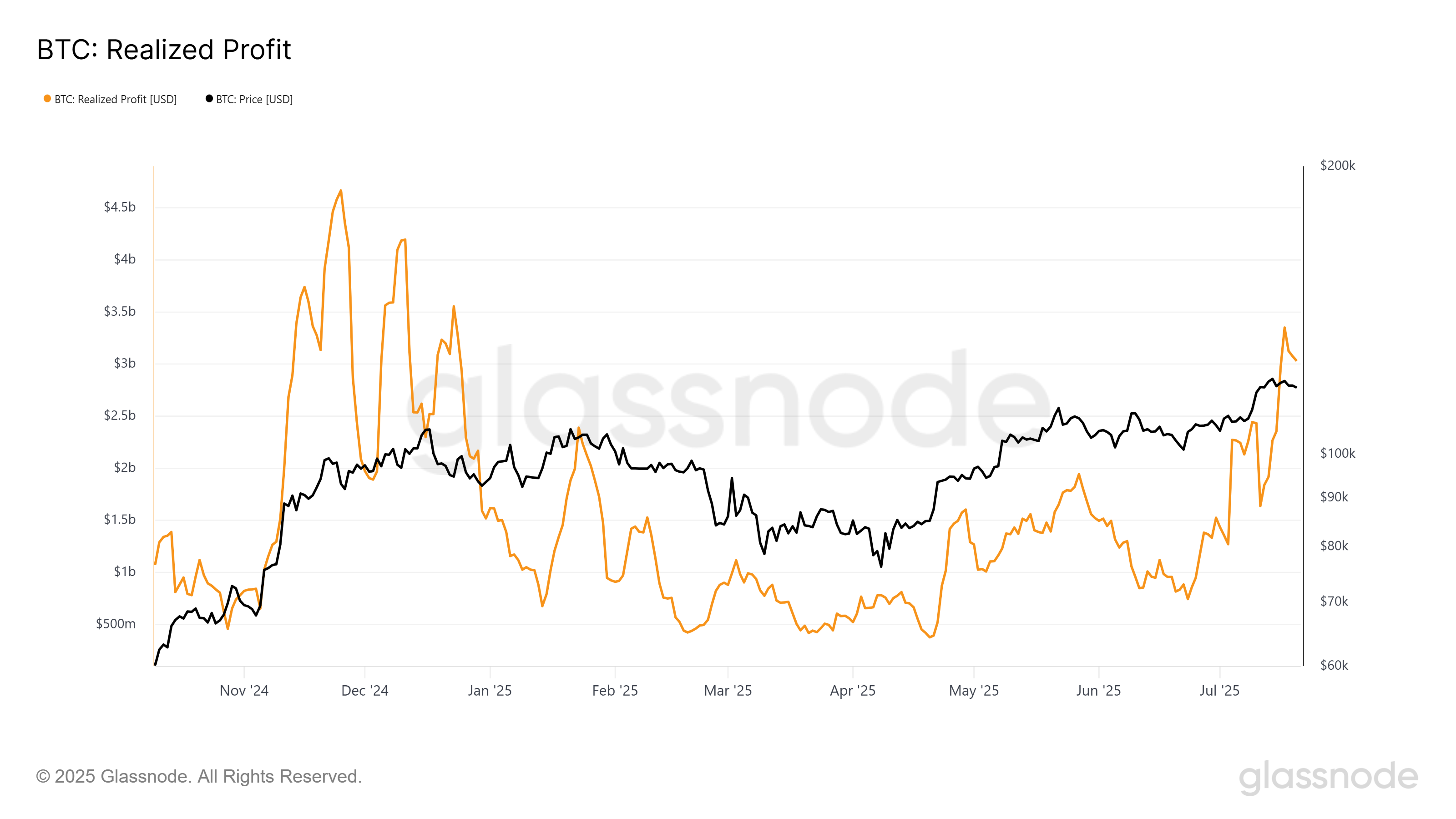

Bitcoin Investors Begin Profit-Taking

Bitcoin's realized profits have reached a 7-month high, indicating increased selling activity among investors. This surge suggests that holders are securing profits rather than expecting further increases. Such behavior often appears when investors lose confidence in continued upward momentum, and it seems this situation is currently occurring.

As profit-taking intensifies, investor sentiment is moving away from Bitcoin. This could limit the upward potential in the short term. When many investors exit simultaneously, this typically exerts downward pressure on prices, increasing the likelihood of consolidation or correction.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

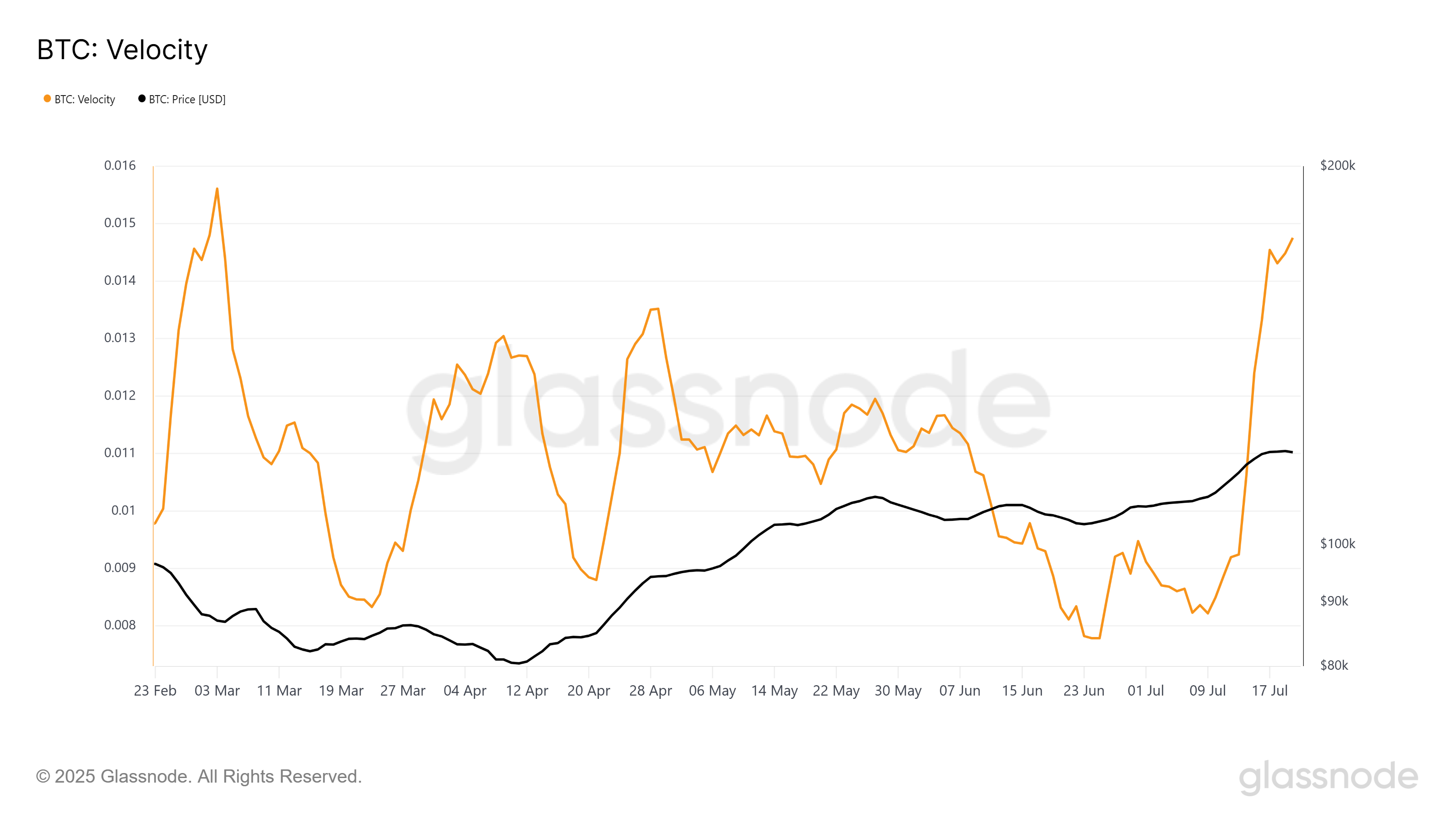

Another key indicator, velocity, has also surged, currently reaching a 4-month high. This indicator tracks the speed at which Bitcoin is traded within the network. High velocity typically accompanies increased trading activity, reflecting investors' attempts to leverage short-term movements.

The increase in velocity suggests that Bitcoin demand still exists, but it is driven by quick trades rather than long-term accumulation. The conflicting signals of profit-taking and demand increase are preventing Bitcoin from moving sharply in either direction. This tug-of-war is contributing to ongoing price stagnation.

BTC Price May Escape Correction... or Worsen

At the time of writing, the Bitcoin price is $119,366. This cryptocurrency giant is struggling to break through the $120,000 resistance level. As its dominance weakens, capital is moving to altcoins, reducing the immediate breakthrough possibility.

Bitcoin's current indicators support a sideways price movement. If the market stabilizes, BTC could continue to consolidate between $117,000 and $120,000. This range is likely to be maintained unless significant buying momentum returns.

On the downside, if selling pressure exceeds demand, Bitcoin could fall below $115,000. A stronger correction could push the price to $110,000, invalidating the current upward narrative and reinforcing concerns about short-term weakness.